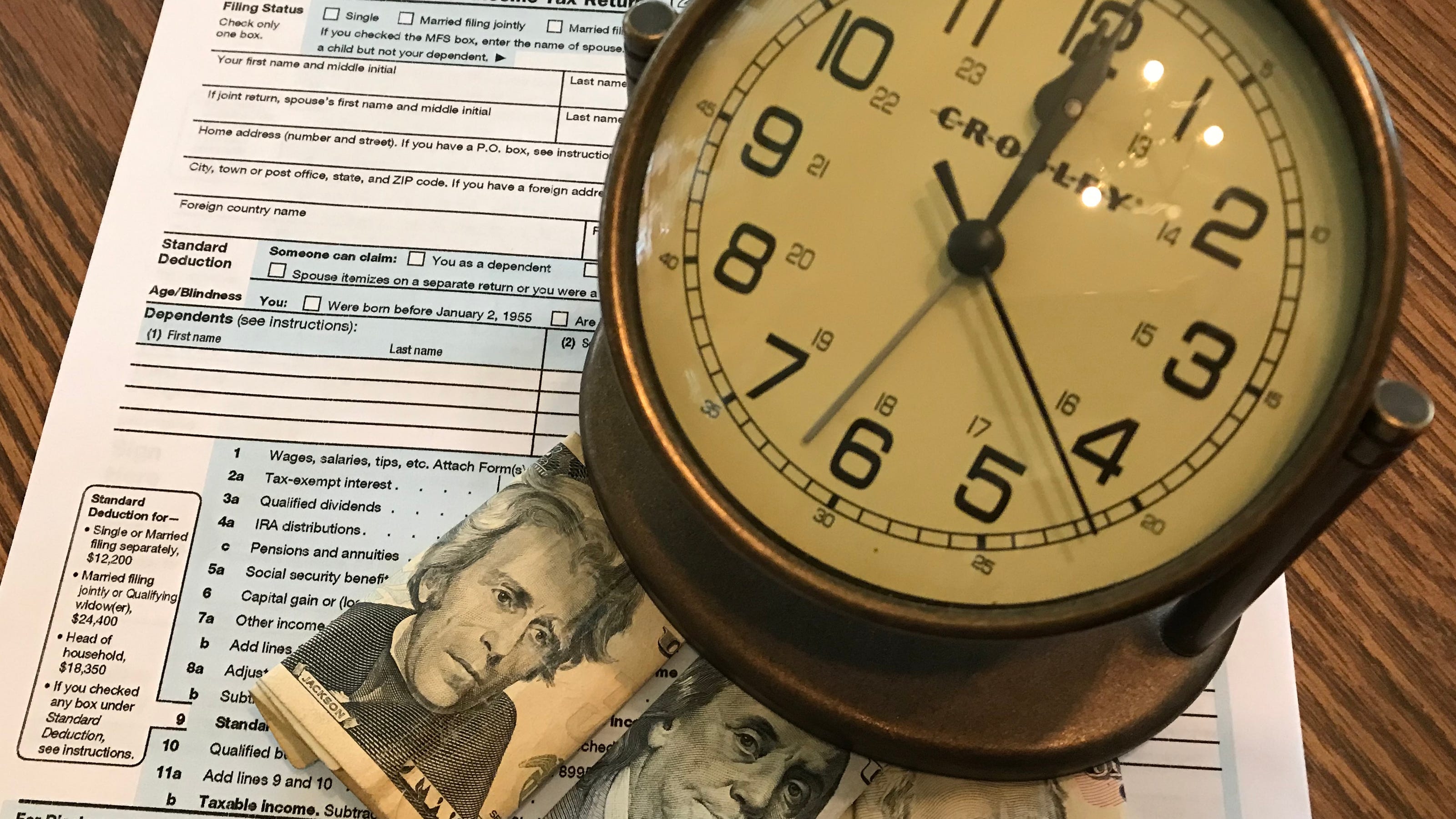

The delay is designed to give a financial break to taxpayers who may be having a hard time making ends meet, as hours are cut and workplaces are closed to combat the spread of the coronavirus.

* * *

If you did not file your federal income tax return or your state income tax return, there is no reason to panic about the traditional April 15 income tax deadline.

Most states have extended the filing deadline into next month and beyond , with Virginia setting a May 1 due date but charging no late penalties on payments made by June 1. Many states, including Alabama, California and Michigan, are extending the deadline to July 15, the same date as federal income taxes are now due.

Were you following this:

Longer-Term Prospects of Coronavirus Response: Bigger State, Higher Taxes - WSJ

World leaders from President Trump to President Emmanuel Macron of France and Queen Elizabeth II of Britain have invoked the wartime spirit as they rally citizens to defeat the new coronavirus.

Like the great wars of the 20th century, some analysts and historians think the current crisis could fuel a new era of big government in which public officials control more of the levers of the economy, for better or for worse.

Alabama could tax some coronavirus stimulus checks

MONTGOMERY, Ala. (WSFA) - Americans are looking forward to their coronavirus stimulus payments as thousands of people struggle to pay their bills. But this money may not be exempt from being taxed by the state when people file in 2021.

Sen. Chris Elliott, R-Daphne, is drafting a bill to exclude the federal stimulus package from state income taxes.

"The point of the stimulus is to get money into people's pockets and I think that adding an income tax on top of that is just antithetical," Elliott said. "We don't want to hit them with a tax burden when they go to file their taxes."

How to Pay Taxes with a Credit Card after Cashing Out Your 401(k)

Seven years later, Ashley, now a financial coach and author of the blog Budgets Made Easy , admits she's learned a lot since that huge tax payment. And the couple is now debt-free except for their mortgage.

At the time, they were planning to grow their family, so they moved into a nice-sized home with most of the amenities they were looking for. But they wanted to complete a few additional renovations to make it "just right."

For all of 2014, the couple focused on finding work and getting by despite the unexpected loss of income. While they juggled these new responsibilities and welcomed their third child, Ashley says they forgot they would have to claim the $25,000 worth of income on their 2014 taxes.

And here's another article:

State tax deadline will move to July 15 under bill Murphy says he will sign - nj.com

New Jersey lawmakers voted to extend the state tax filing and payment deadline to July 15. Getty Images/iStockphoto

State lawmakers voted Monday to extend New Jersey's fiscal year through September and grant taxpayers a three-month extension to pay and file their state taxes.

The bill ( S2338 ), once signed by Gov. Phil Murphy , would make official Murphy's earlier remarks that tax day in New Jersey would be pushed back to July 15 in response to the coronavirus crisis. Murphy said he will sign the bill Tuesday.

Estimated quarterly tax payments are still due in Illinois Wednesday - Chicago Tribune

If you pay quarterly estimated taxes, the state still needs you to get them in by the end of the day on Wednesday, even though other tax deadlines have been pushed back because of the coronavirus pandemic.

People who are self-employed, have second jobs or run a business often have to pay estimated taxes on a quarterly basis, as well as filing returns for the full year. If they pay too little, they may have to pay penalties. Individuals must make estimated payments if their Illinois individual income tax liability is more than $1,000 for the year, according to the Department of Revenue's web site.

Philadelphia school income taxes due April 15 despite coronavirus

Despite extended filing and payment deadlines for city, state and federal taxes, the Philadelphia School Income Tax is still due on Wednesday, April 15, 2020.

The Department of Revenue for the city of Philadelphia said there is no change to the April 15, 2020, due date for filing School Income Tax (SIT) returns.

Taxpayers are directed to file returns for the 2019 tax year and either pay the balance due or claim any over-payment as a refund or credit against their 2020 taxes.

Washington County intends to waive penalties and interest for late property-tax payments due to

The Washington County Board later this month is expected to approve a property-tax relief program to assist those who have been financially impacted by the coronavirus crisis.

The board at its April 28 meeting is expected to waive or reduce interest and penalties for taxpayers who are unable to pay their property taxes by the May 15 due date as a result of COVID-19.

Property taxes are still due by May 15, but those with a genuine need of assistance would be allowed to delay paying their 2020 first-half taxes until July 15, Board Chairman Fran Mion said Monday.

Happening on Twitter

#IRS new tool to help people who normally don't file taxes to register for Economic Impact Payments… https://t.co/6Td6H9oe1Y IRSnews (from Washington, D.C.) Sun Apr 12 21:45:04 +0000 2020

US government debt could soon rise to 130% or 140% of GDP, vs around 100% last year and higher than the level after… https://t.co/WRhOfShvsk lisaabramowicz1 (from New York) Sun Apr 12 16:01:48 +0000 2020

No comments:

Post a Comment