Beacon Hill leaders will further delay tax deadlines for small businesses around the state in another step aimed at lessening pressure on those hit hardest by the economic downturn that the pandemic prompted.

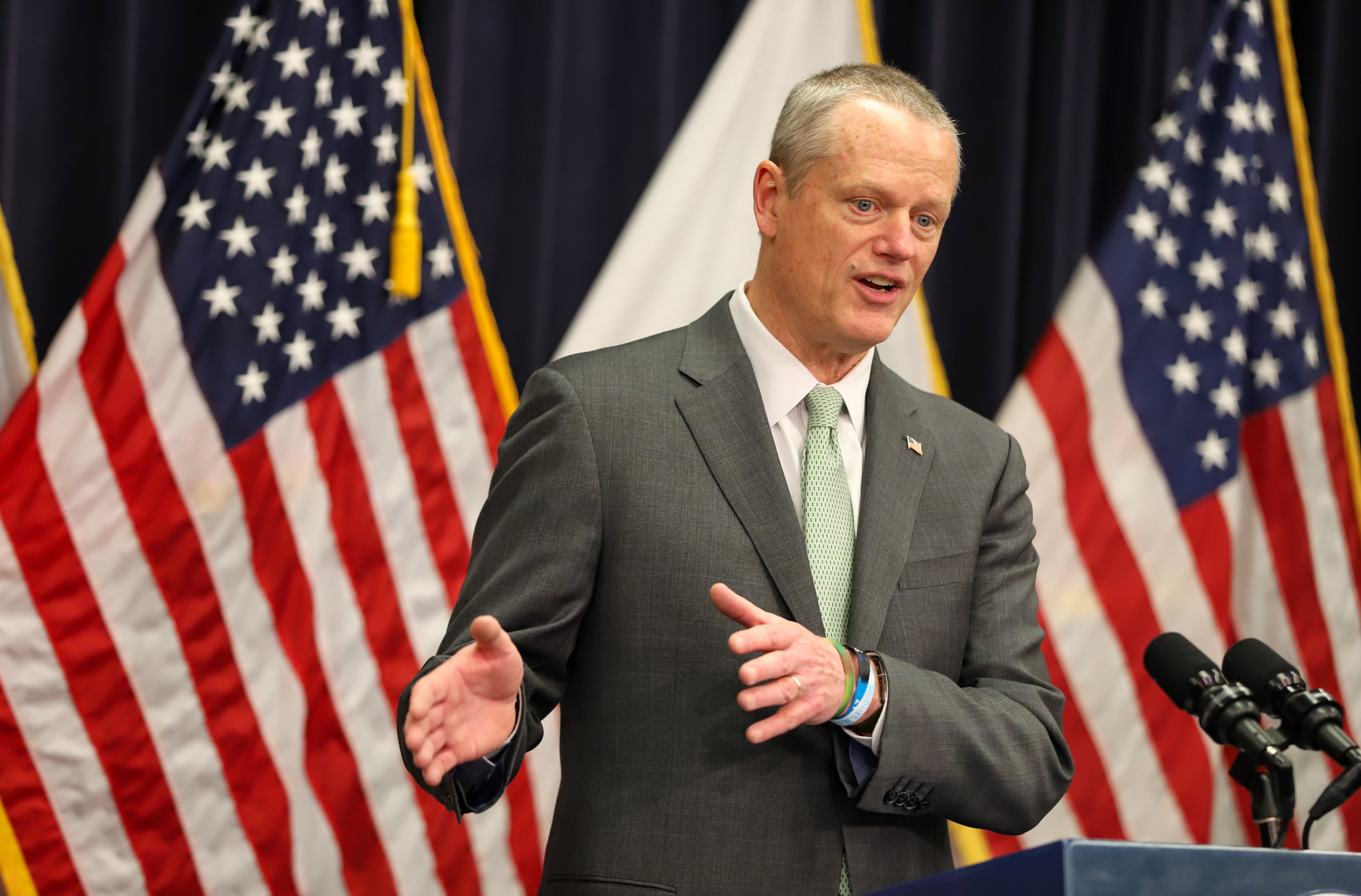

Sales, meals and room occupancy taxes for qualifying businesses for March through August will not be due to the state until September, and those that wait will not face any penalties or interest, Gov. Charlie Baker and legislative leaders announced Thursday.

While you're here, how about this:

US Department of Treasury Proposes Regulations Under Code Section 1031 That Provide

Seyfarth Synopsis: On June 12, 2020, the US Department of Treasury (the “Treasury”) promulgated proposed treasury regulations (the “Proposed Regulations”) under section 1031 (“Section 1031”) of the Internal Revenue Code of 1986, as amended (the “Code”) that (1) abandons prior reliance on piecemeal local law definitions of “real property” in favor of unified, broad, and taxpayer-friendly definition for purposes of Code

The determination of whether property is real property has taken on additional significance as a result of the TCJA amendment limiting Section 1031 Exchange treatment to real property.

EY and multinational tax clients adjust to coronavirus | Accounting Today

Big Four firm Ernst & Young and its business tax clients at companies across the U.S. and other countries have faced a series of challenges amid the coronavirus pandemic, including new tax legislation like the CARES Act, just as they were starting to grow more familiar with the Tax Cuts and Jobs Act of 2017 and all of its brand-new tax provisions. Still, as EY and its clients adjust to working from home and dealing with each other remotely, they have found ways to get their jobs done.

IRS Clarifies Eligible Like-Kind Property under Proposed Section 1031 Regulations | Hanson

On June 11, 2020, the IRS released proposed regulations for like-kind exchanges under Internal Revenue Code (the "Code") section 1031 to incorporate the Tax Cuts and Jobs Act ("TCJA") changes. Prior to the TCJA, both real property and personal property were eligible for like-kind exchange treatment. The TCJA restricted the tax deferral benefits solely to exchanges of real property.

Various Treasury regulations define real property to apply Code sections other than section 1031. Although similar in many ways, the definitions differ in scope to reflect the purposes underlying those particular provisions. To uphold the Congressional intent that real property eligible for like-kind exchange treatment prior to the TCJA continues to be eligible, the Treasury and the IRS rejected fully adopting any existing definition from another section of the Code or regulations.

Not to change the topic here:

Final Treasury Regulations Reduce Donor Reporting Requirements for Some Tax-Exempt Organizations

The Department of the Treasury has adopted Final Regulations, providing guidance on information to be reported on the annual return of tax-exempt organizations with respect to their “substantial contributors." For these purposes, a tax-exempt organization’s substantial contributor is any donor who, in a taxable year, contributes to the organization an aggregate of $5,000 or more (in cash or property).

Tax-exempt organizations ( other than those described in Code § 501(c)(3) or Code § 527) are no longer required to report, on their annual return, the names and addresses of their substantial contributors.

Further tax delays 'not enough' to help devastated restaurant, hotel industries

Emergency regulations that will further delay sales tax deadlines for restaurants, hotels and other small businesses hard-hit by pandemic-induced closures “isn’t enough,” say business owners trying to pay their rent and utility bills on a fraction of the revenues they typically see.

“We need something much bigger and broader. Anything the state does is helpful and we’re certainly not going to turn down any help, but this isn’t enough,” said Tony Maws, co-founder of Massachusetts Restaurants United — a group of 700 independent restaurant owners that formed in March to lobby state and federal governments for relief amid the pandemic.

Tax, Accounting, and Audit in Vietnam 2020 - Vietnam Briefing News

A strong understanding of tax liabilities enables foreign investors to maximize the tax efficiency of their investments while ensuring full compliance with all tax laws and regulations.

Vietnam Briefing's Tax, Accounting, and Audit Guide for 2020, produced in collaboration with our tax experts at Dezan Shira & Associates, aims to provide an overview of taxes for businesses and individuals in Vietnam, as well as fundamental accounting and audit information in the Vietnamese business context.

LEGISLATURE WRAPUP | In a bizarre, broken session, Colorado lawmakers make history | Legislature

DENVER, CO - MARCH12: Lobbyists, legislators, and visitors gather outside House chambers at the start of the session. The Colorado General Assembly works through their regular session schedule at the Colorado State Capitol on March 12, 2020 in Denver, Colorado. (Photo By Kathryn Scott)

DENVER, CO - MARCH12: Sen. Rhonda Fields, right, greets Mercedes Blea-Davis, left, with an elbow bump instead of a hug or handshake as advised due to the risks from the coronavirus. Blea-Davis and her government students from the Denver Language School were guests of Sen. Fields inside the Senate chambers. The Colorado General Assembly works through their regular session schedule at the Colorado State Capitol on March 12, 2020 in Denver, Colorado.

Happening on Twitter

The White House organized a call with doctors who are members of the Tea Party to tell reporters we do not have a n… https://t.co/n6HUcZ0Fl6 ASlavitt (from Edina, MN) Fri Jun 19 03:03:37 +0000 2020

BOLTON ALERT: The unparalleled @gtconway3d & I will be covering the court hearing live, at 1PM TODAY, right here.… https://t.co/atcC190JDf neal_katyal (from WashDC Author of IMPEACH ) Fri Jun 19 16:22:12 +0000 2020

No comments:

Post a Comment