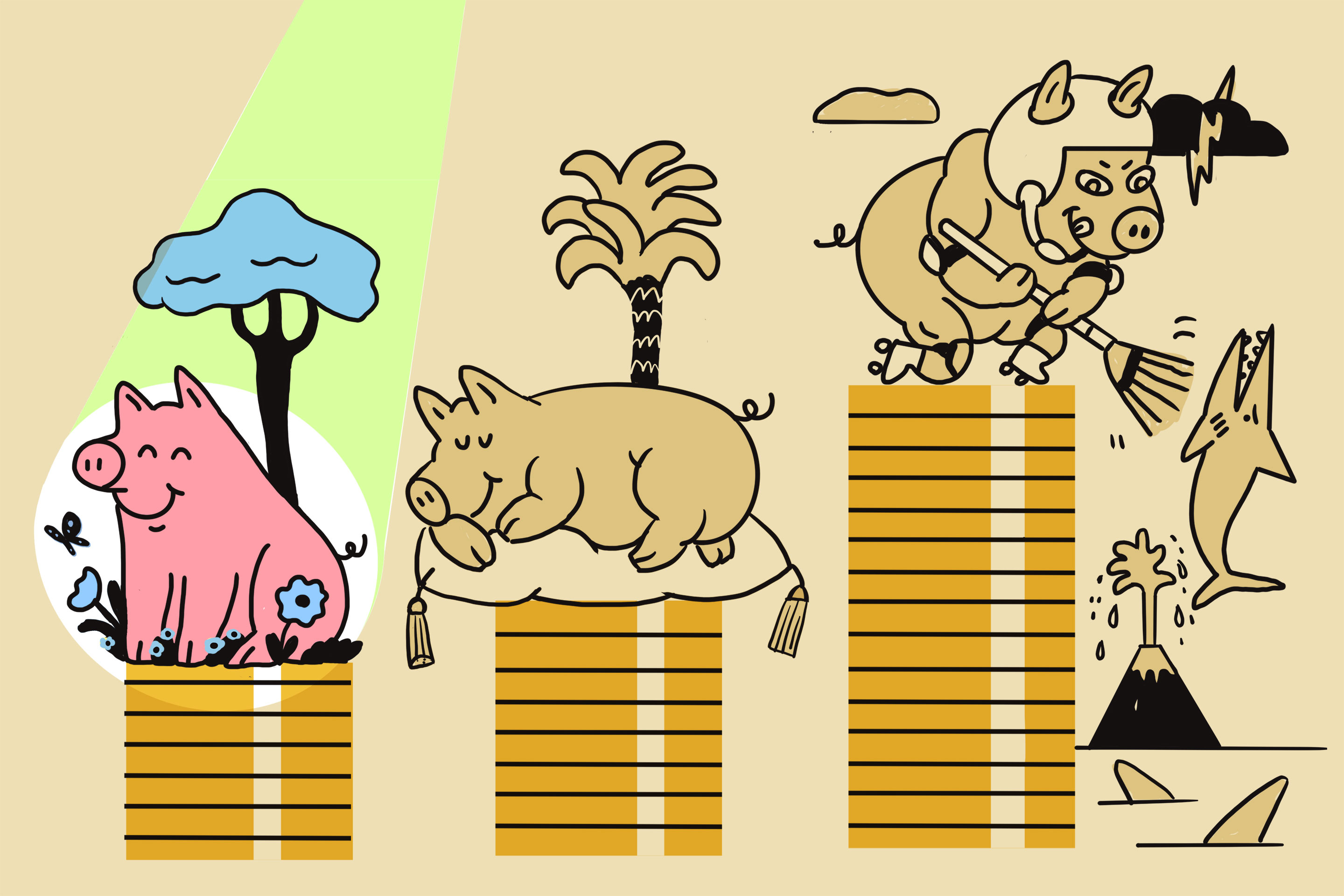

It doesn't matter how much money you make; for some it never feels like enough. You're putting in the hours, you're networking, you're building up your clientele, you're working harder than you ever have before and your revenue reflects that, it's increasing! So why does it seem like it all goes right back out the door to cover taxes, employee expenses, and bills?

If you have no idea where your money goes or why you feel scared, unsure, or frustrated with your finances, check out Wendy's strategies for managing your money like a millionaire:

Were you following this:

5 tips to make more money

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/08-03-2020/t_0b4eb83a0ee1445187d661b0e6e56134_name_image.jpg)

SAN ANTONIO – With the economy the way it is right now, we could all use some pointers on how to make more money in 2020.

Steve Siebold and Tom Mathews just wrote a book on the subject. It's called How Money Works: Stop Being a SUCKER , and it's about how you can take control of your financial future. It's written almost like a graphic novel, with lots of pictures and illustrations to guide you along the way.

* * *

2. Educate yourself. You can find a lot of financial literacy resources online, like the How Money Works website.

Repaving Richmond Street tops Arnold’s plans for $300K in grant money | TribLIVE.com

Arnold is proposing to spend nearly half of a federal grant to pay for resurfacing Richmond Street.

City residents will get a chance to comment on that, and other proposed uses for the more than $300,000 grant, during a public hearing scheduled for 7 p.m. Aug. 11 at the public safety building on Drey Street.

The city is receiving $303,213 through the Community Development Block Grant program, said Rich Rayburg, the city’s community development director. The federal CDBG money is administered by the state.

Jill On Money: Understanding the GDP plummet

The first estimate of second quarter GDP was a doozy. Just how bad was the pandemic’s impact from April through June? The Bureau of Economic Analysis said that the U.S. economy contracted at a 32.9% annualized pace. (GDP is reported as a seasonally adjusted annual rate, which means that a 33% Q2 decline

is approximately a 9.5% decline from the seasonally adjusted Q1 reading, which came in at -5%.) The first half of 2020 makes the 10-year “slow and low” recovery period from 2010 through 2019 seem positively idyllic. Gone are the days when we can complain that the economy was “only growing” by 2.2% to 2.5%.

This may worth something:

Banks say they are tightening lending standards even as demand for money falls

Banks are tightening lending standards across the board even as they're being urged to get money to those who have been hit by the coronavirus pandemic , according to a Federal Reserve survey Monday.

From commercial real estate to credit cards and autos, institutions are getting tougher on giving out money compared with the second quarter, even though demand also has decreased across most categories.

"Major net shares of banks that reported reasons for tightening lending standards or terms cited a less favorable or more uncertain economic outlook, worsening of industry-specific problems, and reduced tolerance for risk as important reasons for doing so," the survey said.

Pittsburgh launches 'guaranteed income' program with Jack Dorsey money | Fox Business

Wall Street Journal editorial page deputy editor Dan Henninger argues guaranteed income would create an aristocracy in which a portion of Americans will always be dependent on universal basic income.

Pittsburgh Mayor Bill Peduto announced that his city is now participating in a program receiving funding from Twitter CEO Jack Dorsey , in which eligible residents will receive $500 in monthly "guaranteed income."

* * *

The money used to start the program will come from funds Dorsey gave that is allowing Pittsburgh and 15 other cities to help those who are struggling during the economic crisis brought about by the coronavirus pandemic.

Money Market Accounts vs. Funds: What's the Difference? | Money

Many companies featured on Money advertise with us. Opinions are our own, but compensation and

in-depth research determine where and how companies may appear. Learn more about how we make money.

The purpose of this disclosure is to explain how we make money without charging you for our content.

Earning your trust is essential to our success, and we believe transparency is critical to creating that trust. To that end, you should know that many or all of the companies featured here are partners who advertise with us.

Ramsey Press Begins Presale of Book Know Yourself, Know Your Money by Two-time #1 National

Understand the deeper reasons of why people handle money the way they do with the newest book from Rachel Cruze, personal finance expert, Ramsey Personality and two-time #1 national best-selling author. "Know Yourself, Know Your Money: Discover WHY You Handle Money the Way You Do and WHAT to Do About It!" is now available for pre-order. In it, Cruze reveals the key factors that shape how people manage money and practical tips on how to win with their finances.

* * *

Headquartered outside of Nashville, Tenn., Ramsey Press, a part of Ramsey Solutions, publishes America's trusted voice on money, Dave Ramsey as well as #1 national bestselling authors Rachel Cruze, Chris Hogan, Christy Wright, Anthony ONeal, Ken Coleman, and Dr. John Delony. Ramsey Press produces practical and inspirational material on a wide range of topics from personal development and leadership, careers and business, to relationships and personal finance.

Happening on Twitter

A study by KPMG found that almost 9 out of 10 Americans agree that privacy is a human right — that's promising news… https://t.co/OSrXxgYSH8 DuckDuckGo Mon Aug 03 13:47:01 +0000 2020

It's surprisingly simple to become financially successful. https://t.co/z4zltpCr8m Inc (from New York City) Mon Aug 03 00:47:54 +0000 2020

5 simple concepts for designing spaces that encourage empathy, honor the past and actually help local communities: https://t.co/QFf7W5dRFV TEDTalks (from New York, NY) Sun Aug 02 13:04:36 +0000 2020

No comments:

Post a Comment