SIDNEY — Monday night Sidney City Council approved a replat request that had failed at the February Sidney Planning Commission meeting.

The request of Britt Havenar, on behalf of Brent and Helen Goins, was for approval to create one new lot out of two lots on the south side of the cul-de-sac terminus of Erie Court in the R-1, single family residence district. The property has not been developed.

City staff recommended at its meeting Feb. 18 for the Planning Commission to approve the replat and to recommend for Sidney City Council to approve the request. Commission members were split in a tie vote on whether to approve the request, therefore the item failed without a tie-breaking vote. The replat was then forwarded to City Council for consideration.

Many things are taking place:

Five things you need to know about omnibus bill on taxation - Wed, February 26 2020 - The Jakarta

The upcoming government-initiated landmark bill on taxation is expected to simplify tax regulations and boost investment in Indonesia as it proposes corporate tax cuts and requires internet companies to pay taxes, albeit at the expense of lower tax revenue.The bill will introduce several major changes to the 2008 Income Tax (PPh) Law, the 2009 Value-Added Tax (PPN) Law, the General Taxation System (KUP) Law and the Regional Tax and Fees Law.These changes aim to deregulate existing tax

Supreme Court upholds decision to abide by IRS on mailbox rule for tax refund claims | Accounting

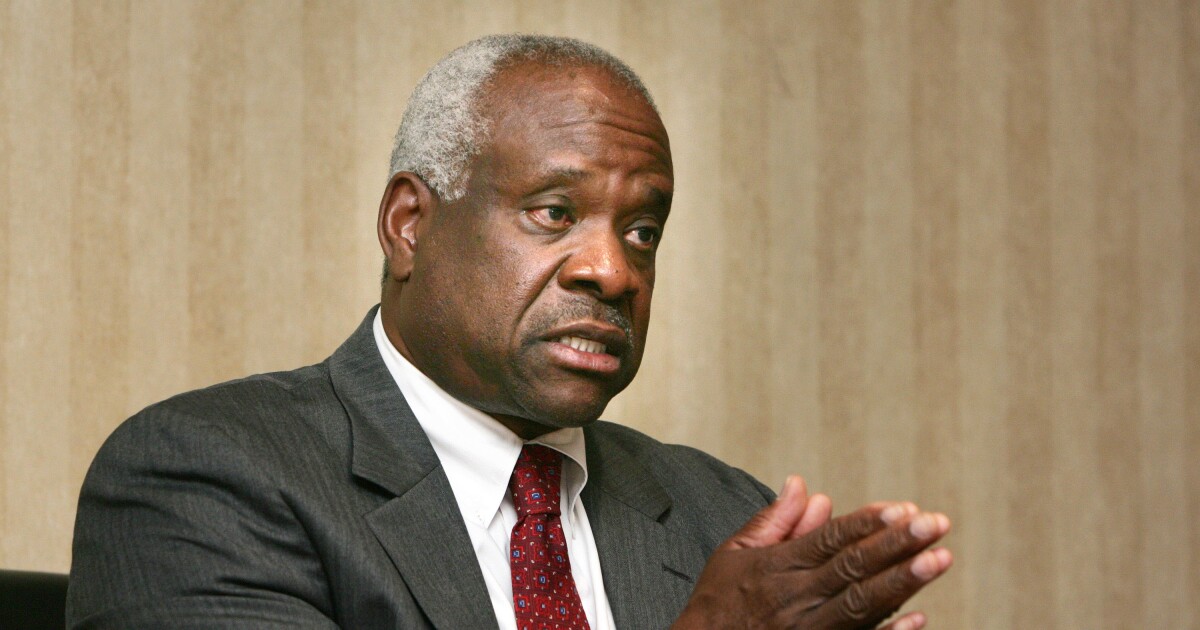

The Supreme Court let stand an appeals ruling that precluded a tax refund to movie producers Howard and Karen Baldwin, deferring to an Internal Revenue Service regulation that ended the common-law mailbox rule for refund claims, even though Justice Clarence Thomas reversed his position on an earlier case.

The Baldwins sued for the refund, and won at trial in the District Court for the Central District of California, which relied on the common law "timely mailing" rule. In the meantime, the IRS issued a new regulation in August 2011, after the Baldwins had mailed in their claim, that ended the common-law mailbox rule for refund claims.

Investors seek tax savings for fees they can no longer deduct | Financial Planning

It's been two years since investors were able to claim tax write-offs for investment costs and advice, but lawyers have found a potential workaround hidden in years-old IRS regulations and case law that may cut tax bills for some private equity and hedge fund investors.

The strategy likely won't generate a deduction as large as what was previously allowed for financial advisory fees. However, if investors are hiring third-party advisors for assistance picking complicated assets, including distressed debt and thinly-traded stocks, they may be able to recoup some of the lost tax benefits, according to a note that advisory firm RSM US will send clients on Thursday.

In case you are keeping track:

Justices Ceded Too Much Power To Agencies, Thomas Says - Law360

Enter your details below and select your area(s) of interest to receive Law360 Tax Authority daily newsletters

The high crime of Congress | TheHill

Today, however, the impeachment proceedings have shown that such use in Congress of public powers for private political advantage can really be thought of as a high crime. After all, legislators have done this repeatedly and with calculated disregard for the critical promise of the Declaration of Independence of a federal government that is based upon "the consent of the governed.

Not just with taxing and spending but with legislative powers in general, members of Congress frame statutes to maximize credit and minimize blame rather than maximize the benefit to constituents. Such statutory designs allow them to evade blame for the harm done to the public when they do favors for special interests and cater to voters of the extreme left and right who wield disproportionate power in the primaries.

Wine and Liquor Makers Toast Excise-Tax Defeat for Treasury Department - WSJ

WASHINGTON—Makers of wines and spirits are celebrating a federal-court decision that could save them billions of dollars in excise taxes each year.

The ruling struck down Treasury Department regulations from 2018 that attempted to end what government officials saw as an unfair benefit for imported products.

Those new retirement regulations: - News - Milford Daily News - Milford, MA

The U.S. Congress loves warm and fuzzy acronyms. But it’s the fine print that counts, not the name of a particular piece of legislation.

Just as the Affordable Care Act (ACA) made health insurance more expensive, the SECURE Act — that’s the Setting Every Community Up for Retirement Enhancement Act — will make the future more insecure for many retirees and their heirs.

However, most financial experts consider annuities to be a bad investment, as annual fees for a variable annuity are between 2.18% and 3.63%, depending on the product and features selected, according to Morningstar.

No comments:

Post a Comment