Jason Yun of Ernst & Young LLP provides an overview of the key amendments to South Korean transfer pricing regulations under the recently enacted 2020 tax reform bill, and discusses considerations for taxpayers.

South Korea enacted the 2020 tax reform bill on December 31, 2019. Under the 2020 bill, the Law for the Coordination of International Tax Affairs (LCITA) and its Presidential Enforcement Decree (PD of LCITA)—South Korea's transfer pricing (TP) regulations—have been amended.

Other things to check out:

What to Know in Washington: 2017 Tax Law on Table in Aid Bill - Bloomberg Government

Some of the most contested pieces of the 2017 tax overhaul are being revisited as the White House and Congress begin to discuss another round of economic stimulus, including restoring the break for entertaining business clients and lifting the cap on state and local deductions.

Speaker Nancy Pelosi (D-Calif.) said the next coronavirus response bill should suspend the $10,000 cap on deductions for state and local taxes. President Donald Trump wants to restore a tax break for corporate client outings, dinners, sporting games, concerts and cruises, which were limited under the tax overhaul.

Unrigging the Economy Will Require Enforcing the Tax Laws - Center for American Progress

Pictured is a 300-year-old statue of Lady Justice overseeing the Well of Justice in Frankfurt, Germany.

* * *

A flurry of recent news stories highlights the scourge of tax dodging by wealthy individuals and large corporations.

These stories, which are just the tip of the iceberg, have a common thread running through them: When it comes to policing tax compliance among wealthy individuals and corporations, the IRS is badly outgunned.

DOL Temporary Regulations Answer Questions About Employee Documentation Needed to Support Paid

Enter the IRS. The IRS issued its own guidance related to seeking the tax credits, and if you thought that the IRS was not going to put limits on the eligibility for tax credits, you were wrong. While the documentation requirements for the tax credit largely mirror the DOL temporary regulations, there is one large difference when it comes to paid leave for childcare purposes.

So, while an employee may be eligible for leave for any child under 18, the employer will only be eligible for a tax credit if the leave is for children 14 and under (absent some exceptional circumstance). This makes clear that employers need to be careful to gather needed documentation to capture as much tax credit as possible.

And here's another article:

Charitable Giving is Down Due to Trump's Tax Overhaul | Sojourners

The Republican-passed Tax Cuts and Jobs Act of 2017 was the most sweeping overhaul to the federal tax code in decades. Among other things, it doubled the standard deduction. It is no longer cost-effective for most Americans to itemize donations. This creates a "giving gap" between middle-class donors and ultra-wealthy donors.

Even some Republicans found these changes controversial. They were unable to hide that most benefits would accrue to Americans with incomes in the top 5 percent.

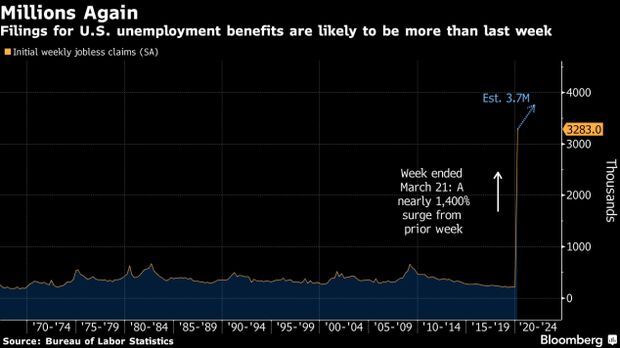

Tax Rules May Take Backseat as IRS, Treasury Triage Amid Pandemic

Tax practitioners who were once optimistic about seeing final international tax rules soon are no longer holding their breath.

Multinationals have been waiting on final rules on new 2017 tax law provisions such as a deduction on American-made exports and a new foreign income category. But practitioners are telling their clients they may have to wait a lot longer amid the economic shock caused by the Covid-19 pandemic.

The 2017 tax law introduced a host of new international tax provisions and income categories that tax professionals say increased complexity for multinationals. The IRS and Treasury have said they hope to have all guidance tied to the law wrapped up by fall, and they were targeting a spring release date for some, including rules on ordering previously taxed income and final rules on the dividend write-off a U.S. corporation gets from a foreign company in which it owns shares.

AICPA advocates on Wayfair burden, virtual currency taxation - Journal of Accountancy

The AICPA addressed two separate tax issues at important forums on March 3, advocating for small businesses in the wake of the Wayfair decision and discussing the taxation of virtual currency in separate events.

The hearing, " South Dakota v. Wayfair, Inc .: Online Sales Taxes and Their Impact on Main Street," focused on the regulatory and financial burden placed on small business as a result of a 2018 Supreme Court decision that radically changed sales tax collection rules.

Senate Republicans urge Northam to amend or veto tax hikes, regulations amid coronavirus crisis |

Tyler Arnold reports on Virginia and Tennessee for The Center Square. He previously worked for the Cause of Action Institute and has been published in Business Insider, USA TODAY College, National Review Online and the Washington Free Beacon.

Happening on Twitter

Sharing this sunset with everyone else cheering the key workers. With a brother, sister and sister-in-law in the NH… https://t.co/ZfJPcAPIwc Helenglovergb Thu Apr 02 19:17:13 +0000 2020

The most definitive piece you will read about why India is not testing more for coronavirus. The most shocking in… https://t.co/an83Qev2hF sharmasupriya (from India) Fri Mar 27 06:42:00 +0000 2020

No comments:

Post a Comment