The Hechinger Report is a national nonprofit newsroom that reports on one topic: education. Sign up for our weekly newsletters to get stories like this delivered directly to your inbox.

When the University of Pennsylvania said it would pay $10 million a year for 10 years to address environmental hazards in Philadelphia's public schools, Gerald Campano's reaction was complicated.

"Of course it's important that Penn at least recognizes the profound challenges that the School District of Philadelphia faces with things like lead poisoning and asbestos," Campano, a professor at Penn's Graduate School of Education, said. "But charity is not the same as social and racial justice."

Were you following this:

New Jersey Recreational Marijuana Legalization & Gross Receipt Taxes

Thursday, the New Jersey Senate and Assembly passed bills ( S21 and A21 ) legalizing recreational marijuana sales, as required since voters passed Question 1 on Election Day. Sales will begin after the Cannabis Regulatory Commission finalizes its rules and regulations.

Sales of recreational marijuana in New Jersey will be taxed under the general state sales rate of 6.625 percent. This is appropriate, as recreational marijuana is a consumer good and a well-designed general sales tax is levied on all final consumption while exempting all purchases made by businesses that will be used as inputs in the production process.

Don't raise cigarette taxes, cut spending | READER COMMENTARY - Baltimore Sun

I don't smoke nor do any of my four siblings but my dad who passed away at the age of 90 smoked two packs a day from age 16 to 75. Our lungs appear to be fine as apparently were Mom's who passed away just this past summer at the age of 104. No, smoking isn't healthy but enough with the tax increases ( "Tobacco tax increase long overdue in Maryland," Dec. 16).

Government needs to tighten its belt. Stop the "It's for education to help our children" pitch as "taxes for education" never seem to make it to education anyway. I mean, what really happened with the tobacco settlement money? Or lottery dollars? Or gambling revenues? This entire column rings very hollow.

Property taxes continue to rob owners of 'Home Alone' house

While Kevin McCallister's wit allowed him to scare off the "Wet Bandits," his tricks will be no match for the Cook County tax assessor who comes back each year with a higher tax bill.

Property taxes paid on the "Home Alone" house in Winnetka where the movie was set will be about $30,201 in 2020 and are on track to be a few hundred dollars more in 2021. Since 1990, when the holiday film featuring a young Macaulay Culkin came out, the homeowners have paid more than $890,000 in property taxes.

In case you are keeping track:

How to Manage the Taxes on a Covid-Related Withdrawal From Your IRA or 401(k) |

With little more than a week left to take tax-friendly withdrawals from individual retirement accounts and 401(k)s under the Cares Act, people stung financially or physically by Covid-19 are making last-minute decisions while wading through a thicket of rules that could have an impact on future taxes. To help readers navigate the rules, Barron's Retirement has been looking for answers and expert guidance.

I'd like to take $90,000 out of my IRA before the Cares Act runs out this year. If I do that, will I have any control over when I pay the taxes or will I owe taxes on $30,000 every year for three years? I'm not eager to pay taxes this year because my taxes will be a lot lower during the next two years.

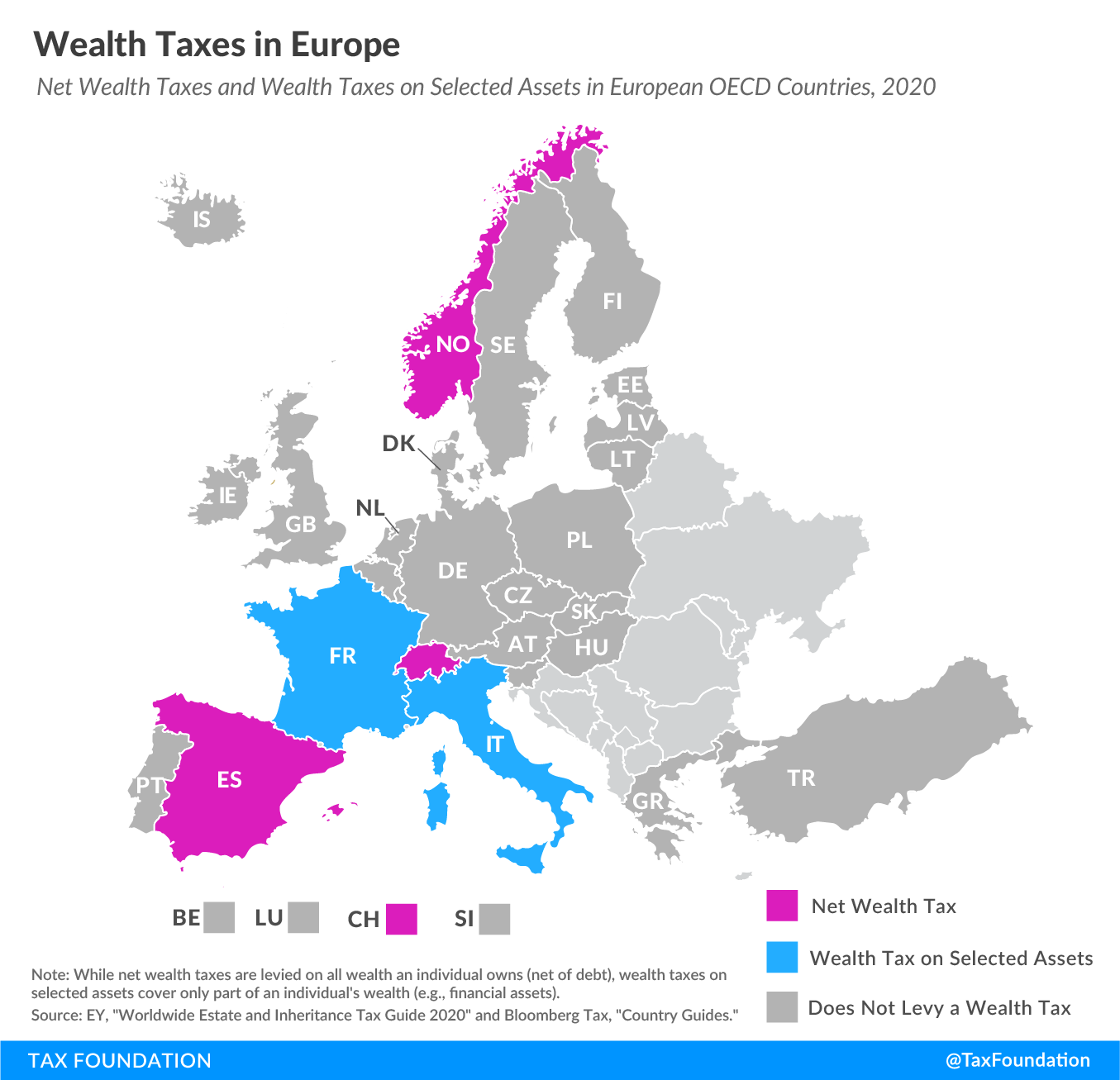

European Countries with a Wealth Tax | Wealth Taxes in Europe

Norway levies a net wealth tax of 0.85 percent on individuals' wealth stocks exceeding NOK1.5 million (€152,000 or US $170,000), with 0.7 percent going to municipalities and 0.15 percent to the central government. Norway's net wealth tax dates to 1892. Under COVID-19-related measures, individual business owners and shareholders who realize a loss in 2020 are eligible for a one-year deferred payment of the wealth tax.

Spain 's net wealth tax is a progressive tax ranging from 0.2 percent to 3.75 percent on wealth stocks above €700,000 ($784,000; lower in some regions), with rates varying substantially across Spain's autonomous regions (Madrid offers a 100 percent relief). Spanish residents are subject to the tax on a worldwide basis while nonresidents pay the tax only on assets located in Spain.

Tax Counsel For John Manocchio Chimes In

Hopefully the loss of this case in the tax court will be vindicated by an eventual appeal of the Tax Court's position. Mr. Leer's position on this is as follows:

"[T]he legislative purpose behind section 265 is abundantly clear: Congress sought to prevent taxpayers from reaping a double tax benefit by using expenses attributable to tax-exempt income to offset other sources of taxable income. This is precisely what [Manocchio] is attempting to do here, and in our judgment, the application of section 265(1) to disallow the reimbursed portion of the flight-training expense deduction is both reasonable and equitable."

County Council unanimously passes resolution waiving penalties on 2021 County Taxes |

A special session of Erie County Council ends with some help for Erie County residents on their taxes.

According to a news release from Erie County Clerk Doug Smith, council has passed Resolution 65, which will eliminate penalties on 2021 County taxes, if individuals pay their county real estate taxes by December 31, 2021.

This means that tax bills that go out in February can be paid later without penalty anytime before December 31st of next year.

No comments:

Post a Comment