Do you consider yourself "just a bookkeeper?" If so, it's time to stop. The role of today's bookkeeper often extends well beyond simply managing a business's books. In fact, as one practitioner of the art put it, the bookkeeper of the 21st century is more akin to a conductor.

"I use analogies a lot, and so I use the analogy of an orchestra director more than somebody who is actually playing the instruments.

The reality is that bookkeeping has historically been viewed as a commodity or a low-value service. However, advancements in technology and shifts in client demand are bringing about change for modern-day bookkeepers, and forward-looking firms are increasingly eyeing new ways to expand their service offerings and better meet evolving client demands.

Other things to check out:

Mixed returns: Lots of easy ones, or fewer, more complex ones? | Accounting Today

Easy and quick? Tough and slower? Preparers say both have their advantages when it comes to doing returns. But future changes in tax law and taxpayer behavior may force the trend in one direction.

According to a recent survey by the National Association of Tax Professionals, some four out of five preparers do a mix of simple and complex returns, and most earn the bulk of their practice's revenue through tax prep.

"At the end of this never-ending tax season, I look forward to the easy returns so I can feel I accomplished something," said Bill Nemeth, executive director of the Georgia Association of Enrolled Agents.

Bonus Accounting Firm To Receive Ethics Award From BBB - ButlerRadio.com - Butler, PA

A local business will be recognized later this week for overcoming challenges while maintaining high ethical standards.

The Better Business Bureau of Western Pennsylvania will present Bonus Accounting, LLC with the 2020 Torch Award for Ethics at a ceremony Thursday at 11 a.m. at their office in Chicora.

An independent panel of academic judges selected Bonus Accounting in the 1 to 10 employee category from among all for-profit businesses physically located in the 28 county region. Criteria used for evaluation includes leadership commitment to ethical practices, communication of ethical practices, and leadership practices to unify the organization.

Art of Accounting: Reducing tax season workload compression | Accounting Today

Workload compression is a ubiquitous drain on our energies. From my calls, it appears that staff tax season hours still increase every year. Maybe 2020 is not a good year to measure anything, but my sense is this is a growing problem and not something that is being tamed.

I do not have a magic sauce to wipe out the problem, but I can suggest some simple things that can be done to not only alleviate some of the pressures but that can also generate additional revenue for things that you would have done anyway and likely would not have charged much extra for doing.

Many things are taking place:

Passport Software, Inc. Announces the Launch of New Customizable Accounting Software

Welcome to accounting software that is affordable and scalable to help growing companies manage changing needs. PBS Essentials is Passport Business Solutions, packaged with an affordable price point for smaller companies.

PBS Essentials is a "choose 3 software modules - build your system" product, offered for a single company /single user with room for expansion.

* * *

Each business is truly unique, so a one-size-fits-all accounting software approach can fall short in many ways. For companies with plans for growth, PBS™ Essentials, enables you to design a system flexible enough to support how you work now, and also adapt with you as your business grows.

The Corporate Carbon Accounting Market

Change happens gradually and then all at once. For years, a quiet revolution has been brewing in ESG corporate disclosure advocacy. With voluntary standards like CDP and metrics guidelines like SASB , leading corporates have opted in to environmental performance transparency. With 42% of companies above a $10bn market cap already disclosing some climate-relevant information, this shift has been happening slowly — and, now, seemingly all at once.

Earlier in November, the UK started the countdown to require all companies to disclose the climate change impacts of their business by 2025. The ruling leans on recommendations from the TCFD (Task Force on Climate-Related Financial Disclosures), an initiative of the Financial Stability Board to promote climate risk assessment. Already, 1,500 organizations have signed on, most in 2020.

The Year Ahead: 2021 for accountants in numbers | Accounting Today

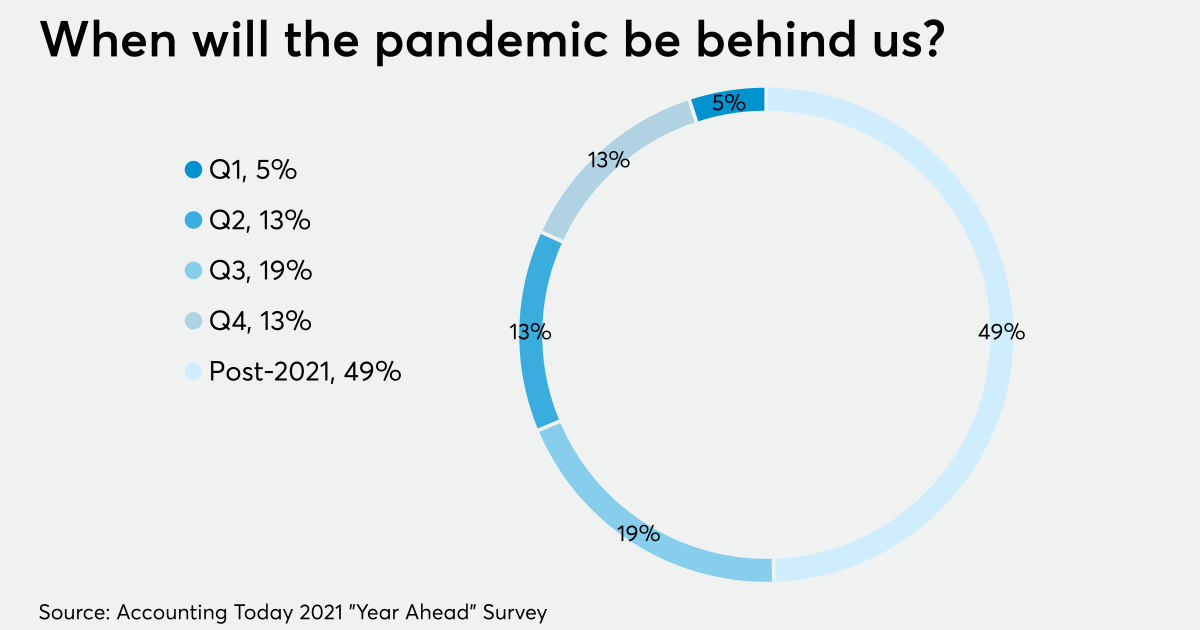

In order to see what CPAs and accountants believe 2021 has in store for them — and what they have in store for it — Accounting Today conducted its annual survey of firms of all sizes in early November, polling professionals on everything from their growth expectations to their plans for tech spending, their use of social media, the new services they're offering, and what they expect to happen with the pandemic.

More MyPayrollHR fallout: Bank sues Albany accounting firm for $34M

Michael Mann, the ex-MyPayrollHR CEO, enters U.S. District Court on Wednesday, Aug. 12, 2020, in Albany, N.Y. (Paul Buckowski/Times Union)

COLONIE — Pioneer Bank is suing the Albany accounting firm that created the financial reports for MyPayrollHR , the Clifton Park payroll services company whose collapse last year exposed a $100 million bank fraud scam by its CEO Michael Mann.

Pioneer Bank, which itself is being sued by the federal government for withholding payroll tax payments diverted by Mann from his clients to his bank accounts at Pioneer, is seeking $34 million from the Albany accounting firm Teal, Becker & Chiaramonte in state Supreme Court in Albany.

Happening on Twitter

#BigTech corporate consolidation continues. We need an antitrust law for the 21st century https://t.co/PPlOPks9jj HawleyMO (from Missouri, USA) Tue Dec 01 01:07:22 +0000 2020

Powerful words from @UN Secretary-General @antonioguterres "the state of the planet is broken." Making peace with… https://t.co/dkZrefi48z andersen_inger (from Nairobi, Kenya) Wed Dec 02 15:33:49 +0000 2020

Welcome to the 21st Century where the rich keep getting richer and the benefits of a growing economy don't go to wa… https://t.co/awC9gGntuK TheRealPBarry (from Sydney) Wed Dec 02 08:33:54 +0000 2020

No comments:

Post a Comment