Japanese Prime Minister Shinzo Abe is putting the era of pandemic economics to an early test. After getting criticized in some quarters for a lackluster response to the coronavirus pandemic, Abe has now swung in the other direction. In addition to imposing a state of emergency on nearly half of the country's population, he has also unveiled a multipronged economic stimulus package he claims is worth nearly $1 trillion in total.

Abe announced the measures in a nationally televised news conference in which he said the Japanese economy is "in the worst crisis since the end of World War II." He said that the total value of the support measures would total 108 trillion yen—approximately $1 trillion—equal to 20 percent of annual GDP. Economists quickly reckoned actual new spending would be much lower, with most of the headline figure representing programs already in place.

And here's another article:

Lockdowns flatten the "economic curve," too | Ars Technica

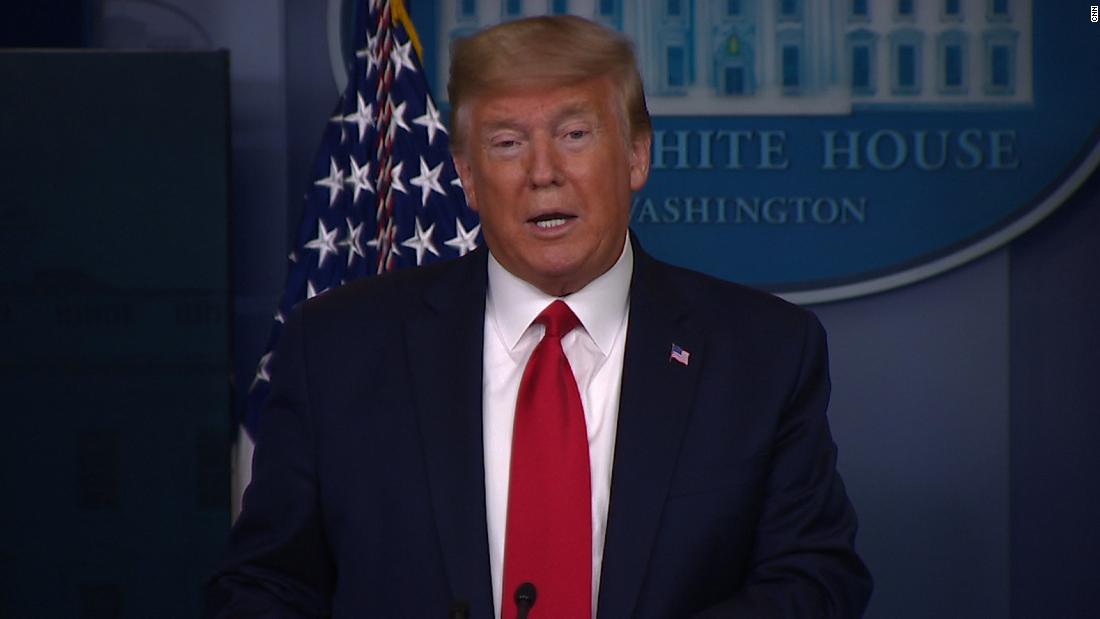

The lockdown measures being taken in response to the coronavirus pandemic are causing economic turmoil. Faced with this, President Donald Trump balked at the prospect of continuing those measures long-term, tweeting, "WE CANNOT LET THE CURE BE WORSE THAN THE PROBLEM ITSELF."

But in reality, the best economic medicine may be the dreaded lockdown. A working paper by economists at the Federal Reserve and MIT digs into data from the 1918 flu pandemic and finds that cities that reacted quickly and aggressively to the pandemic also had stronger economic growth after the crisis was over.

Coronavirus Relief: Economics of 2020 Stimulus Package | National Review

I t is not uncommon to look to fiscal and monetary intervention to offset the fall-off in demand in economies undergoing severe economic contraction. Even today, there is some lingering dispute about whether such actions really do much good. Generally, fiscal and monetary stimuli are thought to have little impact on price levels in the early stages of an economic recovery, as output and employment gradually begin to recover.

The "Phillips Curve" rule of thumb is that inflation will be low when the economy is weak and inflation will begin to rear its head only as economies approach full capacity. The data have never supported that rule of thumb. The American economy in the 1970s experienced a decade of rising inflation and rising unemployment, a decade that came to be known as the decade of "stagflation.

The US is already in a recession, 45 economists say - CNN

Other things to check out:

Bloomberg - Are you a robot?

Trump preparing to announce second task force focused on economic recovery - CNNPolitics

Coronavirus: Worst economic crisis since 1930s depression, IMF says - BBC News

The coronavirus pandemic will turn global economic growth "sharply negative" this year, the head of the International Monetary Fund (IMF) has warned.

Kristalina Georgieva said the world faced the worst economic crisis since the Great Depression of the 1930s.

* * *

Earlier this week, a UN study said 81% of the world's workforce of 3.3 billion people had had their place of work fully or partly closed because of the outbreak.

The Economist Asks: Kristalina Georgieva - Can the IMF bail out the global economy?

AS GOVERNMENTS around the world see their finances savaged by the pandemic, emerging economies are crying out for cash. More countries are turning to the International Monetary Fund for support than at any point in its history. In an exclusive podcast interview ahead of its Spring Meetings, host Anne McElvoy and Zanny Minton Beddoes, The Economist's editor-in-chief, ask IMF's head Kristalina Georgieva how it intends to bail out the global economy .

Happening on Twitter

Japan's PM Shinzo Abe just declared a state of emergency through May 6, and announced a nearly $1 trillion economic… https://t.co/uKbpBMVA8k CNBC (from Englewood Cliffs, NJ) Tue Apr 07 16:38:08 +0000 2020

Japan is committing nearly $1 trillion to try to protect its economy from the fallout from the coronavirus pandemic. https://t.co/HQPNvyPPqy CNN Mon Apr 06 13:40:02 +0000 2020

Japan set to announce coronavirus emergency, finalise near $1 trillion stimulus https://t.co/saN76ca7H2 https://t.co/IHpNVWiWRs Reuters (from Around the world) Tue Apr 07 03:22:09 +0000 2020

No comments:

Post a Comment