That certainly was true last Monday, when oil prices reportedly reached a negative $37.63 per barrel. In other words, if you had a barrel of oil you did not want, you had to pay someone that much to take it off your hands. That prompted queries to economics professors and pundits. How can there be a negative price for oil? When will filling stations start paying you to take 20 gallons of gasoline out of their tanks? Is this a "market outcome?"

While you're here, how about this:

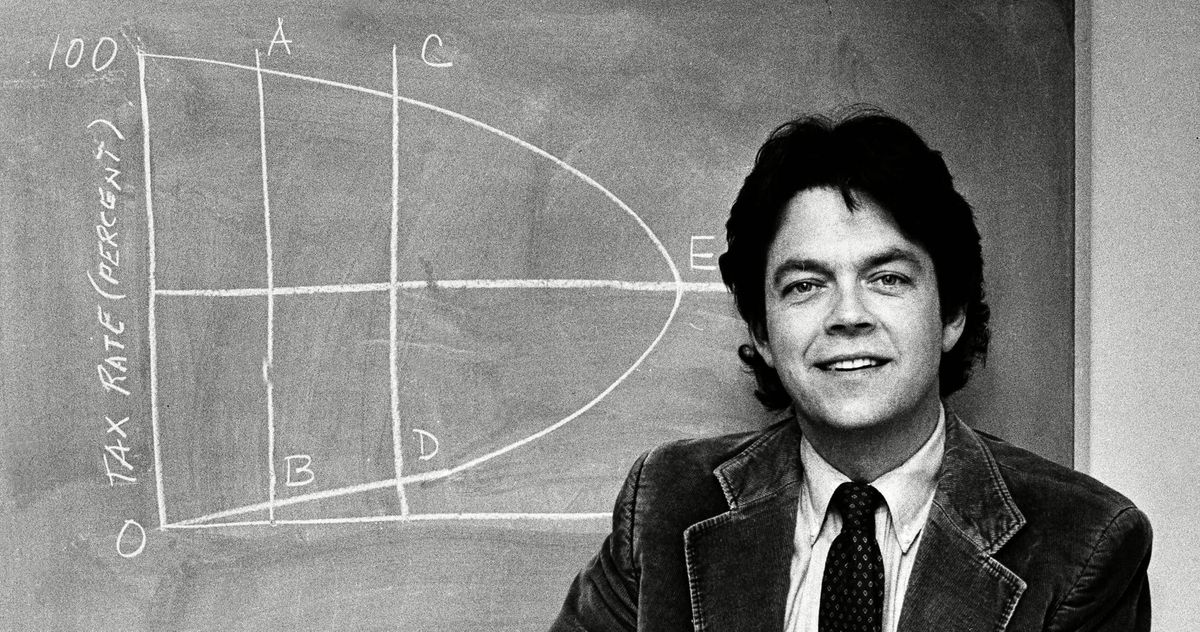

Arthur Laffer and the Economists Steering Our Public Health

One night in late March, President Trump, seized by one of his periodic bouts of dismay with his public-health officials, sought out a second opinion on how to handle the coronavirus pandemic. He called Arthur Laffer. After missing the president's first three calls, the 79-year-old Laffer finally answered, and the two men connected for what Laffer described as "a very serious conversation," shortly after which Trump tweeted , "WE CANNOT LET THE CURE BE WORSE THAN THE PROBLEM ITSELF."

Stocks week ahead: Why a flood of bad economic data isn't rattling stocks - CNN

Maine's economic fallout from coronavirus could be nation's worst - Portland Press Herald

One analysis puts Maine in the No. 1 spot among states likely to experience severe economic fallout from the pandemic because of its demographics and economic makeup. Another study ranks Maine sixth in the U.S. for highest share of “contact-intensive occupations” likely to be impacted in the transition to a low-touch economy dominated by social distancing requirements.

Here are the major the factors that make Maine the most vulnerable among the 50 states to a severe negative economic impact from coronavirus:

And here's another article:

Coronavirus: Hassett says unemployment will approach Great Depression

White House economic advisor Kevin Hassett warned on Sunday that unemployment could hit levels not seen since the Great Depression as the economy contracts dramatically while businesses in most parts of the nation remain shuttered due to the coronavirus pandemic.

Speaking to reporters on the White House lawn on Sunday morning, Hassett said the unemployment rate could hit 16% and "the next couple of months are going to be terrible" for economic data.

Markets Diverge in Assessing the Economic Freeze - WSJ

Stocks continue to rise despite an unprecedented freeze in global economic activity and an oil-price crash, a divergence that makes some investors skeptical the gains can continue.

The S&P 500 has baffled many investors by rebounding 27% since March 23 even as job losses have mounted. The broad equity gauge is now only down about 3% in the past year, with recent gains led byAmazon.com Inc. and Netflix Inc.

A flood of corporate debt could make the economic recovery more difficult - CNN

NST Leader: Covid economics | New Straits Times

Happening on Twitter

Signed for Real Madrid and benched Pepe in El Clasico aged 18. Won his first Champions League title aged 21. Had… https://t.co/jzWtIyqEd4 goal (from Everywhere) Sat Apr 25 10:30:50 +0000 2020

Watching The Handmaid's Tale is hard enough, but when you add the awful current circumstances in the real world, pl… https://t.co/5nUiIyd550 JoyAnnReid (from USA) Sun Apr 26 02:11:55 +0000 2020

It was horrible that they destroyed our economy on flawed models because Fauci needed a real world experiment and d… https://t.co/OGM44twH2i johncardillo (from Florida ) Sun Apr 26 11:52:07 +0000 2020

No comments:

Post a Comment