HONOLULU, Hawaii (HawaiiNewsNow) - People who don't normally file a tax return, but get Social Security, Railroad Retirement, Supplemental Security Income or VA benefits are facing a Wednesday deadline.

Anyone who gets those benefits and wants to use the non-filers tool on the IRS website to add dependent children under age 17 must submit by noon Eastern time, according to the Internal Revenue Service.

* * *

U.S. Sen. Mazie Hirono, D-Hawaii, urges those who qualify to complete the necessary forms immediately. "As we continue working to make sure all those eligible for direct payments receive this assistance, I urge those with qualifying dependent children to apply for these payments as soon as possible," she said.

Check out this next:

COVID-19 pandemic adds on to concern with increased property taxes in Sedgwick County

As many deal with furloughs and layoffs, property owners in Sedgwick County are scheduled to pay taxes on May 11. Many reached out to Eyewitness News about the increase they saw in January. Now, the COVID-19 pandemic creates an even bigger problem when it comes to spikes in property taxes.

* * *

"I said that I didn't think that was very fair," he says. "I didn't think they were giving the people of Sedgwick County any latitude. This is a pandemic. They keep saying it is unprecedented, and if it is unprecedented, we need to deal with it differently and in a better economic way for the people of Sedgwick County."

Ohioans working at home due to coronavirus crisis still paying income taxes as if they're in the

Ohioans working from home because of the coronavirus crisis will continue to pay municipal income taxes as if they worked at the office, state legislators decided in a bill signed into law late last month.

The change was made in response to Gov. Mike DeWine's declaration of an emergency on March 9 . Under that declaration, the state developed health orders and guidelines that led to thousands of people working from home.

City Of Darien To Return A Portion Of Taxes To Keep Restaurants Afloat Amid Coronavirus Shutdown

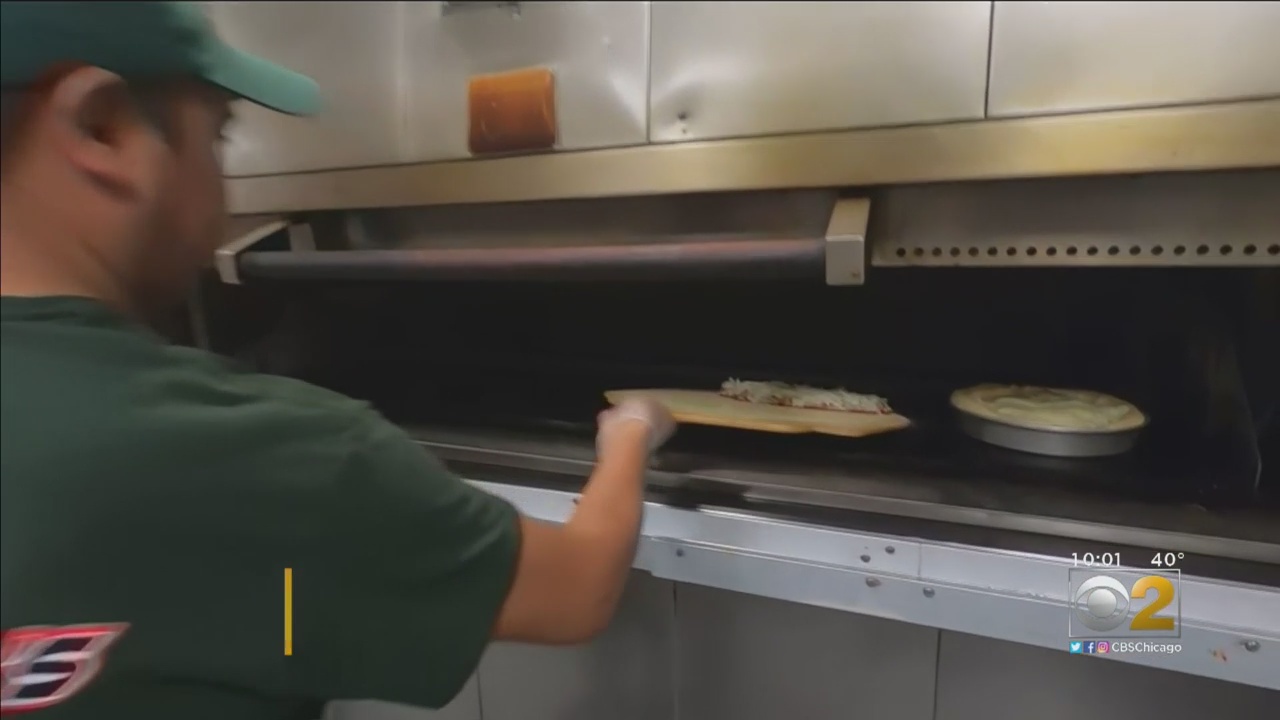

DARIEN, Ill. (CBS) — The southwest suburban City of Darien has launched a generous plan to save jobs and restaurants amid the coronavirus shutdown, which some businesses say just might work.

As CBS 2's Jermont Terry reported, you won't find anyone at bars and restaurants in Darien if you drive around – as they're all closed due to the pandemic. But the Darien City Council made a move it hopes will help the businesses remain open.

* * *

In the kitchen at Zazzo's Pizza, they are still flipping the dough. But since the COVID-19 pandemic there has been a drastic decline in the more important kind of dough.

Many things are taking place:

Wealth taxes should be considered as new revenue source during pandemic: IMF - Business Insider

The International Monetary Fund is pushing governments around the world to consider implementing wealth taxes to raise revenue as the pandemic slams economies.

For individuals, the IMF encouraged slashing payroll taxes as well as cash transfers to help those hardest hit with job losses or other circumstances.

In the US, Democratic Sens. Elizabeth Warren and Bernie Sanders helped thrust wealth taxes into the mainstream with their unabashedly progressive presidential campaigns.

Norwin proposes 2.9% hike in school taxes | TribLIVE.com

North Huntingdon, Irwin and North Irwin property owners will pay 2.9% more in school real estate taxes for 2020-21 fiscal year under a $76.4 million tentative budget unanimously approved Monday by the Norwin School Board.

The proposed tax increase would raise the millage by 2.4 mills to 84.8 mills for property owners in the three Westmoreland County municipalities for the next tax year, which begins July 1. For the 18 property owners in the Allegheny County portion of the district, taxes also will increase by 2.9%, from 12.36 mills to 12.72 mills. The millage rate is different for residents in the two counties because of differences in property assessments for tax purposes.

Vt. towns, state brace for collapse in property taxes

BURLINGTON, Vt. (WCAX) While Vermont finances were strong back in the beginning of March, COVID-19 and the subsequent mass layoffs will take a big toll on both state and municipal tax revenues in the months ahead.

COVID-19 is clobbering tax revenue -- from income Vermonters are not earning to consumption taxes not being generated in stores, car dealers, restaurants and hotels.

"We're concerned about every fund, every source of revenue and we're seeing this across the board," Gov. Phil Scott said Monday.

Pandemic taxes an already stretched health care workforce, but there are big imbalances -

JAKE DANNA STEVENS / STAFF PHOTOGRAPHER Family Nurse Practitioner Dr. Lynn Heard DNP at her office Tuesday in Covington Twp..

The Covington Twp. doctor of nursing practice lost her collaborative agreement earlier this month. The agreement, which she had for more than two decades with the same doctor, allowed her to treat patients as their primary care provider under a supervising physician.

* * *

Health systems are redeploying nurses and other staff to frontline departments, while some nurses see their hours cut or find themselves laid off as health systems excise elective or non-urgent procedures from their calendars.

Happening on Twitter

2008, we went for a pitch. All was going well until I identified as the CEO. "You don't look like some that can han… https://t.co/paqXgBBUsu OluyomiOjo (from Staying at Home) Tue Apr 21 18:22:21 +0000 2020

Unemployment benefits are backlogged, small businesses are shut out of emergency relief, and millions of Americans… https://t.co/yp3sIm5cEM RBReich (from Berkeley, CA) Mon Apr 20 19:46:28 +0000 2020

This kind of playing with data by the Centre is unacceptable. All labs send their data to ICMR and it should be put… https://t.co/7vCD2uTMbe SitaramYechury Tue Apr 21 17:15:35 +0000 2020

totalitarian government can get away with anything because people are so fearful they don't ask questions or disagr… https://t.co/NfFNMCFTO6 CharlieDaniels (from Mt. Juliet, TN) Mon Apr 20 12:52:52 +0000 2020

No comments:

Post a Comment