(Washington, D.C.) -- The nation's farmer cooperatives want the Trump administration to withdraw proposed tax rules that would raise taxes on farmers and ranchers across the country.

The Executive Council of the National Council of Farmer Cooperatives last month asked the Treasury Department and the Office of Management and Budget to withdraw a proposal that would implement Section 199A(g) of the tax code. The proposal doesn't allow farmer cooperatives to deduct business with non-members of the cooperative.

Were you following this:

Treasury/IRS Release Proposed Regulations on Section 4960 Excise Tax | McDermott Will & Emery -

The US Department of the Treasury has released long-expected proposed regulations regarding the section 4960 excise tax on certain remuneration or separation amounts paid to the five highest paid employees of a tax-exempt organization. The new proposed regulations continue the tough approach previously taken on section 4960 issues, while also providing some new exceptions and important clarifications.

Summary : The US Department of the Treasury released long-expected proposed regulations regarding the section 4960 excise tax ( i.e. , the 21% excise tax on vested remuneration over one million dollars paid to a covered employee, and on excess parachute payments triggered by an involuntary separation from service). Prior to these proposed regulations, the Internal Revenue Service (IRS) had issued a lengthy notice (Notice 2019-09, Dec.

Proposed Regulations Clarify Application of New 'Ratable Share' Recognition Period for Federal

On May 21, 2020, the Department of the Treasury (Treasury) released proposed regulations (the proposed regulations) * regarding the new five-year credit period for the historic rehabilitation tax credit (HTC) under Section 47 of the Internal Revenue Code (the Code).

* * *

The proposed regulations would apply to taxable years beginning on or after the date the regulations become final. However, the proposed regulations also allow a taxpayer to rely on them for QREs paid or incurred after Dec. 31, 2017, if the taxpayer follows the regulations in their entirety and in a consistent manner.

Executive Compensation at Tax-Exempt Organizations Back in the Limelight – IRS Issues New

The Tax Cuts and Jobs Act of 2017 (“TCJA”) is mostly known as the legislation that cut the top corporate tax rate from 35% to 21%. It also introduced a new excise tax under Code Section 4960, which imposes an excise tax equal to the corporate income tax rate on “applicable tax-exempt organizations” (“ATEOs”) that pay covered employees compensation that either exceeds $1 million or is an excess parachute payment (i.e.

The proposed regulations, which at 177 pages long, reflect how simple Code Section 4960 will be to comply with, are intended to provide comprehensive guidance on the application of Code Section 4960.

And here's another article:

IRS offers tax relief to opportunity zone funds and investors in response to coronavirus |

The Internal Revenue Service is giving investors in opportunity zone funds relief from some of the requirements in the controversial program because of the COVID-19 pandemic.

Opportunity zones were ushered in by the Tax Cuts and Jobs Act of 2017 and provide substantial tax breaks to investors who develop projects in economically distressed communities, in some cases allowing them to defer capital gains taxes indefinitely. However, many of the initial projects under development have been in gentrifying areas that were already attracting substantial real estate investment and not in truly underprivileged communities.

Airbnb-NYC Settlement Means Hosts Will Have to Pay Taxes or Leave the Platform – Skift

That Airbnb consented to such a settlement in one of its biggest global markets may have implications for other cities.

With some exceptions, such as for private and shared-room listings and properties that were listed for fewer than four nights in the previous quarter, New York hosts would be subject to paying state sales and use tax, New York City hotel occupancy taxes, and city and state nightly room fees.

Expatriate Attorney Says Treasury Must Suspend GILTI Regs - Law360

Enter your details below and select your area(s) of interest to receive Law360 Tax Authority daily newsletters

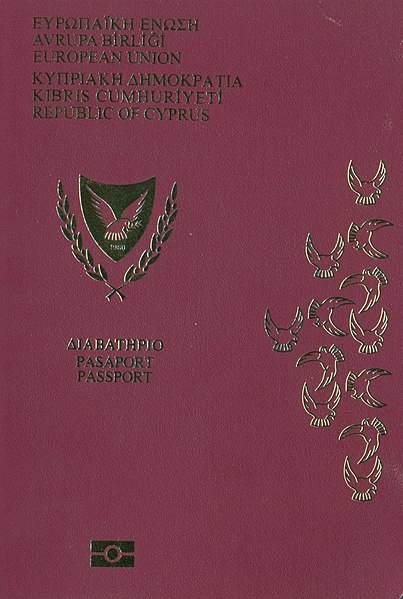

Golden Visas: Cyprus to Tighten Regulations

Cyprus plans to tighten requirements for its 'citizenship by investment' programme following a warning from European authorities earlier this year that the scheme is vulnerable to exploitation by criminals.

Cyprus considers tightening citizenship for investment programme ( Photo: Council of Europe, CC SA-BY 3.0 ) OCCRP has previously focused several investigations on so-called Golden Visa programmes, which enable wealthy elites to secure a country's citizenship in return for investment.

No comments:

Post a Comment