FASB issued an update Wednesday that delayed the effective dates of its revenue recognition and lease accounting standards for certain entities in response to the coronavirus pandemic.

The board issued an Accounting Standards Update that permits private companies and not-for-profits that have not yet applied its new revenue recognition standard to implement the new rules for annual reporting periods beginning after Dec. 15, 2019, and interim reporting periods within annual reporting periods beginning after Dec. 15, 2020.

Quite a lot has been going on:

Unforeseen Number of Banks Seize Congressional Accounting Relief

Forty-five small banks seized on the provision, part of the $2 trillion coronavirus relief law ( Public Law 116-136 ), that allowed them to blunt the effect the current expected credit loss (CECL) accounting standard on their capital and earnings. The large number of banks that chose the delay surprised analysts who previously thought the provision in the bill was clumsily written and provided little tangible relief.

Accountants see pandemic over by year's end; recovery will take longer | Accounting Today

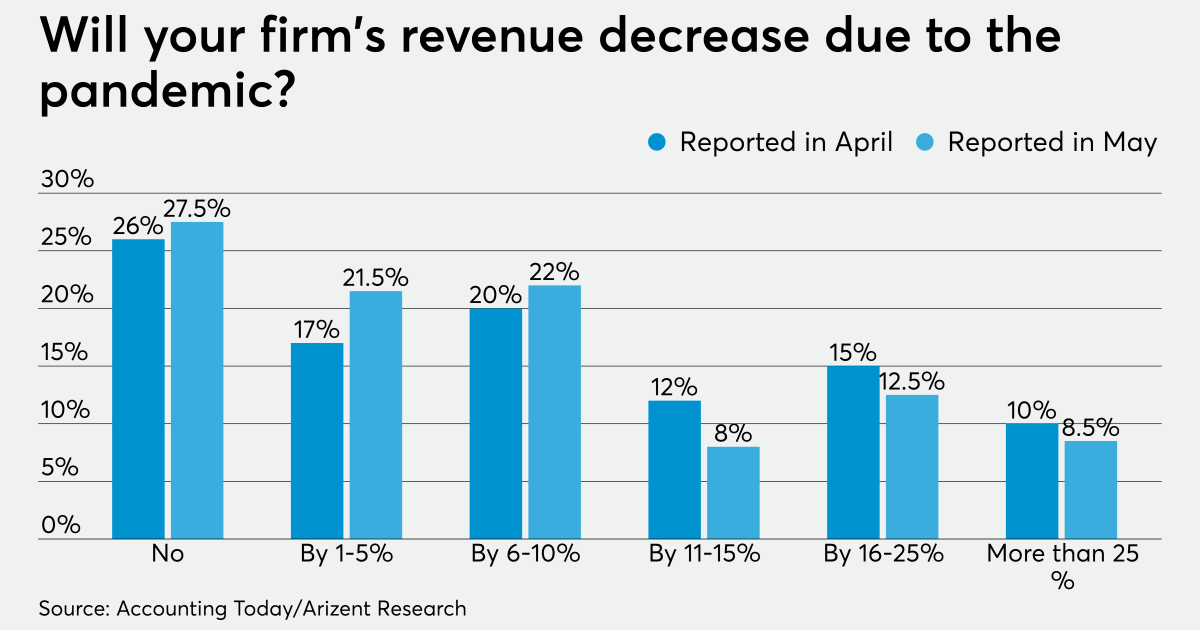

Over half of accountants (56 percent) expect the coronavirus pandemic to end before 2021, and two-fifths of those (42 percent) think it will be wrapped up by the end of September, according to a recent Accounting Today survey.

They're less sanguine about the prospects for the economy, however: The AT study, which was conducted in mid-May and sponsored by ADP, found that more than half of the 200 accountants responding (54 percent) don't think it will recover until after the first quarter of 2021. For more details, and other key findings of the survey, see the charts below.

Nakisa Talks Accounting Challenges For Lessors | PYMNTS.com

The International Accounting Standards Board introduced a significant overhaul to lease accounting standards , and while the changes went into effect at the start of 2019, corporates continue to face challenges to adhere to the standards and remain compliant.

Today, Nakisa announced the launch of its lease management and accounting portal, a solution that Mia told PYMNTS has one important focus to address a gap in the market: the platform targets the lessor, an entity that is just as impacted by the IASB’s lease accounting standard changes, yet is underserved by FinTech solutions to ease the transition.

Check out this next:

AAFCPAs acquires Goffstein in Massachusetts | Accounting Today

AAFCPAs, a Regional Leader in the New England area, has acquired Scott A. Goffstein & Associates, a 14-person CPA firm based in Waltham, Massachusetts.

* * *

The addition of the Goffstein staff increases AAFCPAs' headcount to 34 partners and a total staff of 240. AAFCPAs plans to continue to keep the Goffstein office in Waltham, in addition to its other locations in Boston, Westborough and Wellesley, Massachusetts.

"We couldn't be more excited about being a part of the AAFCPAs quickly growing family," said Scott Goffstein, who will become a partner at AAFCPAs, in a statement. "We share the team's passion, its high standards of service excellence, and we immediately recognized the value of joining the pre-eminent regional CPA and consulting firm in New England."

Financial terms of the deal were not disclosed.

SEC needs to address overseas accounting: Nasdaq CEO | Business Insurance

![]()

BI's Article search uses Boolean search capabilities. If you are not familiar with these principles, here are some quick tips.

To search specifically for more than one word, put the search term in quotation marks. For example, "workers compensation". This will limit your search to that combination of words.

To search for a combination of terms, use quotations and the & symbol. For example, "hurricane" & "loss".

* * *

(Reuters) — Regulators need to address transparency and accounting issues at companies based in foreign jurisdictions that are looking to go public through the U.S. markets, Nasdaq Inc. Chief Executive Adena Friedman said on Thursday.

Five Accounting and Reporting Considerations Before Reopening - CFO

Businesses around the country are preparing to reopen as local stay-at-home orders are lifted. But the world looks a lot different than it did a mere three months ago, and many companies must now adjust to a yet-evolving new normal. While companies now understand how the COVID-19 pandemic has affected their operations, the dust is still settling on the short-term impacts of the crisis and what business will be like in the long term.

As management contends with important changes to the business, such as supply chain disruptions, headcount reductions, and long-term work-from-home policies, chief financial officers and other finance leaders are sorting through the resulting accounting and financial reporting impacts. Here are five areas for companies to keep in mind as they prepare to reopen and maximize value in a post- pandemic operating environment.

Our Education: SIUE Accounting grad student earns $10,000 national scholarship - Alton Telegraph

EDWARDSVILLE — For the third consecutive year, a Southern Illinois University Edwardsville School of Business Master of Science in Accountancy (MSA) student has earned a competitive $10,000 national scholarship from the Public Company Accounting Oversight Board (PCAOB) Scholars Program.

Award recipient Stacee Durell, of St. Jacob, notes the scholarship will almost completely pay for her advanced degree, allowing her to make her dreams of becoming a Certified Public Accountant (CPA) a reality.

No comments:

Post a Comment