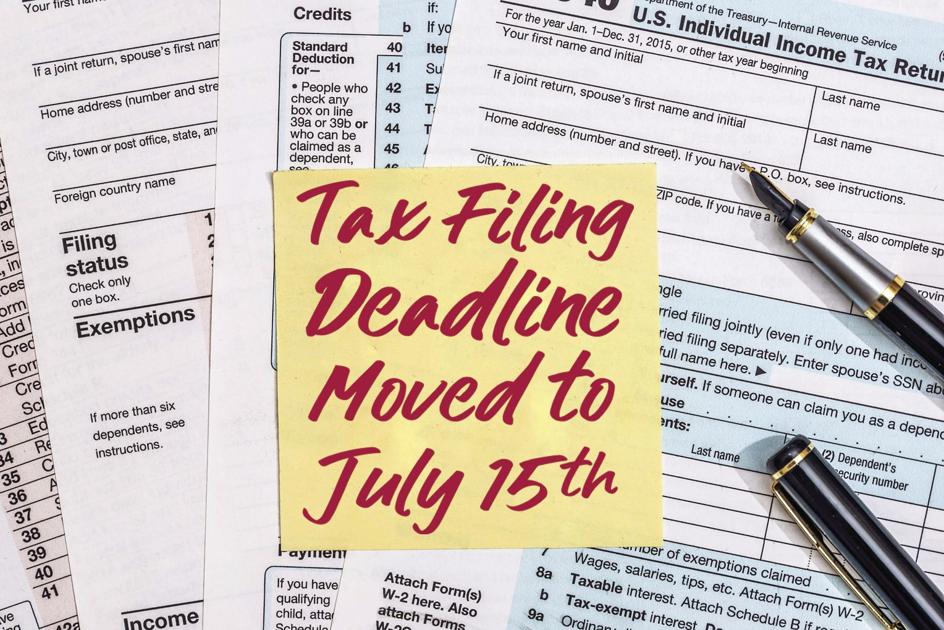

Spring is the season of warmer weather and blossoming flowers, but it is also – usually -- the season of taxes. Tax Day is typically April 15, but the Internal Revenue Service (IRS) recently extended the deadline for filing and paying your 2019 federal income taxes to July 15, 2020.

While this gives you more time to get your tax records in order, the IRS recommends that anyone expecting to receive a tax refund should file as soon as possible. According to the IRS, most refunds are being issued within three weeks of a tax return's acceptance. You should also double check your state's tax deadlines. Some states have announced tax filing or payment extensions, but other deadlines remain in place.

And here's another article:

Herb McMillan: Pittman's vision for coronavirus recovery includes raising taxes - Capital Gazette

"There are three kinds of men. The ones that learn from reading. The few who learn from observation. The rest of them have to pee on the electric fence for themselves." Will Rogers

Recently, Anne Arundel County Executive Steuart Pittman said he supported raising taxes progressively, at every level of government to rebuild in response to the coronavirus pandemic. To that end, he called for a repeal of the federal Tax Cuts and Jobs Act of 2017, apparently supports higher state income taxes, and definitely still wants to increase Anne Arundel county's income taxes "progressively."

New Mexico must not raise taxes during recovery

For all intents and purposes, New Mexico is closed for business until at least May 15 per the Governor's recent orders. Whether you agree with the way the Gov. has handled the COVID-19 crisis or if (like me) you think some of her measures have been unnecessary and heavy-handed, the fact is that New Mexico has done better than most other states in terms of preventing the spread of the virus.

* * *

But, every day that goes by the budget and economic state of New Mexico worsen. In addition to her focus on "flattening the curve," the Gov. needs to begin focusing more attention on the economy and state budget — even prior to a potential special session when the worst of the virus has passed.

Have old tax bills? Here's why you should pay them immediately

The IRS isn't processing paper returns right now as they deal with distributing coronavirus stimulus checks.

While that's not an issue for most taxpayers, who currently have until July 15 to turn in their 2019 federal income tax returns and pay any amounts owed, it is a big problem for people who have to file amended returns. These can only be processed on paper.

The solution: if you owe something for prior years, pay it now as penalties and interest continue to pile up.

While you're here, how about this:

Ramsey County offers reprieve for some taxpayers facing May 15 property tax deadline – Twin

Three groups of property owners in Ramsey County will get an extra two months to pay property taxes due to hardships caused by the coronavirus pandemic.

* * *

“We're really trying to provide this relief to those who are most impacted,” said Ramsey County Commissioner Victoria Reinhardt.

Fifty percent of taxpayers pay property taxes through an escrow company. Roughly one-third of the county’s total property tax revenues of $1.15 billion are expected to be paid through escrow. These taxpayers naturally see a flattening of payments made for property taxes.

The Tax-Break Bonanza Inside the Economic Rescue Package - The New York Times

As the federal government dispenses trillions of dollars to save the economy, small businesses and out-of-work individuals are jostling to grab small slices of aid before the funds run out.

But another group is in no danger of missing out: wealthy individuals and big companies that are poised for tax windfalls.

As part of the economic rescue package that became law last month , the federal government is giving away $174 billion in temporary tax breaks overwhelmingly to rich individuals and large companies, according to interviews and government estimates.

Editorial: Beware consequences of deferred property taxes | Honolulu Star-Advertiser

The threat of the coronavirus as well as the unprecedented travel and social restrictions have negatively impacted businesses in the Waikiki area.

Seeking a way to ease the economic burden of the coronavirus lockdown , two City Council members introduced a bill that would allow affected Oahu businesses to defer their property taxes. It’s a generous impulse and a starting point for discussion. But realistically, it doesn’t seem feasible right now.

Taxes, COVID-19 and nuclear weapons funding — our nation's priorities | TheHill

This is the time in April we traditionally fund our nation's priorities. There is nothing traditional this year. In the midst of the international COVID-19 pandemic, tax day has been placed on hold just as much of the world has. It is also the time of year that we fund our greatest existential man-made threat — nuclear weapons.

The COVID-19 pandemic demands that we reassess our priorities through the lens of caring for one another and our basic human needs addressing income, health and environmental inequities across the nation that are so apparent at this time.

Happening on Twitter

I thought of writing a history of capital markets. No need. Many good books already Top picks: - Money Changes… https://t.co/UOSeExqZeK jtepper2 Sat Apr 25 20:28:09 +0000 2020

3. You can't speak credibly: Since there's no policy, nobody speaks credibly for our country 4. Diplomacy is impo… https://t.co/VlNLzVxOx3 brett_mcgurk (from Palo Alto, CA) Fri Apr 24 04:01:09 +0000 2020

No comments:

Post a Comment