With claims recently hitting some 40 million in the U.S. and more expected, unemployment payments are a critical part of the current safety net — but in the middle of an historic pandemic, this part of the net comes with a lot of tax questions.

"First, I'm educating my clients about how, where and when to apply for unemployment," said Phyllis Jo Kubey, an EA in New York, one of the localities where the state Labor Department's computer system initially groaned under the deluge of benefits applications.

And here's another article:

Here are Virginia's new taxes that go into effect on July 1

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/JZLIQQW4FNHQ3JPWSRZBWF6KSA.jpg)

RICHMOND, Va. – During the recent Virginia General Assembly session, many new tax laws were approved.

* * *

Cigarette and Tobacco Products Tax Increase: The tax rate will double for cigarettes and other tobacco products currently subject to the tax. The tax on a pack of cigarettes increases from 30 cents to 60 cents per pack.

Liquid Nicotine Subject to Tobacco Products Tax: The new tax rate for liquid nicotine products is 6.6 cents per milliliter on sales or purchases on or after July 1.

April sales taxes show decrease in revenue decline in most Summit County towns | SummitDaily.com

DILLON — The sales tax reports of Summit County towns show the financial impact of the COVID-19 shutdown and April sales tax numbers reflect the economic downturn, although they are slightly stronger than March numbers in several towns and even positive in Blue River and Dillon. March showed dismal sales tax numbers that were attributed to the onset of the county-wide shutdown, which began March 16 .

"Thankfully, April & May are our two lowest earning months in sales tax revenue, with things slowly opening back up staff feels the Town will weather the pandemic," the report stated.

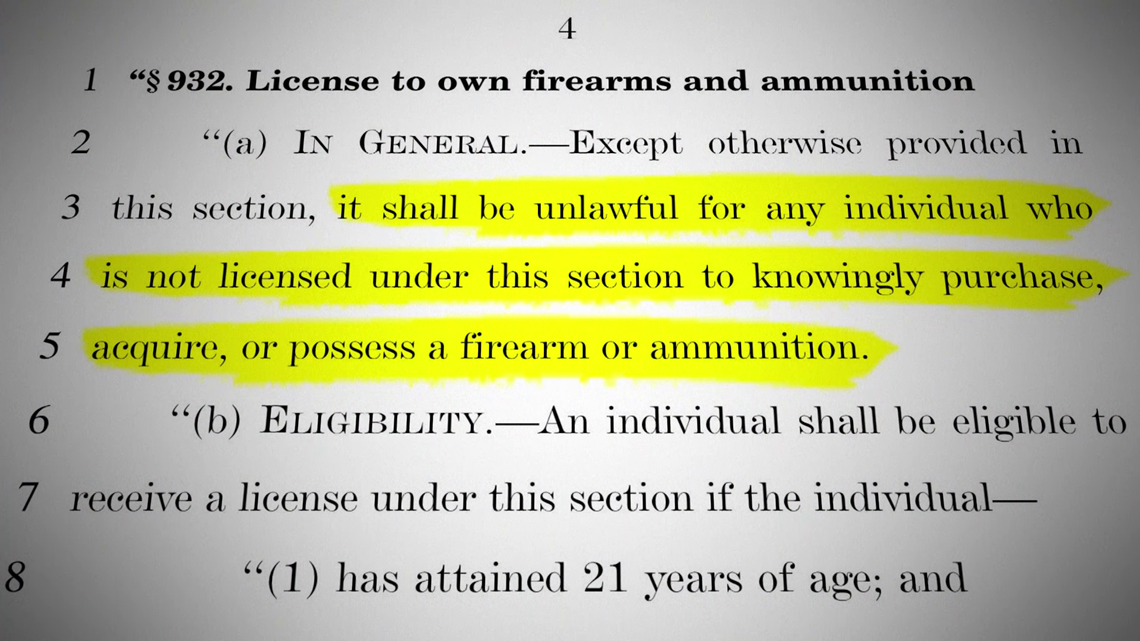

VERIFY: H.R.5717 proposes taxes on gun and ammo purchases | wusa9.com

Have the media been ignoring coverage of a new bill that would tax your guns and require you to get licensed? That's the claim at the heart of this viral post:

The first part is easily answered by pointing to dozens of articles and stories from a variety of outlets on H.R. 5717, from when it was first introduced, until today.

The other claims in the post, though, are actually more factual and take a bit more explanation.

Does HR5717 propose new taxes on guns and ammunition while also requiring licenses for all gun owners?

Many things are taking place:

Sugar-sweetened beverage taxes may prevent CVD, diabetes

All sugar-sweetened beverage tax designs, including volume, tiered and absolute sugar content taxes, have potential to generate substantial health gains with regard to CVD and diabetes in addition to cost savings, a study found.

Participants in this study were aged 35 to 80 years (mean age, 55 years), 53% of whom were women, 72% were white adults and 29% were low income .

During a mean simulated follow-up of 28.7 years, the volume tax would prevent 269,000 cases of diabetes (95% CI, 265,000-274,000) and 850,000 cases of CVD (95% CI, 836,000-864,000). In addition, it would save $53.2 billion in net costs (95% CI, 52.3-54.1) and gain 2.44 million QALYs (95% CI, 2.4-2.48).

Here's why you haven't received your tax refund

"We filed a client's return, and it was accepted on April 14," said Nayo Carter-Gray, an enrolled agent at 1 st Step Accounting in Towson, Maryland.

* * *

Big money is at play. The IRS distributed an average refund check of $2,767 as of June 12. In comparison, the agency delivered stimulus checks of up to $1,200 per individual, plus $500 for each qualifying child.

"Some clients haven't received refunds yet, but they did receive stimulus payments," said Carter-Gray. "In the midst of the IRS shutting down and teleworking, there's kind of a gap there."

Your Money – Minimizing taxes in retirement | WJET/WFXP/YourErie.com

Roland Kljunich, President of Roland Financial Wealth Management and author of the book “Magnetic Retirement” discusses minimizing taxes in retirement.

* * *

When COVID-19 put an end to the school year and the extracurricular activities as well 11-year old Bryson took to running, and since the month's since the schools closed he's run more than 110 miles.

Putting the blame where it squarely belongs when commercial property taxes in Cook County jump -

Once the Cook County assessor's office was run on the up-and-up, it was inevitable there would be a painful day of reckoning.

For decades in Cook County, the size of your property tax bill was dictated way too much by whether you were rich, had the right friends or hired a politically connected lawyer.

Commercial landlords caught a break, as did people who owned North Shore mansions. Middle-class and lower income homeowners got stiffed.

No comments:

Post a Comment