If you are one of the people who despite having several clothes and still ends up always wearing the same, do not stop reading this article. You'll love it!

It is scientifically proven that most of the time (if not all) we women use only 20% of our wardrobe .

We regularly make the same combinations when it comes to dressing because they are the ones that are at the top of our mind; We attribute this to our brain since its function is to try to do things in a known way that is why it is very common to hear the phrase "I always use the same thing."

While you're here, how about this:

Real Money for Virtual Gems: What To Do When Kids Overspend On Apps – Forbes Advisor

The first time one of Matt Whitton's four children managed to bypass the parental controls on Apple ID on his phone was several years ago, when his son ran up about $60 worth of in-app purchases without his permission. Whitton disputed the charge with Apple and got the charges reversed.

"She knew she was spending money," Whitton says, "but didn't have a concept of how much it was. She also knew she shouldn't be doing it, but she was being a bit of a stinker."

This Firm Is Like Money in the Bank - RealMoney

How to Prepare Yourself (and Your Money) for COVID-19 in 2021 | Kiplinger

Having been caught largely unaware in 2020, how can businesses and individuals financially prepare for 2021? While it is a large undertaking, it is achievable if people make solid financial plans and stick to their budgets.

Finally, everyone should re-evaluate their well-prepared financial plans regularly as 2021 goes on to make sure they are in the best financial situation possible. Where do you start? Here are five steps to consider.

Certain stocks took a particular beating this year, while others — such as general health care and medical stocks — did well. It is a good idea to review and fine-tune financial portfolios now while there is still flexibility in place for 2021. Given the interest rate environment, consider planning for other portfolio income too. For example, you could look at buying publicly traded real estate companies.

In case you are keeping track:

Subscribe to read | Financial Times

How much money should you keep in savings? | Fox Business

Having a flush savings account is important for every household — safeguarding you against job loss, high medical bills or home repairs and, in 2020’s case, a worldwide pandemic.

* * *

But exactly how big do those savings need to be? And where should you be storing them? Here’s what experts have to say about storing — and growing — your hard-earned cash.

According to Michaela McDonald, a certified financial planner and financial advice expert at personal finance app Albert, you should have at least three to six months’ of expenses in the bank.

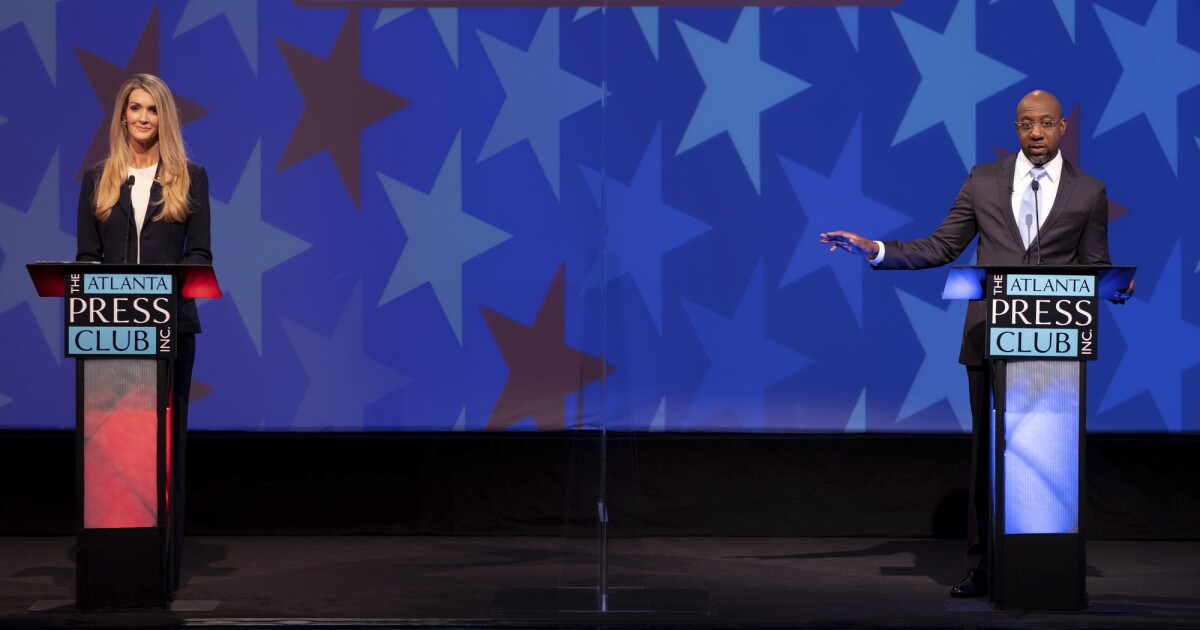

GOP holds big money advantage in Georgia Senate runoff races - Los Angeles Times

With spending in Georgia's twin Senate runoffs rocketing toward record levels, Republicans appear to be gaining a significant advantage on the state's airwaves as heavy spending by outside groups finances a flood of mostly negative ads.

The Republican edge marks a sharp reversal from the general election, when Democrats largely outspent their opponents in key races nationwide.

Much of the Republican advantage comes from campaign committees tied to Senate Majority Leader Mitch McConnell (R-Ky.) that are raising and spending huge sums on the two races.

:max_bytes(150000):strip_icc()/GettyImages-1473129313-1bb95034c249450bb44ac00b5a2dcfd4.jpg)

No comments:

Post a Comment