Head of global multi-asset at T. Rowe Price Sebastien Page on whether investors should move beyond the classic 60/40 portfolio approach.

As a retiree, the last thing you want to worry about is paying out a big chunk of your fixed income to the IRS . Unfortunately, many different sources of retirement income could be taxable, including distributions from your retirement account as well as some of your Social Security benefits .

* * *

This tax-saving technique most Americans aren't taking advantage of is investing in a Roth 401(k) . Just 12.5% of people who are offered this type of account are making contributions to it, according to Fidelity.

Check out this next:

NY Health Insurers: Taxes On Policies Drive Up Premiums

Taxes on health insurance in New York is driving up the cost of premiums, a report set to be released Wednesday by the New York State Conference of Blue Cross and Blue Shield Plans found.

Taxes in 2020 on health insurance plans reached an estimated $5.57 billion, increasing premiums by 6% to 9%, the report found. These taxes are placed on both employer-based coverage as well as individual plans.

Bonsai's Freelance Tax Hub is Free and Public for Everyone Now

However, Bonsai's team realized that this annoying work doesn't end when the freelancer gets paid. Many freelancers struggle with managing their finances, setting and tracking financial goals, and being prepared for tax time. So they built this resource hub to make filing freelance taxes as easy as the rest of a freelancer's workflow.

Cerro Gordo County says that Southbridge Mall owes at least $400,000 in back taxes | Business |

Through Sept. 2019, two parcels of land that Southbridge Mall in downtown Mason City sits on had $333,320 in taxes owed by Southbridge Mall Realty Holding , which is run by Mike Kohan out of New York.

* * *

Just a few months prior, in June, those parcels were sold for $161,452 to the ACC group of Dubuque, the process being that when a person or organization participates in a tax sale, they pay the delinquent taxes on parcels of land. The county, in this case Cerro Gordo, would then note that payment as a lien in its system.

Check out this next:

Community Development Tax Expenditures Remain a Fraction of Other Expenditures | Novogradac

The Joint Committee on Taxation (JCT) recently released its Estimates of Federal Tax Expenditures for Fiscal Years 2020-2024 , which reports, yet again, that estimated tax expenditures for affordable housing and community development tax incentives – the low-income housing tax credit (LIHTC), historic tax credit (HTC), renewable energy production tax credit (PTC), renewable energy investment tax credit (ITC), and new markets tax credit (NMTC) and the Opportunity Zones (OZ) incentive – cost

Poll: Most Americans support raising taxes on those making at least $400,000 | TheHill

Most Americans, including nearly half of Republicans, support raising taxes on people making at least $400,000 while keeping the current tax rates for everyone else, according to a new poll from The New York Times and SurveyMonkey .

About two-thirds of respondents said they supported higher taxes on those making $400,000 or more and maintaining tax rates for others. Eighty-eight percent of Democrats, 70 percent of independents and 45 percent of Republicans said they backed this idea.

Monroe County's property tax statements going out this week | News | djournal.com

Best & Worst State Sales Tax Codes | Tax Foundation

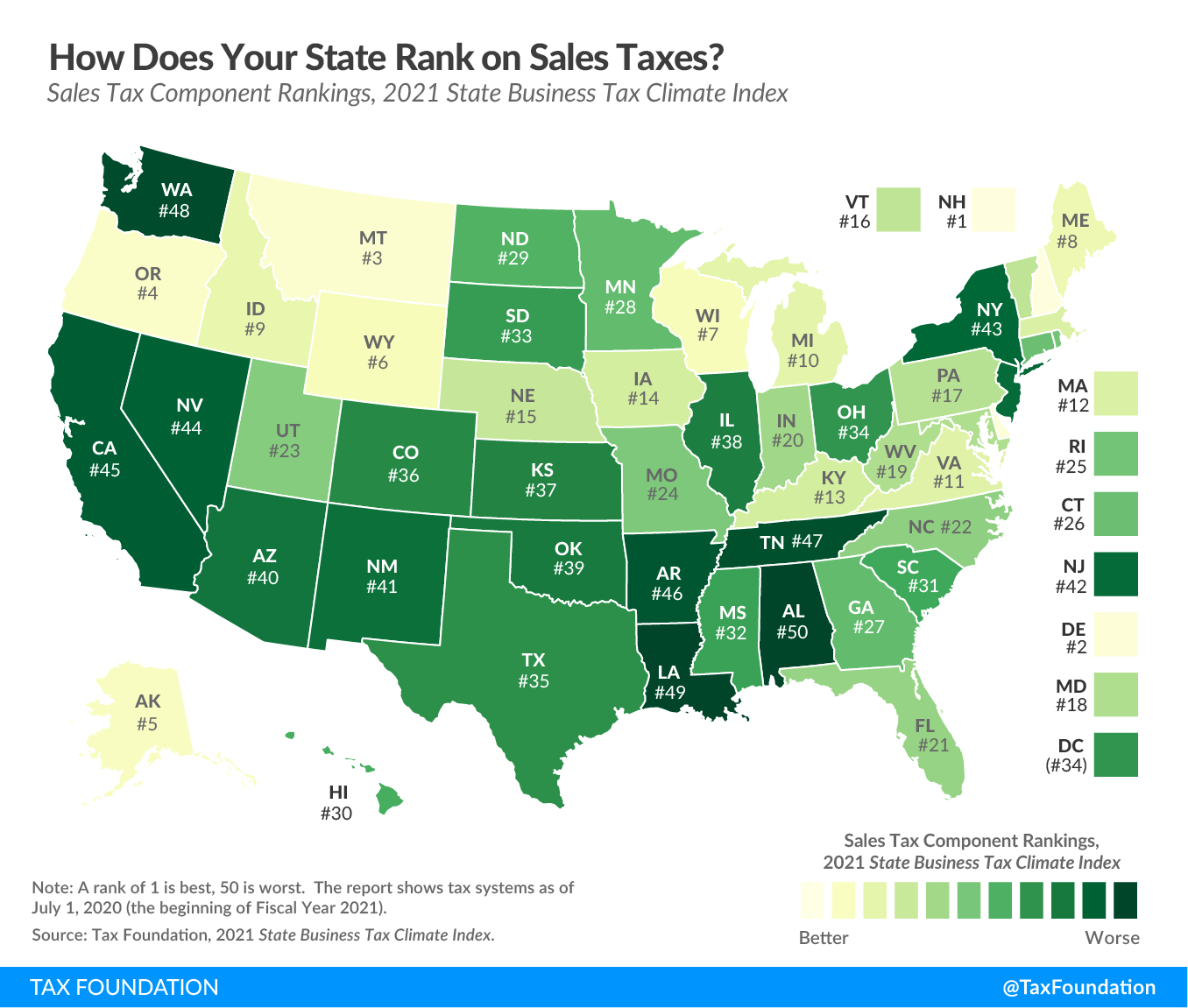

Today we continue our map series on the 2021 State Business Tax Climate Index with a map showing states' rankings on the Index 's sales and excise tax component.

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate. Broad-based, low-rate tax structures minimize tax-induced economic distortions that can occur when people change their purchasing behavior because of tax differences.

It is important to note that a well-structured sales tax applies only to the final consumer at the point of sale. It does not apply to the sale of machinery, raw materials, and other business inputs, as those taxes increase the costs of production and ultimately get passed along to consumers in the form of higher prices. States that avoid taxing business inputs perform better on the Index .

Happening on Twitter

I'm pleased to announce that FL has been awarded an additional $28 million in federal funds through @USDOL for disa… https://t.co/5STX0tKhob GovRonDeSantis Tue Dec 01 19:55:30 +0000 2020

BREAKING: NFL announces that Steelers-Ravens Week 12 game will be postponed until Lamar Jackson is eligible to play… https://t.co/wZ6vpdghFu ChrisMuellerPGH (from Pittsburgh) Tue Dec 01 00:09:25 +0000 2020

LA County is launching a grant program to help restaurants impacted by #COVID19 restrictions. Eligible businesses c… https://t.co/Z9lu3wcjC0 CountyofLA (from Los Angeles County) Tue Dec 01 18:44:51 +0000 2020

Veterans and active duty military are eligible. Many veterans can verify their eligibility in seconds using the VA'… https://t.co/VmNImNEFxV SecWilkie (from Washington, DC) Wed Dec 02 13:26:13 +0000 2020

No comments:

Post a Comment