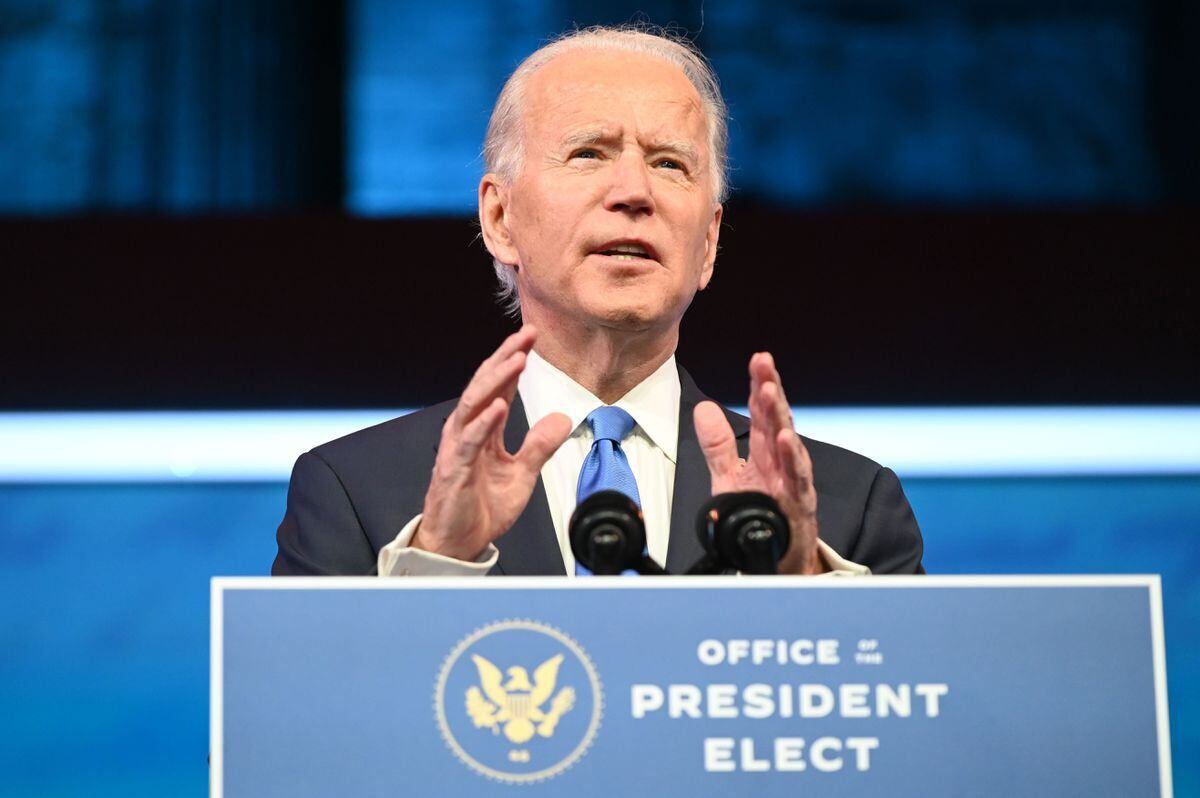

WASHINGTON — On Saturday, President-elect Joe Biden introduced his climate team at The Queen Theater in Wilmington, Delaware.

Biden's would-be energy secretary, former Michigan Gov. Jennifer Granholm, talked about U.S. investment of trillions for "electric cars, solar panels, wind turbines and energy-efficient appliances and buildings."

Biden said, "A key plank of our Build Back Better economic plan is building a modern, climate-resilient infrastructure and clean energy future."

This may worth something:

Newly adopted regulations aim to streamline financing of low-income housing | Orange County Breeze

State Treasurer Fiona Ma announced that two committees she chairs, the California Debt Limit Allocation Committee (CDLAC) and the California Tax Credit Allocation Committee, have each adopted regulations to streamline the process for financing low-income housing and create greater alignment with the Newsom Administration's housing goals in the process for financing low-income housing with the use of tax credits and tax-exempt bonds.

The new CDLAC regulations will include sections for geographic sectors as well as improved regulations to address housing for the homeless.

Rich Americans who fear higher taxes hurry to move money now

Rich Americans are rushing to make large transactions before the end of the month, trying to get ahead of any moves next year by President-elect Joe Biden and Democrats in Congress to raise taxes or close loopholes.

Some advisers say they're busier than ever in the last weeks of 2020, especially with helping clients transfer wealth to the next generation tax-free while they still can. Appraisers, who are crucial for valuing assets used in these estate planning strategies, have been inundated.

Crypto exchanges urge US Treasury to slow regulation push - Business Insider

In a letter sent last week to the US Treasury's FinCEN financial crimes unit, the lead lawyer at Coinbase had a simple message: "There is no emergency here."

Coinbase is one of several leading crypto firms pushing back against a FinCEN proposal that would require them to log personal details about the people who use cryptocurrency.

Treasury officials published a draft version of the new rules on December 18. FinCEN says the proposal would help stop money laundering, so they put in place a 15-day public comment period on the new rules.

In case you are keeping track:

Audit and Compliance in Thailand: A Guide for Foreign Investors

All companies, partnerships, joint ventures, and branches of foreign companies in Thailand must prepare financial statements for their assigned accounting period to the Ministry of Commerce.

Foreign companies (ROs, branch offices, regional offices) must submit their financial statements no later than 150 days after the end of the fiscal year. Once an accounting period is chosen, it cannot be changed unless there is written approval obtained from the Revenue Department.

No, the COVID stimulus isn't sending $85M to Cambodia; complaints over alleged omnibus pork

The U.S. Capitol building in Washington, D.C. Coronavirus relief programs are due to run out in the coming weeks and months. (Dreamstime/TNS) TNS

President Donald Trump on Tuesday called the bipartisan $908 billion COVID-19 stimulus package a "disgrace" stuffed with wasteful spending, though the bulk of his complaints actually centered on foreign aid and money for nonprofits and research in the overall year-end spending bill Congress passed to fund the next fiscal year and avoid a government shutdown.

Boris Johnson touts 'big changes' to business taxes and regulation post-Brexit - LBC

Boris Johnson has touted post-Brexit changes to business taxes and regulation next year as Conservative Eurosceptics pored over the details of his trade agreement with the EU.

The Prime Minister said that Chancellor Rishi Sunak is "doing a big exercise on all of this" but insisted that the UK would not regress on workers' rights or environmental standards.

Scrutiny of the treaty began in earnest when the 1,246-page document was officially published on the morning of Boxing Day - less than a week before its implementation.

Alert: IRS Issues Final Regulations Under Section 162(m) | Cooley LLP - JDSupra

On December 18, 2020, the IRS issued final regulations under Section 162(m) of the Internal Revenue Code to reflect certain changes that were made to Section 162(m) by the Tax Cuts and Jobs Act of 2017. The final regulations are generally consistent with the regulations proposed by the IRS in December 2019, except as described below.

Under Section 162(m), compensation paid to a publicly held corporation's "covered employees" that exceeds $1 million per year for any covered employee is non-deductible. Among other changes, the act amended Section 162(m) to expand the scope of covered employees and eliminate the qualified performance-based compensation exemption from the $1 million deduction limit.

Happening on Twitter

Could Biden regulations make US like CA Cali has regulations you generally support & employers are fleeing. Why d… https://t.co/ygAMrMBok8 debrajsaunders Sun Dec 27 13:29:03 +0000 2020

No comments:

Post a Comment