In December, Katten provided analysis on DAC, the draft UK Regulations implementing the new reporting requirements relating to certain cross border arrangements, in an advisory, " New EU wide tax anti-avoidance law introducing sweeping disclosure requirements ". In this follow up note, Katten examines the key updates since the UK Regulations 1 were finalised on 13 January 2020.

* * *

The 2018 EU DAC6 Directive 2 (DAC6) amended the 2011 Directive on administrative cooperation in the field of taxation 3 (DAC) to introduce a mandatory EU-wide regime requiring intermediaries in cross-border arrangements to make a disclosure to their relevant tax authority, where the arrangement meets certain hallmarks that suggest a potential risk of tax avoidance.

Check out this next:

Final Tax Regulations Offer More Certainty to Opportunity Zone Fund Managers and Investors |

Opportunity Zone (or “OZ”) investment was hailed in 2018 and 2019 as the hottest and most innovative way of attracting significant private capital to distressed communities in the United States and its territories by offering significant tax deferrals, reductions and exclusions to investors with capital gains willing to make these investments.

Orrick’s November 2018 client alert on Opportunity Zones and Qualified Opportunity Funds” Accelerating U.S. Community Impact Financing sets forth the key elements of the tax benefits provided by investment in Opportunity Zones. In large part, these key elements remain unchanged:

Treasurer Fiona Ma Will Ensure New Federal Tax Credits Go to Counties Struck by Disaster | YubaNet

SACRAMENTO, Feb. 7, 2020 – California State Treasurer Fiona Ma announced today that the California Tax Credit Allocation Committee, (CTCAC) which she chairs, is clarifying its regulations to make certain that 13 counties hit by disasters receive $100 million in new federal tax credits.

The federal credits, carried by Rep. Mike Thompson, D-Napa, and approved by the federal government in December, are intended to finance housing projects in 13 counties struck by wildfires in 2017 and 2018, including the Camp Fire, the Tubbs Fire, the Thomas Fire and the Mendocino Complex.

Little Rock investor-zone forum keys on needs of area

While there are few regulations restricting what investors who receive special tax treatment can do in federally created opportunity zones, officials hope a community-focused approach will ensure any new development benefits neighborhoods.

The initiative, part of the federal Tax Cuts and Jobs Act of 2017, allows investors to defer capital-gains taxes on new investments in designated census tracts. The opportunity zone program has been branded as a way to encourage cash flow in economically depressed areas.

In case you are keeping track:

Tax-Aide Volunteers Help County Residents Crunch Their Numbers | TAPinto

SOMERVILLE, NJ - The Somerset County Office of Volunteer Services and AARP have teamed up again this year to provide a free tax-counseling assistance for residents who need help preparing their federal and New Jersey income tax returns.

Appointments are required through April 15, according to Somerset County Freeholder Brian D. Levine,

Volunteers have many years of experience and receive annual training on the latest federal and state tax regulations including guidelines for deductions and credits, so that all tax returns are prepared accurately. All tax-preparation volunteers are tested at the advanced level and certified by the IRS.

OECD Digital Tax Negotiations • IRA Myths • Donor-Advised Funds

This week we look at the OECD's Inclusive Framework's extension of the deadline to reach a consensus; the myths about traditional vs. Roth IRAs and 401(k)s; donor-advised funds in the new decade; the evolution of digital tax; SECURE Act re-planning; and state controlling interest transfer taxes. We'll hear from:

Jeff VanderWolk of Squire Patton Boggs on the OECD's agreement to keep trying to reach an agreement on digital taxation

Tax Tips for Wealthy Investors From Expert Robert Willens - Barron's

Robert Willens just celebrated his 12th anniversary as an independent tax and financial-accounting analyst for hedge funds and other Wall Street pros. To survive as a bespoke accounting research firm—and one charging $75,000 a year—at a time when investors could get tax advice from Wall Street's big brokerage firms is a testament to Willens' longstanding reputation for expertise.

Before founding Manhattan-based Robert Willens LLC, Willens spent 20 years at Lehman Brothers, advising the firm on corporate capital transactions and helping clients use the tax code and accounting nuance to generate potentially lucrative investment ideas. He was named to Institutional Investor's All-American Research Team for 15 consecutive years.

Mayor fights to keep internet sales tax local | Community | palestineherald.com

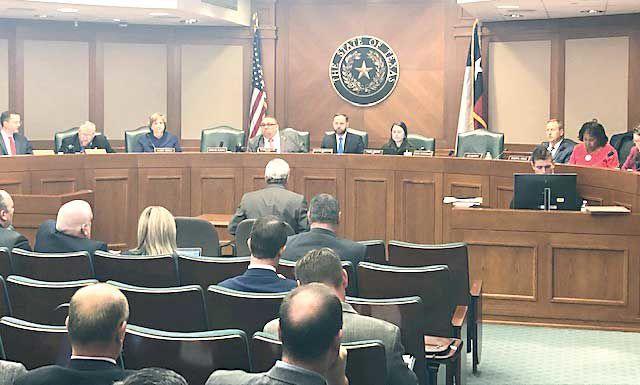

Palestine Mayor Steve Presley delivers a speech during an public hearing in Austin about a proposed online sales tax regulation that could benefit cities like Palestine.

Tuesday, Palestine Mayor Steve Presley spoke with state officials in Austin, hoping to ensure online sales tax paid by the residents of Palestine stay in Palestine.

During a public hearing on a proposed new tax plan, Presley said sales tax money should remain in the communities where online goods are purchased and delivered.

Happening on Twitter

We're calling for fillers to be made illegal for under 18s and for increased regulations #HadOurFill… https://t.co/JXzkainZ2w Fabulousmag (from London) Sat Feb 08 15:00:56 +0000 2020

We're cracking down to stop botched ops - we're calling for fillers to be made illegal for under 18s and for incre… https://t.co/wSwIK8d2XS TheSun (from London) Sun Feb 09 16:42:07 +0000 2020

Contrary to what Boris Johnson says, a Canada style trade deal with the EU would lead to checks on the border betwe… https://t.co/5PTdvdKWk4 LibDems (from United Kingdom) Mon Feb 03 11:50:00 +0000 2020

"Mr Johnson will bring forward his Trade Bill this month which will include measures to stop foreign countries from… https://t.co/AflJICDYYP StandUp4Brexit (from United Kingdom) Thu Feb 06 08:41:25 +0000 2020

No comments:

Post a Comment