The government will begin deferring withholding payroll taxes for federal employees to fulfill a memorandum President Trump issued earlier this month, according to a notice from one of its payroll processors.

Trump issued his presidential memorandum to defer the taxes from Sept. 1 through the end of the year, citing the need to put more money in the pockets of American workers as the novel coronavirus pandemic continues to wreak havoc on the U.S. economy. It has remained unclear what impact the memo would have, as business associations across the country have repeatedly made clear they would not implement it.

In case you are keeping track:

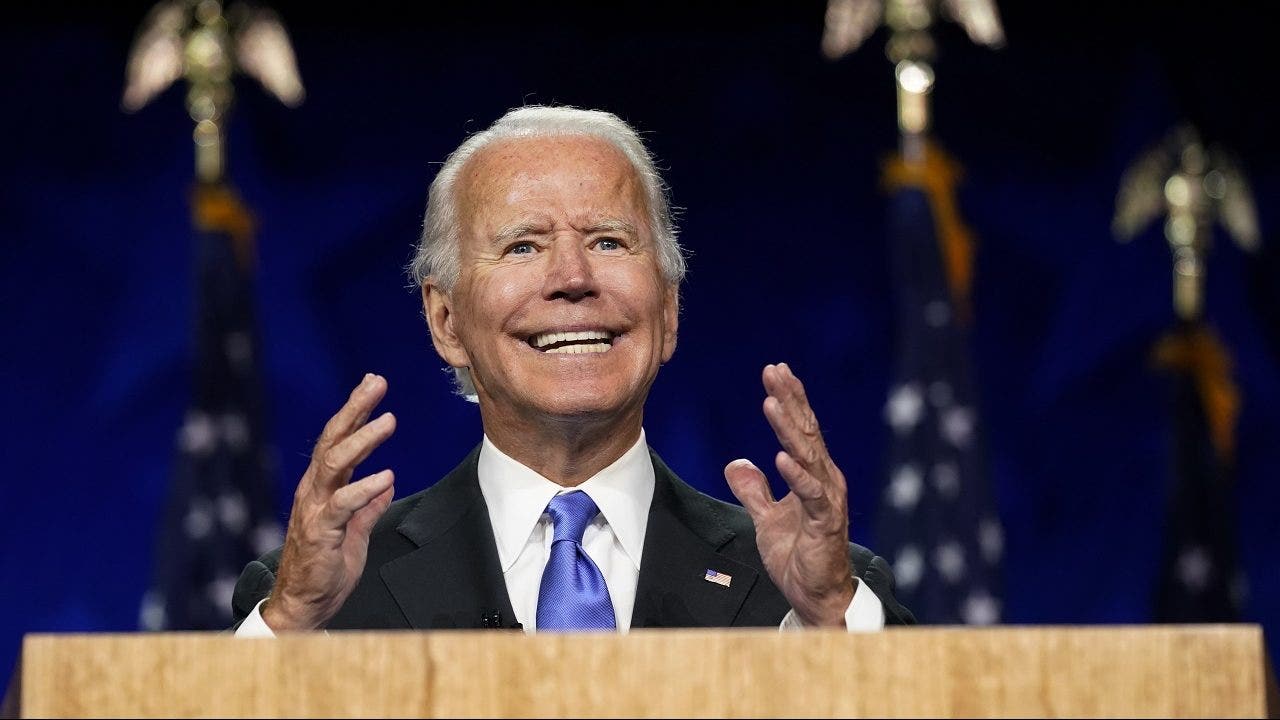

Biden retirement proposal would overhaul traditional 401(k) tax benefits | Fox Business

An often overlooked part of Democratic presidential candidate Joe Biden 's tax plan would overhaul the tax preferences of traditional retirement accounts like 401(k) plans.

* * *

Biden has vowed to convert the current deductibility of traditional retirement contributions into matching refundable credits for 401(k)s, IRAs and others.

Under current law, workers contribute pre-tax dollars to the accounts, reducing their annual taxable income. (When the funds are eventually withdrawn in retirement, that money is taxed). But the system tends to disproportionately benefit wealthier earners since deductions are more valuable the higher one's income bracket is.

Rural people are being hit hard with Pennsylvania taxes | PennLive letters - pennlive.com

Many argue about why Pennsylvania is in such financial distress when we have high taxes. The issue is that corporations pay no income tax. We are a commonwealth and we share our resources. When corporations do not pay their fair share, it undermines the entire foundation of Pennsylvania.

The Delaware Tax Loophole allows these corporations to get out of paying their fair share, while we are burdened with property taxes and a gas tax, which is hitting rural people harder because we have to drive everywhere. If we closed this loophole and started taxing corporations, fairly, hardworking families could get a break for once. Looking at the current state of Pennsylvania finances, taxes will need to be raised somewhere. I ask you, where would you like that tax to be placed?

Why Some Workers May Need to Prepare for an Extra $2,232 Tax Bill in 2021 | Business |

Lawmakers have been deadlocked on a second COVID-19 relief bill that should, in theory, allow for a second direct stimulus. Until such a bill is signed into law, that money can't go out.

Why the delay? It boils down to Democrats and Republicans not seeing eye to eye on a number of key issues, and unemployment is a big one. But President Trump has made it clear that he's unhappy with that lack of progress, and to that end, in August, he signed a number of executive orders designed to provide relief in the absence of an approved bill.

Check out this next:

Thinking about moving to a state with lower taxes?

If you're contemplating moving to a different state, taxes may be a deciding factor. This column explains how to evaluate the tax picture in states you may be considering.

The property tax rate on a home in some Colorado Springs locales is about 0.49% of the property's actual value, as determined by the county assessor. Say you move to one of these areas and buy a $500,000 home. Your annual property tax bill would be about $2,450, which is a really low number. Say your taxable income is $200,000. Your Colorado state income tax bill would be $9,260. Your combined property tax bill and state income tax bill would be about $11,710.

Why Trump's payroll tax holiday isn't going to happen on Sept. 1 - The Washington Post

Talk is cheap. And it's often a lot easier to talk about a big, attractive-sounding plan you've come up with than it is to implement it.

Today's case in point: President Trump's splashy announcement earlier this month that he was ordering Treasury Secretary Steven Mnuchin to figure out how to let tens of millions of employees defer their 6.2 percent Social Security tax payments from Sept. 1 through Dec. 31.

But guess what? That deferral isn't going to happen on Sept. 1, because the Treasury Department still hasn't produced the guidelines for employers and payroll processors to start offering eligible employees a chance to defer their Social Security tax.

The mistakes to avoid when moving to a state with lower taxes and why low mortgage rates

'Sweden's prized herd immunity is nowhere in sight,' according to the Journal of the Royal Society of Medicine.

Queries appeared to surge in response to social distancing orders and early pandemic milestones.

Salesforce CEO Marc Benioff revealed this week that about one-third of the company's employees had reported experiencing a mental-health issue.

Ireland's EU Commissioner for Trade resigned late Wednesday after reports alleging that he did not abide by the rules of his 14-day quarantine period, in addition to attending an 81-person dinner, also directly contravening government guidelines

Why taxes are a key part of representative government : The Indicator from Planet Money : NPR

Taxes have been around for thousands of years. Governments want your money! But the relationship between taxes and representative government is particularly interesting. Today, The Indicator takes a trip to Greece, and talks with financial historian William N. Goetzmann about the relationship between democracy and taxes.

No comments:

Post a Comment