Luckin Coffee Inc. has agreed to pay $180 million to settle regulatory claims that it cooked its books to make growth appear more robust and meet earnings targets.

The Securities and Exchange Commission announced the penalty on Wednesday, eight months after the Chinese company disclosed that some of its officers fabricated sales in 2019. Luckin neither admitted nor denied the SEC's fraud claims, which were filed in Manhattan federal court. The settlement is subject to a federal judge's approval.

While you're here, how about this:

PwC Challenge offers students an inside look at real-world accounting | Bryant News

Accounting firm settles FDIC claims tied to Chicago bank's failure | Accounting Today

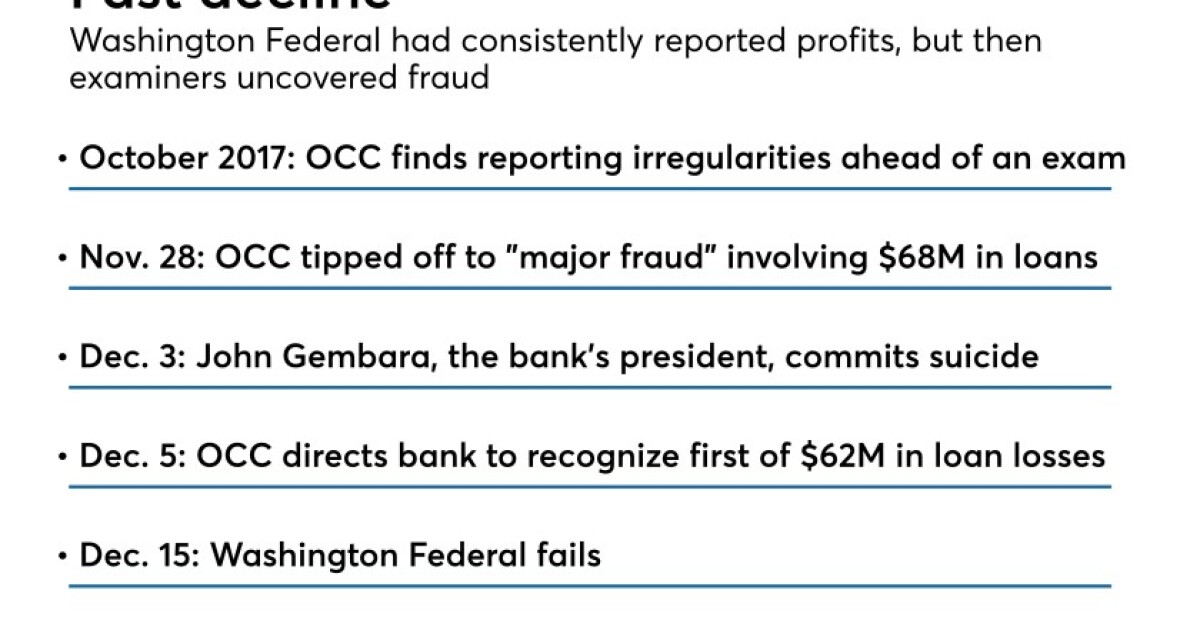

A Chicago accounting firm has reached a settlement with the Federal Deposit Insurance Corp. over its alleged role in the December 2017 failure of Washington Federal Bank for Savings.

Bansley & Kiener, which denied responsibility, agreed to pay $2.5 million to resolve claims it was liable for the Chicago bank's collapse. The accounting firm had signed off on years of financials for Washington Federal at a time when alleged fraud was taking place.

Carbon Accounting Becomes Increasingly Important for Climate Mitigation Efforts - Niskanen Center

Effective climate policies and initiatives require reliable and accurate carbon emission measuring and tracking. However, carbon accounting at the firm or product level is a challenge in an age of complex supply chains and international trade. A recent report discusses the importance of carbon accounting and proposes solutions to address these challenges.

The report focuses on carbon accounting of corporations' direct emissions and supply chain emissions—those associated with suppliers' production of goods and services. One of the biggest challenges of carbon accounting, according to the report, is tracking the carbon emissions associated with a certain product throughout the supply chain.

Other things to check out:

FASB aims to clarify accounting for acquired revenue contracts | Accounting Today

The Financial Accounting Standards Board has issued a proposed Accounting Standards Update that it hopes will create more consistency around how businesses account for revenue contracts with customers that they have acquired.

Current GAAP does not provide specific guidance on contract assets and liabilities that are accounted for under Topic 606, "Revenue from Contracts with Customers," and FASB reported that some stakeholders that certain related recognition and timing issues were unclear.

Top New Products 2021: Call for nominations | Accounting Today

The report, which will appear in February, will recognize the best new and significantly improved products aimed at tax and accounting professionals, as judged by the editors of Accounting Today .

Products for consideration must be designed for the tax and accounting profession; must have been released no earlier than January 2019; and must be currently available (i.e., not in beta testing) in the U.S. market.

ServiceSource Appoints Jennifer Frank as Chief Accounting Officer

Ms. Frank is a seasoned leader with more than a decade of public accounting and audit experience. Prior to her most recent role at ServiceSource as Vice President and Corporate Controller, Ms. Frank spent more than four years managing corporate accounting, SEC reporting, stock administration, and accounts payable functions for a publicly-traded industrial real estate investment company. A Certified Public Accountant, Ms.

Ms. Frank graduated from the University of Northern Colorado with a Bachelor of Science in Business Administration with an emphasis in Accounting.

CPA Exchange launches digital platform for selling firms | Accounting Today

CPA Exchange LLC has launched a digital platform that allows public accountants to sell firms and clients online.

"What if you want to buy a CPA firm in a particular geographical area or with a specific practice specialty, or if you're looking to retire and sell your practice? CPA Exchange streamlines the process of browsing practices to buy and listing practices for sale, without the hassle of working through a middleman," said co-founder and CEO Paul Weinberg, in a statement.

Happening on Twitter

China's Luckin Coffee has agreed to pay $180 million to settle regulatory claims that it intentionally faked more t… https://t.co/0sjC4jtssd WSJ (from New York, NY) Thu Dec 17 00:30:09 +0000 2020

US regulators fine China's Luckin Coffee $180 million for defrauding investors over its financial performance… https://t.co/Q6um9WdGF1 AFP (from France) Thu Dec 17 02:24:33 +0000 2020

China's Luckin Coffee will pay $180 million to settle accounting fraud charges https://t.co/uR8CIIfkyG by @ritacyliao TechCrunch (from San Francisco, CA) Thu Dec 17 02:45:39 +0000 2020

:max_bytes(150000):strip_icc()/GettyImages-1473129313-1bb95034c249450bb44ac00b5a2dcfd4.jpg)

No comments:

Post a Comment