During the Covid-19 pandemic, transparency from public companies is more important than ever and accounting practices are remaining an enforcement priority for the SEC. In Part 2 of a two-part series on public company disclosures, Ballard Spahr attorneys explore accounting judgments and compliance with Generally Accepted Accounting Principles.

As the country continues struggle with the financial effects of the Covid-19 pandemic, the reporting of accurate information and transparency from public companies is more important than ever. In the first article of this two-part series, we examined guidance for public companies regarding supply chain and workforce disclosures. In this article, we will explore accounting judgments and compliance with Generally Accepted Accounting Principles (GAAP) in the age of Covid-19.

And here's another article:

ProNexus Launches Outsourced Accounting Practice

Let ProNexus help you stay focused on growing and managing your business while we improve your cash flow!

Consulting - assess needs, make recommendations, and deliver results;

Projects – support CEOs, CFOs, CIOs to accomplish critical projects;

Outsourcing/Co-Sourcing - Internal Audit, Tax, Accounting, PMO;

Interim Management - CFOs, CIOs and more;

Staff Augmentation - to support the CFO or CIO organizations;

Other Services – Retained Search and NetSuite ERP

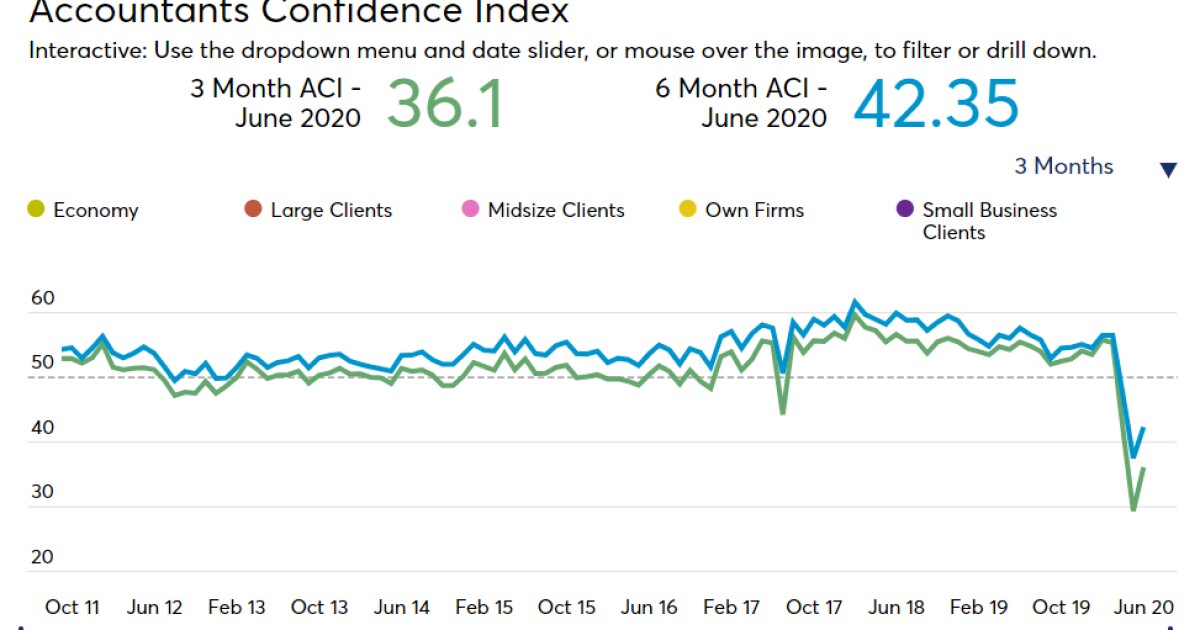

Accountants' confidence rises from an all-time low | Accounting Today

Following two months of precipitous drops, the Accountants Confidence Index levelled off a bit for June, though respondents are still deeply concerned about the impact of the coronavirus pandemic on the economy.

Respondents to our monthly survey were uniform in their agreement that the shutdown orders in states across the country were significantly harming their clients (particularly small businesses), but many were holding out hope for a rebound, or at least an end to the bleeding, all depending on how soon the economy reopens.

Haresh Sapra: Now is not the time to relax accounting standards | Chicago Booth Review

As a result, the accounting standard for recognizing losses was replaced by an expected-loss model. Regulators on both sides of the Atlantic—the International Accounting Standards Board (in London) and the Financial Accounting Standards Board in the United States—changed the way that banks recognize losses. These rules were debated for a long period of time and were finally put in place in 2016.

In light of all the pushback, the Coronavirus Aid, Relief, and Economic Security (CARES) Actthat President Trump signed on March 27, 2020, included one short paragraph—on page 538 of an 880-page document—allowing banks to delay implementation of this expected-loss model, which in the US is called the CECL (the current-expected-credit-loss model).

And here's another article:

A grander reopening post-coronavirus | Accounting Today

What we can do, however, is determine how we each, individually and within the organizations we work for, go about reopening. First and foremost, we should bear in mind that everyone feels differently about it, and try to respect those differences. Not all your staff, for instance, will feel comfortable returning to the office, no matter how early or late the reopening is, and you should put as many measures in place to reassure them and keep them safe as you need.

We can also remember that few things are ever as certain as we would like them to be. By the mid-1930s, Americans thought they had emerged from the Great Depression that started in 1929 — only to face another steep downturn in 1937-38. Whenever you reopen your firm, don't assume that it will be for the last time, or that your state or local authorities won't call for a do-over, should the coronavirus return.

Call for Submissions: Accounting Today's 2020 VAR 100 | Accounting Today

It's that time of the year again — Accounting Today is putting together its VAR 100 ranking of the top value-added resellers of accounting and accounting-related software by revenue.

Cannabis case challenges non-deductibility of expenses | Accounting Today

The Harborside case is not the first time that an entity specializing in the processing, sale or distribution of cannabis has challenged the constitutionality of Code Section 280E, but it is very likely the largest and the most closely watched case. And if the Ninth Circuit agrees with the appellant, it will ultimately be decided by the Supreme Court.

The Tax Court decision in Patients Mutual Assistance Collective Corporation d.b.a. Harborside Health Center v. Commissioner held that the medical marijuana dispensary could not deduct business expenses despite operating its business legally under California law. The Tax Court denied Harborside's deductions from 2007 to 2012, citing Code Section 280E, which prevents any trade or business that "consists of trafficking in controlled substances from deducting any business expenses.

No comments:

Post a Comment