The outcome of a case—now pending at the U.S. Supreme Court—that deals with a Civil War-era law could strike a further blow to a long tradition of special treatment for Treasury Department regulations.

The Anti-Injunction Act was enacted in 1867 to help with the administration of the first federal income taxes. The act, which blocks many lawsuits trying to restrain tax assessment or collection, is facing a test as the Supreme Court goes to conference on Friday, where it could decide to take up a case that strongly divided appeals court judges.

Many things are taking place:

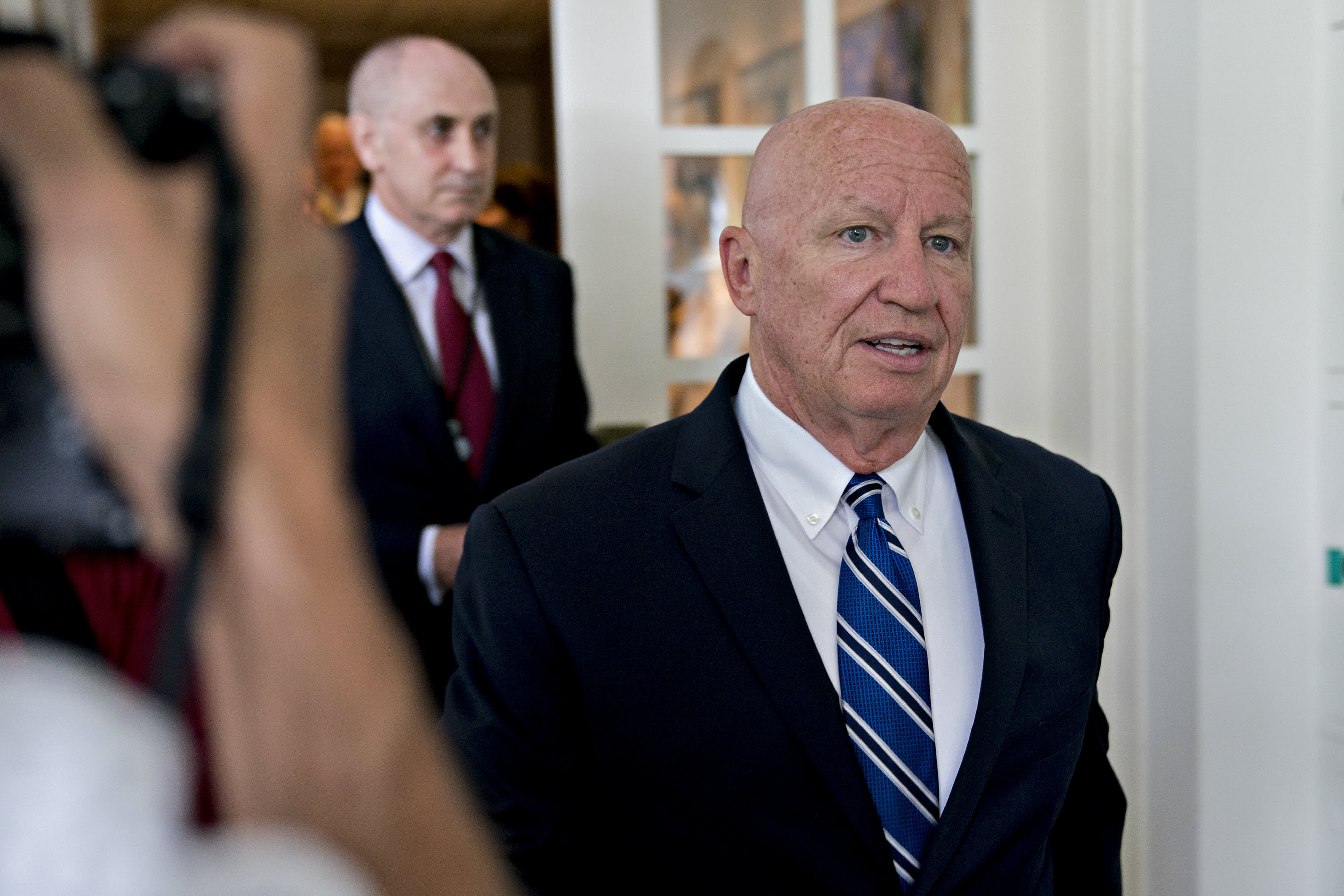

Kevin Brady: Punishing businesses with higher taxes would workers

Rep. Kevin Brady told CNBC on Friday that higher taxes and more regulations should not be put in place in response to the coronavirus economic crisis.

"I don't think you punish business in order to help that blue-collar worker. I think it's the opposite. We lift them together," the Texas Republican said on "Squawk Box."

Brady, ranking member on the tax-writing House Ways and Means Committee , said he believes policies enacted by the Trump administration, including the 2017 tax cut , helped put the U.S. economy in a robust position going into the coronavirus crisis. Brady was chairman of the committee three years ago when Republicans controlled the House and Senate.

Governor suspends some business regulations during coronavirus emergency | News | mdjonline.com

Gov. Eric Holcomb signed an executive order Thursday postponing some business tax payment deadlines and suspending other business regulations for the duration of the coronavirus pandemic.

A new executive order issued by Indiana Gov. Eric Holcomb aims to reduce the administrative burden on Hoosier businesses at a time when many are unable or prohibited from conducting normal operations due to the coronavirus.

The governor's directive , issued Thursday night, extends the deadline for companies required to file a business personal property tax return to June 15, instead of May 15.

China: The government continues efforts to stimulate economy | International Tax Review

Building on efforts in 2019, China is continuing to relax restrictions on foreign investors in China's financial services sector. Recently, Chinese government authorities, including the People's Bank of China, the State Administration of Foreign Exchange and the Shanghai government, set out 30 measures to foster the further development of Shanghai as an international financial centre, including to:

This may worth something:

INSIGHT: Are Taxing Jurisdictions Pushing Us Toward the Point of No Returns?

Tax authorities around the world are seizing control of businesses' accounting records through the digitization of transaction reporting. This means governments will soon have better insights into a business's operations and tax liabilities than the CFO. Liz Armbruester and Richard Asquith say within 10 years, company officers will be playing catch-up on their tax liabilities as the authorities claim to be the source of truth on accounting records and tax calculations.

BTAX OnPoint: Unrelated Business Income Tax Regulations

Nonprofits finally have some more direction from the IRS on how to track and report income unrelated to their core mission.

A change in the 2017 tax law mandated that tax exempt organizations must report each stream of their side profits separately—dividing things like basketball ticket sales and profit from corporate partnerships.

The IRS on Thursday proposed ( REG-106864-18 ) a way to group multiple streams together, minimizing the administrative burden for exempt organizations, and greatly reducing the number of separate income categories.

INSIGHT: The Finance Act and the Expectation Gap in the Nigerian Tax System

The Nigerian Finance Act 2019 proposed key amendments to existing domestic tax legislation. Nana Abu of KPMG discusses how successful these changes will be in addressing the expectation gap and reforming Nigerian tax laws to ensure they conform with global best practice.

Although taxation is a fundamental source of revenue to government, it also reduces the disposable income of individuals as well as profits of businesses. Therefore, there are existing expectation gaps between taxpayers and the tax authority in terms of:

IRS proposes rules for unrelated business income for tax-exempt groups | Accounting Today

The proposed regulations explain how to identify the separate trades or businesses, including investment activities, as well as certain other amounts included in UBTI.

Some of the provisions of the 2017 tax overhaul require tax-exempt organizations that are subject to the UBTI tax to compute the income they derive from their businesses, including any net operating loss deduction, separately for each trade or business, which is referred to as a "silo".

Happening on Twitter

Attorney for Dr. Rick Bright: "We will soon be filing a whistleblower complaint with both the Office of Special Cou… https://t.co/jPTmMEmwoN Yamiche (from Washington, DC) Thu Apr 23 20:19:50 +0000 2020

Latest statement from Dr. Rick Bright's legal team: "We will soon be filing a whistleblower complaint with both t… https://t.co/xWoOTMgYdH GeoffRBennett (from Washington, D.C.) Thu Apr 23 20:47:28 +0000 2020

you love to see billionaires given special treatment in a pandemic. Just love it! https://t.co/XUR36ObNpB JoshButler (from Sydney, Australia) Thu Apr 23 03:06:12 +0000 2020

Nurse Jenny McGee says UK PM Boris Johnson did not receive special treatment, but told Television New Zealand he "a… https://t.co/ShJR5ReiTl BBCNews (from London) Thu Apr 23 08:19:26 +0000 2020

No comments:

Post a Comment