Sec. 6402(n), which was added to the Code by Section 1407 of the Taxpayer First Act, P.L. 116-25, directs the IRS to issue procedures within six months of enactment for a taxpayer to report instances in which an IRS refund made by electronic funds transfer was not transferred to the taxpayer's account, coordinate with financial institutions in identifying misdirected funds, and provide procedures for the misdirected funds to be delivered to the correct account.

The regulations define a misdirected direct deposit refund as any refund of an overpayment of tax that is disbursed as a direct deposit but is not deposited into the account designated on the claim for refund to receive the direct deposit refund. It does not include deposits made to accounts where the taxpayer transposed account numbers.

Many things are taking place:

Mississippi should eliminate income tax, reduce regulations: opinion

Americans have been drowning in a sea of COVID-19, social unrest, and election turmoil. The waves have not yet calmed, but shore is in sight.

Leadership can come from unlikely places. Mississippi has a moment to prove it. The state's problems are well documented. But in recent months, Mississippi leaders have also shown flashes of vision.

But the state's opportunity is more than symbolic. For generations, Mississippi has been last in the things you would want to be first in, and first in the things you would want to be last in. Take, for instance, our labor force participation rate, which at 56.4% is one of the worst in the nation, or our lowest in the nation per capita income.

Summary of tax laws in nigeria- taxation in Nigeria - Lexology

Taxation in the Nigerian economy is a significant system that helps in the generation and redistribution of revenue to provide public services and improve the economy. Because of how important this is, the government enacted laws that govern and regulate taxation in the different sector of the economy in Nigeria. This article serves to give an overview of tax laws in Nigeria.

* * *

Section 9 of the Act provides that tax for each year of assessment shall be payable at the rate specified upon the profits of any company accruing in, derived from, brought into, or received in Nigeria in respect of any trade, dividends, rent, or premium, source of annual profits or any amount of profits or gains arising from acquisition and disposal of short-term money instruments.

Mexico's Reportable Transactions Rules in Effect January 1

Beginning January 1, 2021, Mexico's reportable transaction rules require either a taxpayer or a tax advisor to report to the Mexican tax authorities any transactions that are designed, marketed, organized, implemented or administered to provide a tax benefit to the taxpayer.

A reportable transaction is considered to be any transaction that generates or may generate, directly or indirectly, a tax benefit in Mexico and has any of the following characteristics:

Quite a lot has been going on:

Bloomberg - Are you a robot?

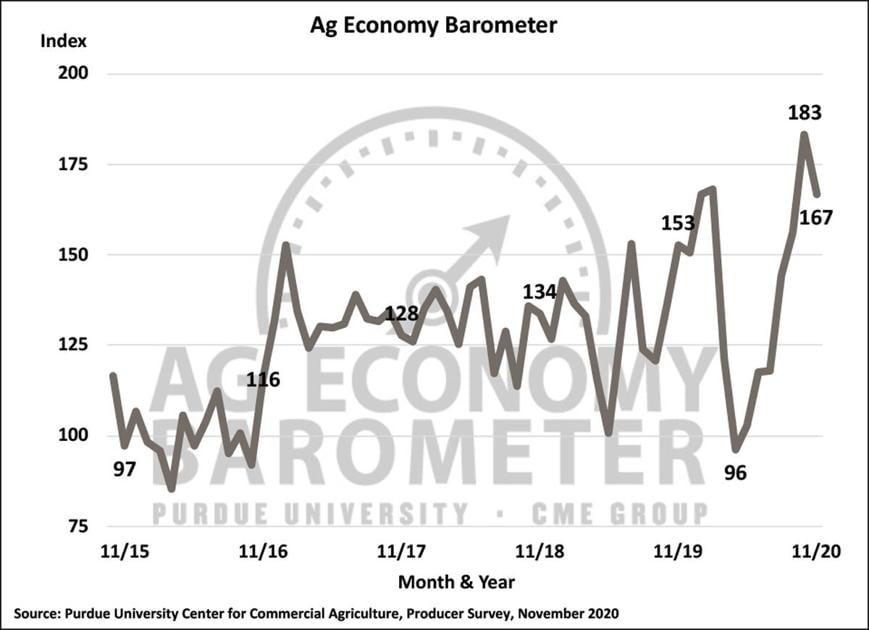

Farmer sentiment pulls back post-election: regulation, trade and taxes rated as top concerns |

China Extends Pretax Deductions for Advertising Expenses by 5 Years

On December 9, 2020, the Ministry of Finance (MOF) and the State Taxation Administration (STA) released the Announcement about Pretax Deduction of Advertising and Business Publicity Expenses ( MOF STA Announcement [2020] No.43 ), to be effective from January 1, 2021 to December 31, 2025.

According to the MOF STA Announcement [2020] No.43, enterprises manufacturing or selling cosmetics, enterprises manufacturing pharmaceuticals, and enterprises manufacturing beverage (excluding alcoholic) can access the following benefit – their advertising and business publicity expenses are tax-deductible if the expenses do not exceed 30 percent of the sales (business) revenue of the current year.

IRS Official Notes Marijuana Legalization's Momentum In Tax Compliance Webinar For Industry

A top official with the Internal Revenue Service (IRS) is taking steps to help marijuana businesses stay compliant with their taxes under the umbrella of ongoing federal prohibition, and in a recent interview recognized that the legalization movement will potentially succeed in ending prohibition in “all states.”

“The challenge really there is, it's still considered a Schedule I controlled substance under federal law,” he said. “However, when I'm talking with my employees and talking with them in our examination, we recognize that this is moving in a direction where potentially all states will have it legalized.”

:max_bytes(150000):strip_icc()/GettyImages-1473129313-1bb95034c249450bb44ac00b5a2dcfd4.jpg)

No comments:

Post a Comment