Results from a new economic tracker that looks at real-time statistics on consumer spending, jobs, and business revenue suggest that the government's traditional recovery strategies to reverse the downturn triggered by the pandemic are not having a major impact, because they fail to address the root of the problem — consumer fear of the virus itself.

The findings, summarized in a report published Wednesday by Harvard's Opportunity Insights group, suggest that the only way to fully revive the economy is to address the virus itself through therapy or a vaccine. And in the meantime, barring some other medical advance or shift in the economy, a more effective approach would be to focus on bolstering the businesses, individuals, and areas most affected, instead of broad-based solutions like direct stimulus payments to all Americans.

Not to change the topic here:

African Gold boosts economics for Kobada - Mining Journal

African Gold Group's Kobada asset is located in southern Mali, approximately 125 km in a straight-line south-southwest of the capital city Bamako

* * *

African Gold originally planned to deliver its DFS in March but as with many miners, timelines have slipped in the wake of COVID-19.

Capex on Kobada will amount to US$125 million plus a contingency of US$11 million, which the company said would be paid back in 3.82 years from start of production.

Stock markets bounce back despite poor economic prognosis | Business | The Guardian

The US central bank took markets by surprise by announcing that it would buy the lowest investment-grade bonds as part of its quantitative easing programme in an attempt to save jobs and stimulate investment.

The announcement brought to an end a sell-off in shares prompted by concerns that a pick-up in Covid-19 in some southern US states would lead to the reimposition of lockdown restrictions and slow the pace of recovery.

"Recently, some indicators have pointed to a stabilisation, and in some areas a modest rebound in economic activity," Powell said in evidence to the US Senate. "That said, the levels of output and employment remain far below their pre-pandemic levels, and significant uncertainty remains about the timing and strength of the recovery."

Federal economics and fiscal 'snapshot' coming July 8: Trudeau | CTV News

And here's another article:

The economic effects of COVID-19 containment measures | VOX, CEPR Policy Portal

Our paper (Deb et al. 2020b) aims to quantify the average economic effect – across countries and measures – of containment measures. Second, it examines whether fiscal and monetary measures implemented by many governments and central banks around the world have been effective in mitigating some of the negative effects of containment measures. Finally, we examine which types of containment measure have resulted in larger economic costs and trade-offs between health risks and economic losses.

For economic recovery, 'virus is the boss' | The Spokesman-Review

The economic downturn from the COVID-19 pandemic is unlike any the country has ever seen, so it's difficult to say whether normal rules for recessions apply, a former chairman of the President's Council of Economic Advisers told a state Senate panel Tuesday.

Whether unemployment rates will follow the normal pattern – "up like a rocket, down like a feather" – is hard to predict, said Austan Goolsbee, a former adviser to then-President Barack Obama and now a professor of economics at Chicago University.

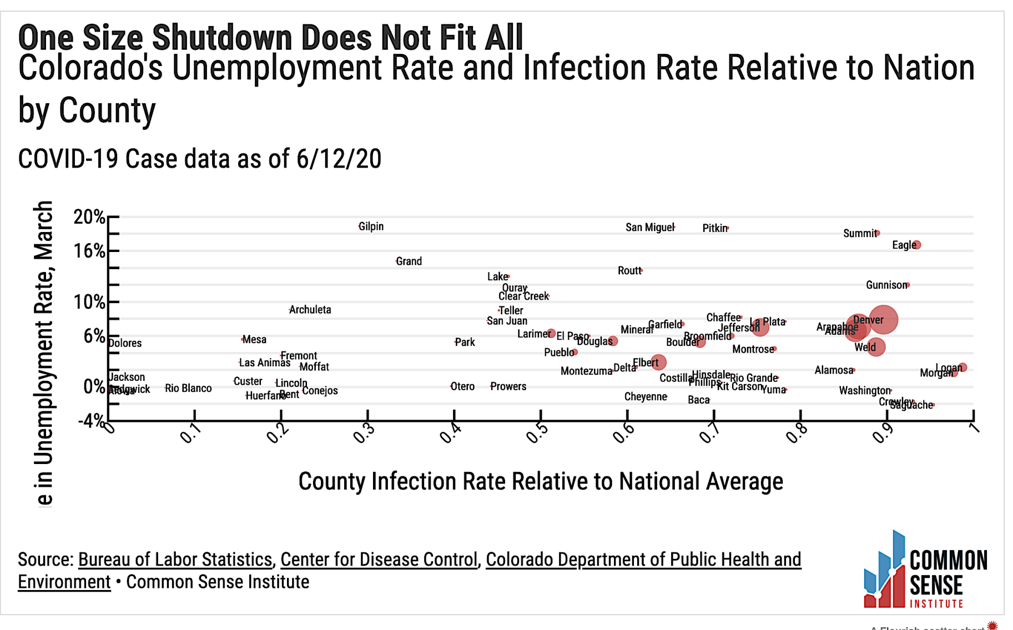

Colorado's coronavirus outbreaks and economic hardships locally disjointed, study says | Health |

A fight more than 15 months in the making finally boiled over on the last day of the 2020 legislative session, and resulted in a closed-door meeting Monday between eight members of the state Senate and Gov. Jared Polis.

* * *

Joey Bunch is the senior correspondent and deputy managing editor of Colorado Politics. His 32-year career includes the last 16 in Colorado. He was part of the Denver Post team that won the Pulitzer Prize in 2013 and he is a two-time finalist.

Veteran Economist Charles Himmelberg Joins Pretium | Business Wire

Mr. Himmelberg brings more than 25 years of research experience in economics and financial markets to Pretium. In his role, Mr. Himmelberg will be responsible for global market research across the firm's strategies.

"Charlie is a highly-respected macro strategist," said Donald Mullen, CEO and Founder of Pretium. " His thought leadership, vast experience navigating through times of market turbulence, and research expertise will be invaluable as we assess opportunities in the current economic environment."

Happening on Twitter

As long as I'm premier Albertans will always have final say via fair referendum vote re: if a hypothetical sales ta… https://t.co/VGo9W78iKO jkenney (from Alberta, Canada) Tue Jun 16 17:08:29 +0000 2020

No comments:

Post a Comment