States facing revenues in sharp decline amid the coronavirus pandemic have tough choices ahead – and you might be shelling out more in state and local taxes as a result.

State and local governments were left out of the $484 billion coronavirus relief bill that President Donald Trump signed into law last week.

"Our costs are going up, serving folks who have lost their jobs, small businesses that have been crushed, folks who are in the health-care system," said New Jersey Gov. Phil Murphy in a Monday morning interview on CNBC's Squawk Box.

Were you following this:

Back to the wealth tax - POLITICO

— A new paper argues that wealth is quite concentrated at the top, but the increase hasn't been as pronounced as other estimates have suggested, raising questions about the rationale for a wealth tax.

* * *

— Another new paper insists the federal government needs to further delay tax filing deadlines, just as the IRS is ramping up staffing to deal with the current filing season.

— Well then: Treasury Secretary Steven Mnuchin says that families of dead persons who received a direct stimulus payment should send that money back.

Residents of this city received the largest tax refunds

Residents in Midland, Texas, received the most money back from Uncle Sam when they filed their 2018 tax returns: an average refund check of $3,800, according to MagnifyMoney.com.

The personal finance site analyzed 2018 tax filing data from the IRS, focusing on 157 metropolitan areas in the U.S.

Houston and McAllen, Texas, both round out the top three cities with the heftiest refunds from Uncle Sam, with taxpayers getting back an average of $3,735 and $3,604, respectively, MagnifyMoney found.

Freeze property taxes - Isthmus | Madison, Wisconsin

There have been no cuts, furloughs or reduced hours for municipal workers in the City-County Building or anywhere else in city government yet.

It's time for local governments in Dane County to make some cuts in response to the economic dislocations caused by the coronavirus epidemic. And, unfortunately, to be meaningful they'll also have to be somewhat painful.

Other state and local governments are acting as well. The city of Los Angeles is planning to impose 26 unpaid days of leave on its workers while Detroit has laid off 200 and furloughed others. Michigan Gov. Gretchen Whitmer, a Democrat and a short list candidate to be Joe Biden's running mate, has furloughed 6% of the state's workforce.

In case you are keeping track:

Nashville mayor proposes 32 percent property tax hike in response to pandemic | TheHill

Nashville Mayor John Cooper is pushing a 31.7-percent increase in property taxes — the first tax hike since 2012 — as the city scrambles to balance its budget, according to The Tennessean.

The plan increases property taxes by $1 for fiscal 2021, which would move the rate from $3.155 to $4.155.

"This is a crisis budget," Cooper said at a city council meeting Tuesday, the newspaper reported. The mayor announced a $2.44 billion budget proposal, which is about $115 million more than the current fiscal year.

Montville Twp Residents Must Pay Their Taxes on Time, Twp Says | TAPinto

MONTVILLE, NJ – Taxpayers must pay their taxes on the regular due date of May 1 in Montville, despite the governor’s executive order (#130) affording the opportunity to postpone the due date. Montville officials said that the order was issued too late for them to act on the order, plus they would have to take on debt in order to pay regular bills that come due, which would ultimately cost taxpayers more money.

May 1 state tax deadline approaching, but relief offered for late filers

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/04-30-2020/t_3e7fb9c5e5fa4641b98e54dffcca7444_name_image.jpg)

ROANOKE, Va. – If you have not filed your state tax return yet, the deadline is quickly approaching, but you may have more time than you think.

Virginia's tax deadline is May 1, but because of COVID-19, there is a six-month extension period if you do not file on time. However, all payments for your taxes are due by June 1, regardless of the extension.

David Kembel of Kembel Tax Service says people with a likely refund can wait until November 1 if they want. However, if you owe money or are likely to owe money on your return, you have to pay what you owe by June.

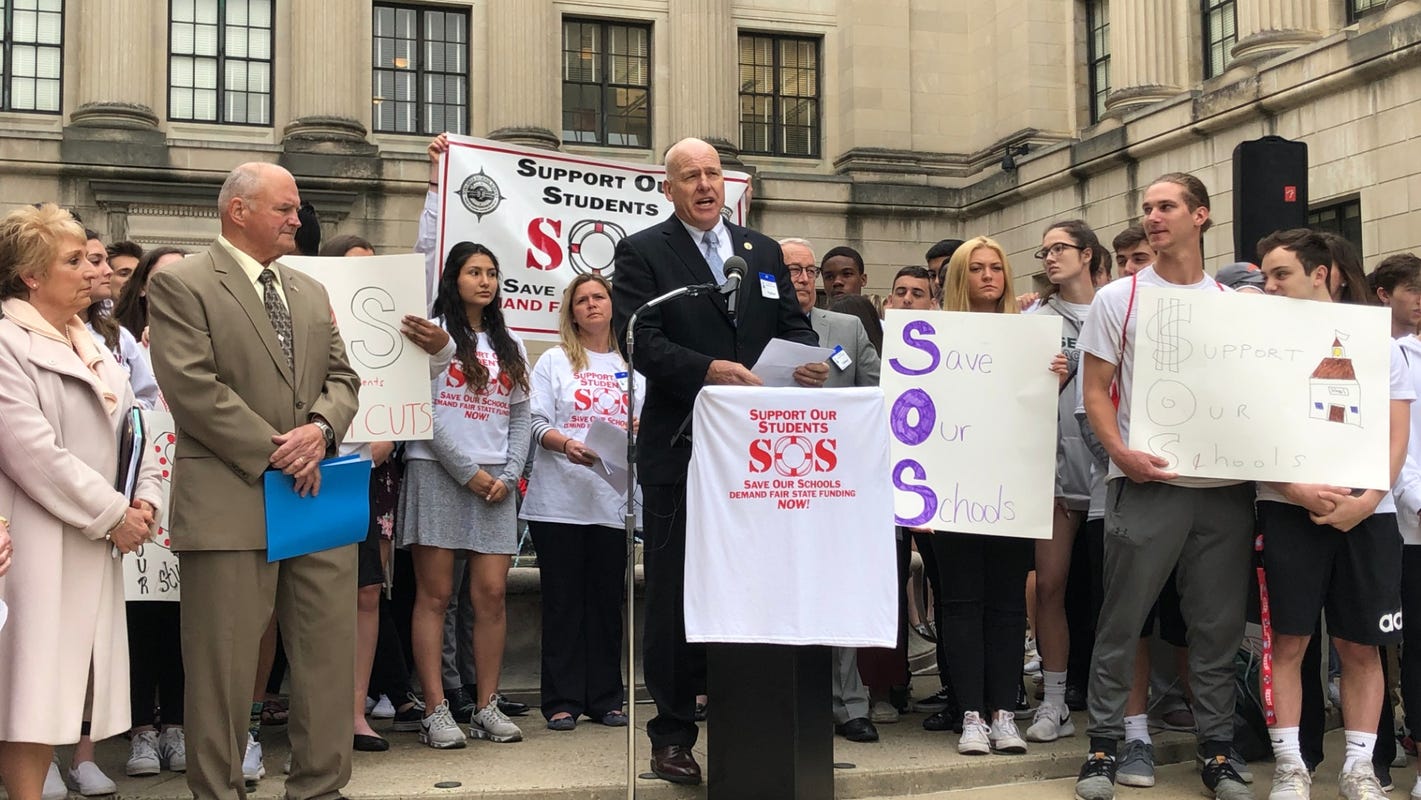

Toms River Regional cuts 37 jobs, raises taxes, but sports and clubs survive

TOMS RIVER -- A somber Toms River Regional Board of Education voted to adopt a $252.3 million budget for 2020-2021 that cuts 37 staff positions and raises taxes for all four towns that send students to the district, but maintains sports programs and extracurricular activities that had been threatened by state aid cuts.

Board members voted 6 to 3 to adopt the budget, and even those who supported the spending plan said they were not pleased with the choices the board and the district's administration were forced to make.

Happening on Twitter

As some states slowly start to open businesses, please be sure to check CDC guidelines, continue to practice social… https://t.co/RNQq97mjyI FLOTUS (from Washington, D.C.) Wed Apr 29 13:30:36 +0000 2020

Pres @realDonaldTrump is committed to safely re-opening America, and thanks to the work of @jaredkushner and his en… https://t.co/ZuBnbvQDTz KatrinaPierson (from Washington, DC) Wed Apr 29 17:59:56 +0000 2020

So, after a week of Republicans raving about "blue state bailouts" I went and looked at an actual state-by-state fo… https://t.co/RbdxKhRgFQ JHWeissmann (from Washington, DC) Wed Apr 29 21:37:23 +0000 2020

In this time when states are starting to reopen, China and the WHO need to be held to account, production of masks… https://t.co/Po6J3anl70 NikkiHaley Wed Apr 29 13:13:02 +0000 2020

No comments:

Post a Comment