Moves by high-profile companies to Texas from California are likely to improve the personal finances of executives and offer employees more affordable housing—but make little difference to the firms' tax bills.

The announcements have highlighted the vastly different tax and regulatory systems in the country's two most populous states. California relies more on taxing personal income, particularly of high-income households, and operates a growing regulatory structure. Texas leans on more regressive property and sales taxes and boasts a more laissez-faire environment. The biggest difference: High-paid executives who move can see their state income-tax bills go from 13.3% to nothing.

Other things to check out:

PPS board declines to raise taxes, increasing district deficit | Pittsburgh Post-Gazette

7 December Moves To Save On 2020 Taxes | Investment | dbrnews.com

The holiday season is full of plans and activities that make December incredibly hectic. If you are the average American, tax considerations and financial adjustments are pretty low on your holiday to-do list. However, you are not the average American — you enjoy saving money, are diligent in seeking ways to save, and excellent at following through with your plans. We can help by offering these potential money-saving tips to take to save on this year's taxes.

North Huntingdon holds line on property taxes for 2021 | TribLIVE.com

North Huntingdon property owners will not have to pay more in real estate taxes to operate township government in 2021.

The commissioners on Wednesday approved setting the tax rate at 11.55 mills for the $14.7 million general fund budget.

Commissioner Jason Atwood was the lone opposition to setting the tax rate at 11.55 mills; Atwood and Commissioner Eric Gass opposed approving the budget.

Were you following this:

Why Major Labor Unions Want to See Taxes Hiked for Rich

Ten major labor unions in New York, including the state AFL-CIO, are pushing for a tax increase on the highest earners in New York as the state faces a multi-billion dollar budget shortfall.

The push for more revenue by increasing taxes on billionaires and "ultramillionaires" comes as the economic crisis could lead to cuts for health care, schools and local governments in New York without significant federal aid.

Waltham Get Ready for Taxes: Stay home and stay safe with IRS online tools | TAPinto

WASHINGTON – The Internal Revenue Service today encouraged taxpayers to take necessary actions now to help file federal tax returns timely and accurately in 2021.

This is the fourth in a series of reminders to help taxpayers get ready for the upcoming tax filing season. A special page , updated and available on IRS.gov, outlines steps taxpayers can take to make tax filing easier in 2021.

* * *

Almost everyone can file electronically for free. The IRS Free File program , available only through IRS.gov or the IRS2Go app , offers brand-name tax preparation software packages at no cost. The software does all the work of finding deductions, credits and exemptions. It‘s free for those who earned $72,000 or less in 2020. Some of the Free File packages also offer free state tax return preparation.

Columbia homeowners could pay up to 4.5% more in taxes for district | Regional |

Students head back to school as Columbia Borough School District kicks off the 2018-19 school year on Monday, August 20, 2018.

* * *

What happened: The board adopted a resolution limiting the district from raising real estate taxes more than 4.5% for the 2021-22 school year. That amount represents the state tax cap, or adjusted Act 1 index, assigned to the district.

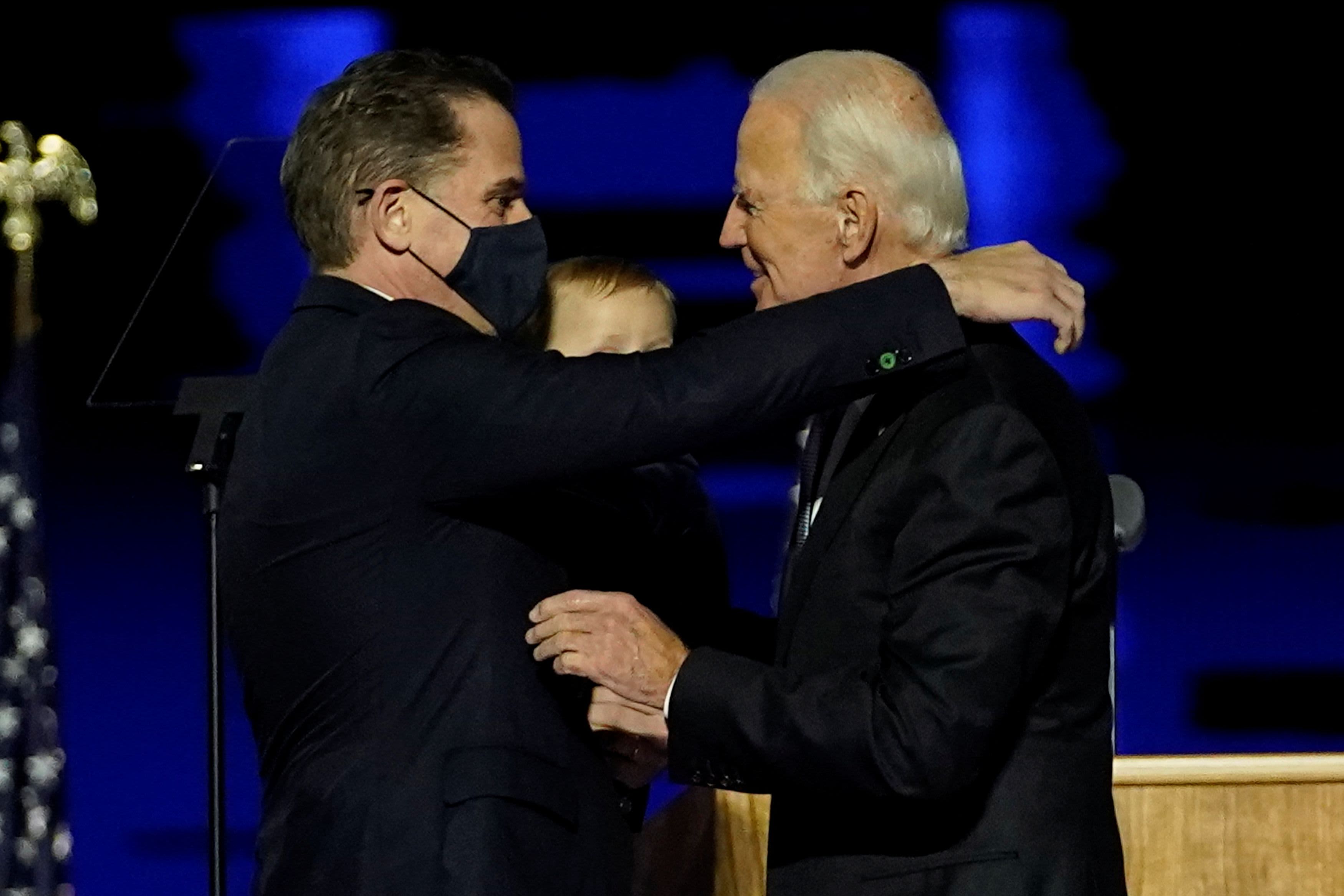

Joe Biden is confident Hunter Biden did not break tax laws

President-elect Joe Biden on Wednesday said that he is confident Hunter Biden did nothing wrong as his son faces a criminal tax probe by federal prosecutors in their home state of Delaware.

Biden's statement appears to be the first time that the Democratic former vice president has publicly said he believes Hunter Biden is innocent of criminal wrongdoing. Hunter Biden has not been charged by prosecutors.

The president-elect previously said "I'm proud of my son" when asked whether he had spoken to Hunter Biden on the heels of the investigation coming to light, and whether he believed his son had committed a crime.

Happening on Twitter

Blue states send more tax dollars to Washington than they get back. Red states get back more than they contribute.… https://t.co/atfn6Bcsk5 RBReich (from Berkeley, CA) Sat Dec 12 17:11:14 +0000 2020

I feel sorry for Texans that their tax dollars are being wasted on such a genuinely embarrassing lawsuit. Texas is… https://t.co/R0hBOIyGvi WisDOJ (from Wisconsin) Tue Dec 08 16:43:54 +0000 2020

Companies moving from California likely won't see their own tax bills shrink, but executives and employees could pa… https://t.co/X0hXXguHDy WSJ (from New York, NY) Wed Dec 16 16:37:51 +0000 2020

:max_bytes(150000):strip_icc()/GettyImages-1473129313-1bb95034c249450bb44ac00b5a2dcfd4.jpg)

No comments:

Post a Comment