As a financial adviser, Elyse Foster helps clients navigate tricky personal issues around managing their money. But the coronavirus has brought an extra layer of complexity — especially where family is concerned.

One client lent a newly unemployed sibling $10,000. But that good intention went awry quickly when the client later learned that his son needed money, too. "The son resented the father for not realizing" it, said Ms. Foster, chief executive of Harbor Wealth Management in Boulder, Colo.

Were you following this:

Black Businesses Largely Miss Out on Opportunity Zone Money | The Pew Charitable Trusts

President Donald Trump says the opportunity zone tax break he signed into law in 2017 has created “tens of thousands of jobs” and is helping minority communities and Black businessowners. In a tweet earlier this month, he pointed to opportunity zones as proof he’d done more for the Black community “than any President since Abraham Lincoln.”

But critics have long said the tax break, which encourages building in designated low-income communities, may end up accelerating gentrification and that it’s unlikely to help Black businessowners.

Fewer Americans are losing sleep over money. But why? | WTOP

It seems to run counter to what one would expect, given the economic devastation from the coronavirus pandemic, but a new Bankrate survey shows fewer Americans are losing sleep over money issues than a year ago.

Its survey of more than 2,500 U.S. adults between June 3 and June 5 found 47% report losing sleep, at least occasionally, about a money issue. That is down from 56% a year ago.

The ability to pay everyday expenses is the most commonly cited money worry, but it is down from 32% last year to 23% in Bankrate's most recent survey.

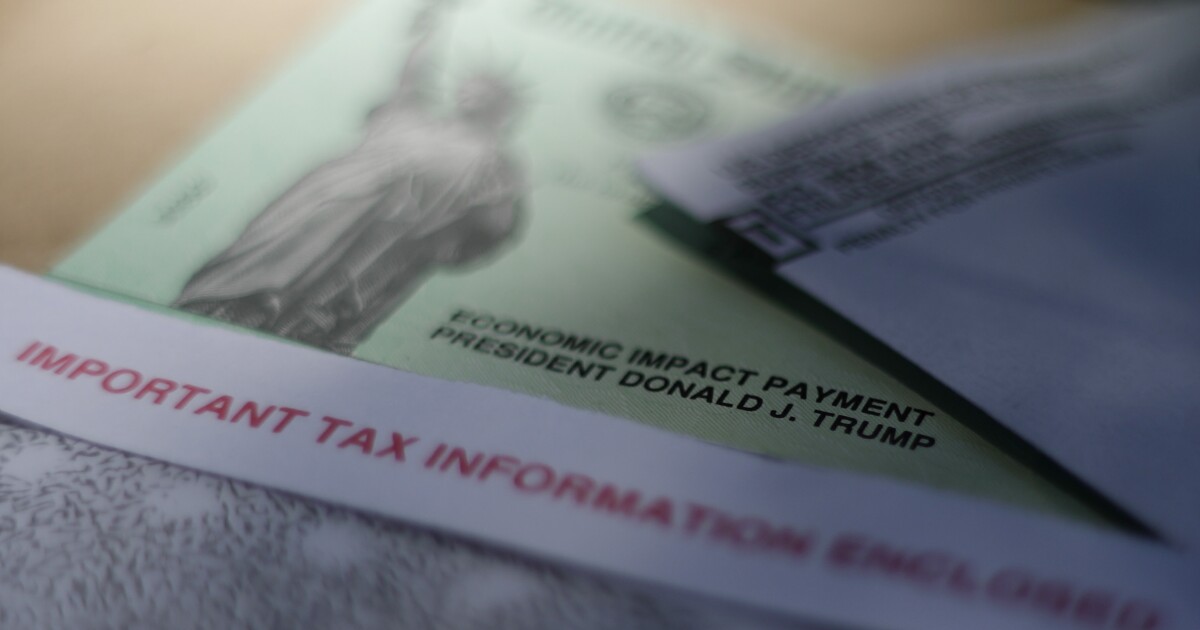

How to get your coronavirus stimulus money from the IRS - Los Angeles Times

Answer: The government did not run out of money, and at a minimum you should be able to file a tax return next year to get your stimulus payment as a refundable credit. Since you need the money now, though, you should follow up with the IRS.

The IRS has reopened the general taxpayer helpline that was shuttered because of the coronavirus pandemic, but it has also added thousands of phone reps to a special hotline to deal with stimulus payment problems: (800) 919-9835. That's the number you should call to inquire about your payment.

Other things to check out:

Pandemic Stalls Investment In 'Opportunity Zone' Areas, Survey Says : NPR

The facade of a former bank is turned into residential housing in 2018 in an "opportunity zone" in Newark, N.J. Julio Cortez/AP hide caption

The economic slowdown caused by the coronavirus pandemic is stifling a federal program meant to spur new investment in low-income neighborhoods, according to a new survey from an advocacy group that backs the initiative.

The Economic Innovation Group surveyed more than 100 investors and other people involved in "opportunity zones," designated areas that offer tax incentives for investment. Created by the 2017 tax cut law, the zones are aimed at attracting money and new businesses to poor communities.

Square, Jack Dorsey's Pay Service, Is Withholding Money Merchants Say They Need - The New York

OAKLAND, Calif. — Jack Dorsey has won plaudits for his corporate activism during the coronavirus crisis, taking on President Trump in his role as Twitter's chief executive and donating nearly a third of his total wealth to pandemic relief.

But at Mr. Dorsey's other company, Square, a payments business where he is also chief executive, he is facing a growing chorus of unhappy customers.

Thousands of small enterprises that use Square to process their credit card transactions — including plumbers, legal consultants and construction firms — have complained that the company recently began holding back 20 to 30 percent of the money they collected from customers. The withholdings came with little warning, they said, and Square asserted the right to hang on to the money for the next four months.

How to Take Money from Your Retirement Account During the Pandemic

You can take a distribution of up to $100,000 from your retirement account for "coronavirus-related" purposes. The usual 10% penalty is waived. You have until the end of the year to do this.

If you replace the money within three years, you don't have to pay income tax on the amount. Otherwise, you have three years to pay the taxes on that money.

* * *

Now the IRS is expanding the temporary allowance to include more reasons you might be feeling financial pressure from the pandemic and associated shutdown efforts.

Everyday Cheapskate: More creative ways my readers save time and money – Red Bluff Daily

![]()

Sometimes, I wonder how “Everyday Cheapskate” readers discover their handy ideas. I mean, who would have thought something that cleans brake parts would also remove stains from clothes?

* * *

I have found that using my husband’s brake parts spray cleaner, Brakleen, works really well for getting out grease stains. It doesn’t affect the color and works when other stain removers have failed, even if the item has already been washed and dried. — Cam

Happening on Twitter

RIP beautiful brother in arms. We've got your watch. https://t.co/htzfZj7FjZ codeofvets (from Murfreesboro Tennessee, USA) Wed Jun 24 00:57:14 +0000 2020

And...everyone welcome this game changer (on and off the field) @PatrickMahomes to the family. Means a lot my Broth… https://t.co/7IuQpys1e3 KingJames (from Amongst La Familia!) Tue Jun 23 02:00:18 +0000 2020

No comments:

Post a Comment