People wait in line for food assistance cards on July 7, 2020 in the Brooklyn borough of New York City.

Governors and lawmakers in at least eight states, including Nebraska, have used millions of federal coronavirus relief dollars to protect businesses from tax increases as unemployment skyrockets.

They're pushing relief dollars into unemployment insurance trust funds, which are funded by business taxes and pay out benefits to laid-off workers. If the funds start to run out of money — as they now are in many states — state and federal law triggers tax increases to replenish the accounts.

In case you are keeping track:

Conservation lands generate Payment in Lieu of Taxes for area counties | West Central Tribune

Some Beaumont property owners will save in property taxes | News | recordgazette.net

More than 1,000 property owners within the Sundance and Tournament Hills community stand to collectively save several million dollars in special taxes as the city expects to refinance existing debt.

City of Banning and Cal Fire has ordered a mandatory evacuation for Banning due to the Apple Wildfire.

A wildfire erupted in Cherry Valley on Friday and is 0% percent contained as of Saturday afternoon after spreading to 1,900 acres and prompting mandatory evacuation orders for Cherry Valley and Banning Bench residents, officials said.

Receiving unemployment payments? Tax season might cost you next year

Individuals receiving unemployment benefits this year could face a tax surprise in 2021: owing Uncle Sam or receiving smaller refunds.

Some 1.43 million people filed for unemployment last week , according to the U.S. Labor Department.

More uncertainty is ahead: The $600 weekly federal unemployment boost ended on July 31 and Congress hasn't agreed on an extension of benefits .

While the additional unemployment income has helped millions of families get by, it can carry some unintended tax consequences that will surface next year.

And here's another article:

Our view: Taxes yes and no may be on ballot

Two citizen initiatives for this November’s statewide ballot may have beaten the Aug. 3 deadline, promising voters a healthy range of choices about how they wish to spend their money.

Initiative 295 seeks voter approval for the creation of any new significant state enterprise that will depend on revenue derived from fees. The intent seems to be to keep the state Legislature from further funding government with fees in lieu of taxes without that approval.

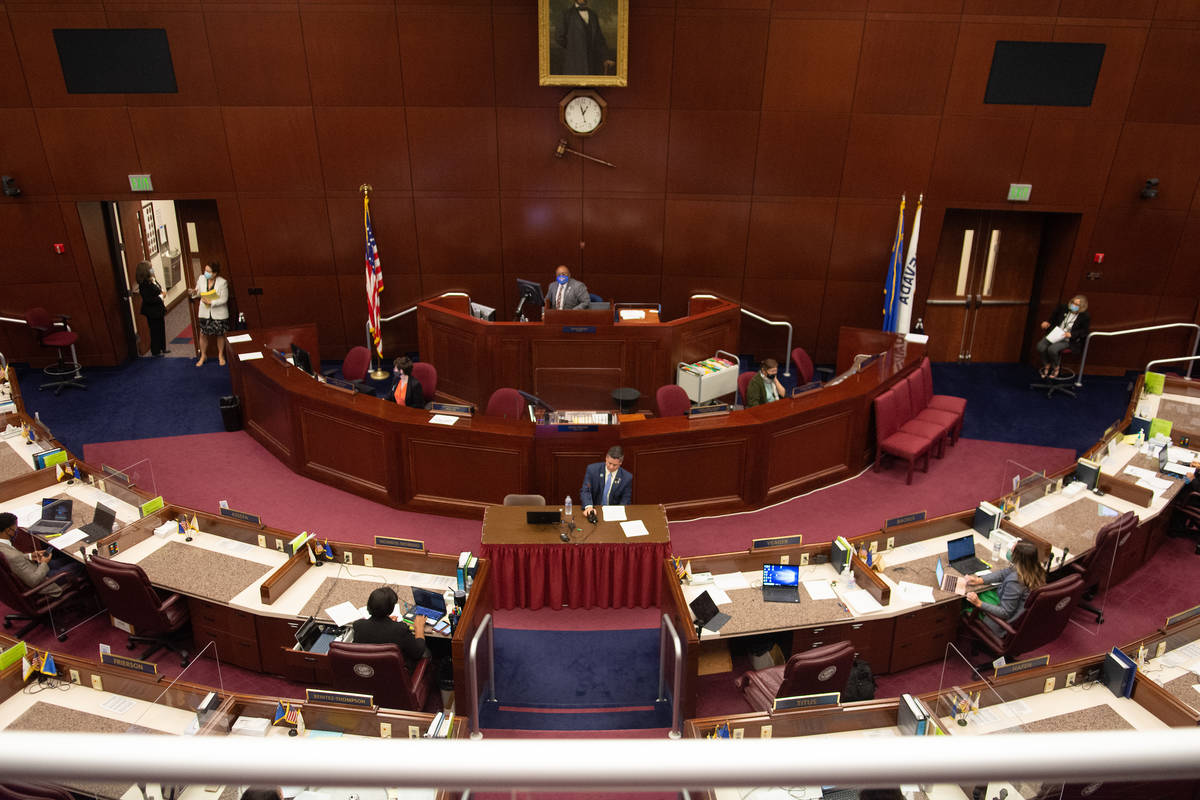

Mostly party line votes in special session on mining taxes | Las Vegas Review-Journal

CARSON CITY — Lawmakers worked into early Sunday morning on competing proposals to raise the state’s mining industry taxes, with the Senate passing one measure and the Assembly passing three on mostly party line votes.

The Senate moved first Saturday, approving Senate Joint Resolution 1 , its version of a proposed constitutional amendment to raise the mining tax, sending it to the Assembly. Much later, after 1 a.m. Sunday, the Assembly pushed through the Senate plan along with Assembly Joint Resolution 1 .

California's tax-the-rich folly – Orange County Register

The California Legislature is back from its summer recess and has frantically resumed its quest for new revenue sources.

One of the latest ideas is Assembly Bill 1253. This proposed legislation would add new income tax brackets for high earners on top of the existing ones.

Income between $1 million and $2 million would receive a one percentage point surcharge, bringing the marginal rate to 14.3 percent. Those earning between $2 million and $5 million would pay an additional three percentage points, and those earning over $5 million would pay an additional 3.5 percentage points, bringing their marginal rates to 16.3 percent and 16.8 percent respectively.

NY eyes taxes for wealthy, working class to help right budget

ALBANY, N.Y. (AP) — New York Gov. Andrew Cuomo says he opposes raising taxes on the wealthy to help the state weather the coronavirus economic crisis, though its clear federal aid alone won't solve the state's fiscal woes.

COVID-19 shutdowns have decimated consumer spending and tourism in New York and observers warn of a slow recovery. Cuomo's administration is projecting a $13 billion drop in tax revenues through next April.

Happening on Twitter

Akshay ji has always supported our nation's armed forces, police in various states. I'm thankful to him for his con… https://t.co/vRZhINLcqy AUThackeray Sat Aug 01 09:01:12 +0000 2020

States are rushing to amend their laws surrounding opioid use disorder treatment as Covid threatens to exacerbate t… https://t.co/MqTbFInOP0 RyanForRecovery (from Las Vegas, NV) Sat Aug 01 13:50:25 +0000 2020

Sen. Elizabeth Warren is urging the CDC to use its authority to implement masks requirements in regions around the… https://t.co/hdckMhBK0H kylegriffin1 (from Manhattan, NY) Mon Jul 27 00:30:00 +0000 2020

No comments:

Post a Comment