A friendly, late-middle-aged couple contact you with questions about their estate plan. The hypothetical couple — let's call them "the Ys" — own a successful chain of home insulation businesses and plan to eventually pass it on to their two children, a math teacher and a musician.

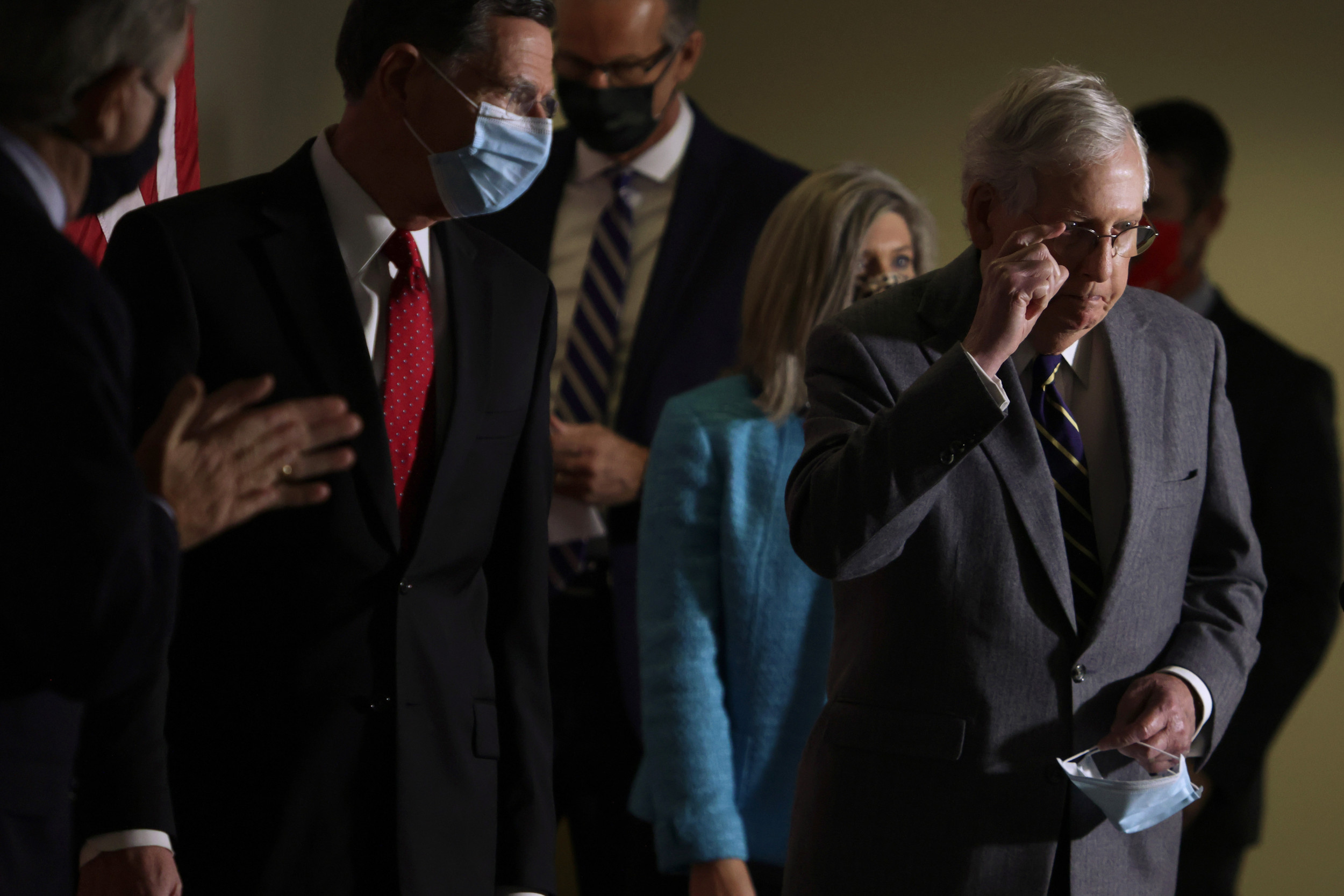

Last summer, with the election in mind, the Ys took some preliminary steps toward transferring wealth. Now, however, they are wondering if they ought to put their plans on hold because of the likelihood that Republicans will retain control of the Senate. The Ys have several questions on their minds.

In case you are keeping track:

Will Republicans Show They Can Reach Across the Aisle on Tax Policy? | Opinion

During his campaign, President-elect Joe Biden talked about raising taxes on rich people more than any candidate in recent memory—and he won. Beating an incumbent president is rare, but Biden pulled it off and appears to be the first presidential incumbent-challenger to capture 51 percent or more of the vote since Franklin Roosevelt's victory in 1932.

As difficult as his race was, his call for higher taxes on the rich and corporations probably helped him. For years, survey respondents have told Gallup that the wealthy and corporations should pay more taxes. Surveys conducted over the past three years show that the public opposes the GOP tax cuts of 2017, the only significant legislative achievement of the Trump administration.

'Tis the Season for Nonprofit Regulation | The Regulatory Review

But the FBI indicates that scammers might try to take advantage of well-intentioned donors. The agency encourages Americans to look out for charity fraud, which occurs when scammers falsely claim to engage in charity work or operate under the name of an established charity.

In addition, profiteers could organize questionable or fraudulent nonprofits to exploit regulatory gaps in the nonprofit sector. Specifically, the Internal Revenue Service (IRS) grants tax-exempt status to nonprofits, allowing more of an organization's funding to serve the public. But the sector sometimes lacks sufficient government oversight to ensure that nonprofits spend these funds according to their stated missions.

Justices Likely To Shield Treasury From Preemptive Action - Law360

In the legal profession, information is the key to success. You have to know what's happening with clients, competitors, practice areas, and industries. Law360 provides the intelligence you need to remain an expert and beat the competition.

* * *

Enter your details below and select your area(s) of interest to stay ahead of the curve and receive Law360's daily newsletters

And here's another article:

From intern to global vice chair: Lessons learned from EY's Kate Barton | International Tax Review

New and emerging technologies, as well as the COVID-19 pandemic, are transforming the tax function and profession at an unprecedented pace. When Kate Barton started her career as an intern at EY, having qualifications in law and tax were a staple of a career in the professional services. However, fast forward three decades and these two qualification criterions make up only part of what many employers demand.

Here, Anjana Haines, managing editor of ITR, talks to Kate Barton, EY global vice chair of tax, about the changes and what this means for millennials, Generation Z, and those entering the workforce today.

Wealth Management Update: December 2020

The December Section 7520 rate for use with estate planning techniques such as CRTs, CLTs, QPRTs and GRATs is 0.6%, which is up from 0.4% in November and down from 2.0% in December of 2019.

As was widely expected, Joe Biden won the presidential election. But Republicans outperformed expectations, picking up several seats in the House of Representatives and limiting their losses in the Senate. It will be difficult for a President Biden to push controversial tax legislation – for example, a reduction in the estate and gift tax exemption or a repeal of "stepped-up" income tax basis – through a closely divided Congress.

The Travellers' Allowances and Miscellaneous Provisions (EU Exit) Regulations 2020 -

This publication is available at https://www.gov.uk/government/publications/the-travellers-allowances-and-miscellaneous-provisions-eu-exit-regulations-2020/the-travellers-allowances-and-miscellaneous-provisions-eu-exit-regulations-2020

At the end of the transition period the government will make changes to the rules for the VAT and excise duty treatment of goods for personal use that are brought into and taken out of Great Britain in travellers' luggage. The new rules will also cover the provision of duty-free sales to passengers bound for EU destinations at ports, airports and international railway stations and on-board ships, planes and trains on international routes.

RiverNorth Closed-End Funds Declare Year-End Capital Gain Distributions | Business Wire

As of the date of this release, RiverNorth Managed Duration Municipal Income Fund, Inc., RiverNorth/DoubleLine Strategic Opportunity Fund, Inc., and RiverNorth Specialty Finance Corp. do not anticipate having to make a year-end capital gain distribution. Such determinations are based on then current estimates and are subject to change.

With each distribution that does not consist solely of net investment income, the respective Fund will issue a notice to shareholders and an accompanying press release that will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes.

No comments:

Post a Comment