Tomicah Tillemann is the chairman of the Global Blockchain Business Council and, at Davos this year, he was interested in taxes. He spoke to Michael Casey at his council's event at the World Economic Forum .

Tillemann and his team are looking to make tax systems more efficient, transparent and accountable.

"So we're working on three big challenges. First, how do we make it simpler and more fair to get taxes from citizens and companies into government? That's a big struggle in many countries. So how do we simplify that process and create a fair playing field where everybody is paying what they should and [not] more than they should?" he said. "The second piece of this is how do we ensure that once those resources are inside the government, they're used effectively?

While you're here, how about this:

Gov. Evers calls special session to reduce property taxes, fund schools - Wisconsin Examiner

Gov. Tony Evers held a news conference on Thursday at the state Capitol surrounded by schoolchildren, teachers and public school advocates to sign an executive order calling for a special session to increase state funding for public schools.

New revenue estimates show that Wisconsin is expected to take in $812.2 million more than previously projected through mid-2021. Evers is proposing to use those funds for what he called a "win-win" — reducing the burden on taxpayers, who have repeatedly approved referenda in districts all across Wisconsin to raise their own property taxes to make up the funding gap for their local public schools.

Progressives Push Taxes Targeting Wealthy to Plug New York's Budget Deficit - WSJ

ALBANY, N. Y.—A surcharge on stock buybacks. A special assessment on pieds-à-terre. New charges on luxury yachts and private jets.

Unions and progressive organizations are offering ways to raise more money for the state budget that involve taxing high-income New Yorkers, who already account for more than half of the state's revenue.

On Your Side: File your taxes for free

The Volunteer Income Tax Assistance (VITA) program offers free tax help to individuals who make $56,000 or less, with disability, and limited English speaking taxpayers. This basic income tax preparation is provided by IRS-certified volunteers.

* * *

Drury accounting students also offer free tax preparation assistance. The Drury tax service mainly deals with walk-in clients. These clinics are held at the Breech School of Business Administration building, on the northeast corner of Central Street and Drury Lane.

Many things are taking place:

My 3 favorite tax-filing services after 8 years of doing my own taxes - Business Insider

From the time I got my first job at age 16 until 2011, I always paid a professional to do my taxes for me. I started out with a bargain price, but as my income and the complexity of my taxes went up, so did my annual costs. After paying $600 my final year and finding errors on the accountant's behalf that would have cost me a lot more, I decided to take over and handle things myself.

A quality tax prep program allows you to enter your financial details into easy-to-understand forms. Based on your inputs, the program does a little tax wizardry and turns the numbers into a final tax return, which you can choose to file online or print for paper filing. But based on your needs, different tax apps could be a better fit.

Grab these last-minute opportunities to save on your 2019 taxes

Tax season has just started, but you can still find opportunities to cut your 2019 taxes if you know where to look.

The IRS started accepting tax returns on Jan.27, kicking off the long march to April 15 — the deadline for taxpayers to pay last year's liabilities.

Even if you're able to get six more months to file your tax return, you're required to pay taxes owed by April 15.

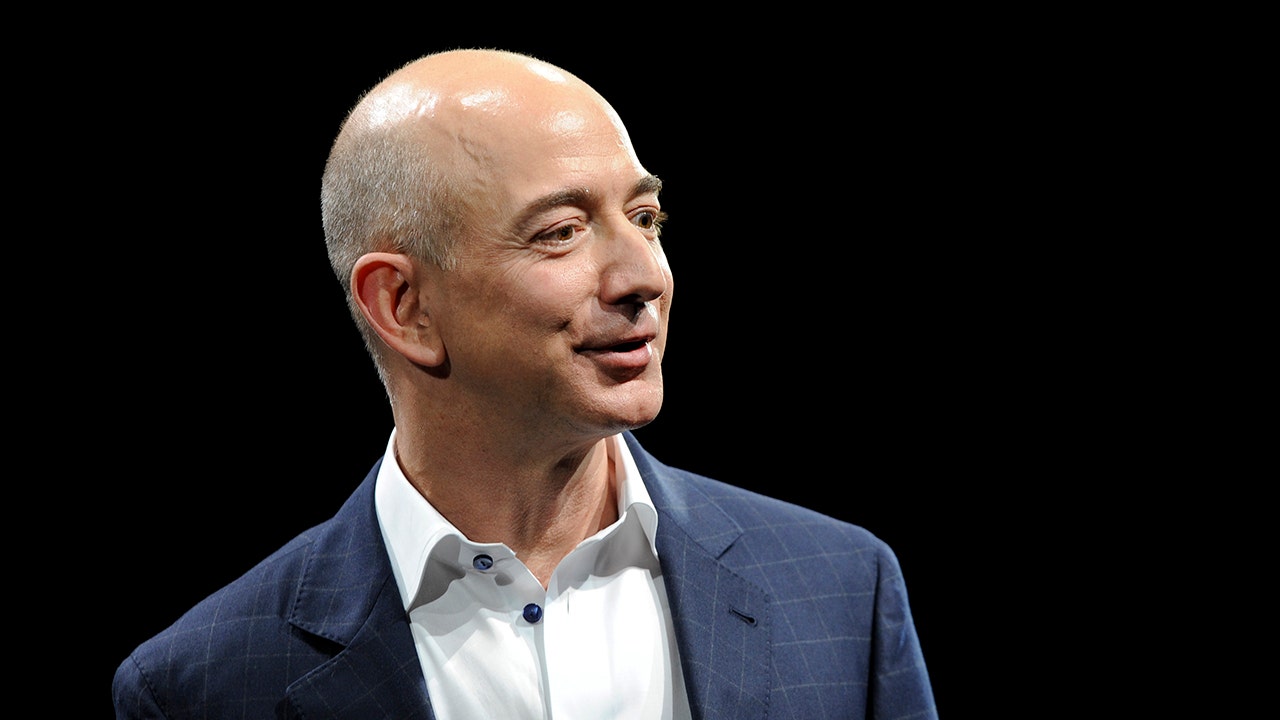

Amazon paid tax rate of 1.2% on $13B in profits last year | Fox Business

For the first time in three years, Amazon , long the subject of criticism from lawmakers across the political aisle, owed federal income taxes .

* * *

In its annual regulatory filing with the Securities and Exchange Commission, Jeff Bezos' sprawling e-commerce empire said it paid $162 million in federal income taxes on $13.3 billion of U.S. pre-tax income, an effective tax rate of 1.2 percent. It deferred more than $914 million in taxes.

Married Women on the Island of Jersey Win Control of Their Taxes - The New York Times

LONDON — Lawmakers on the island of Jersey have approved scrapping a decades-old law that prevented married women from talking to the tax authorities without the permission of their husband or filing taxes under their own names, a mechanism described by a local senator as "archaic."

Jersey, a small island in the English Channel a few miles from the French coast, is a dependency of the British crown but is by and large independent of Britain, with its own directly elected assemblies, fiscal system and courts.

Happening on Twitter

The chairman of the Global Blockchain Business Council is working with others on a way to add transparency and open… https://t.co/k2PxOBfnhR coindesk (from New York, USA) Thu Feb 06 20:01:27 +0000 2020

This is...kind of incredible? It looks like @brenners_smith @bellingcat figured out a way to track illicit bitcoin… https://t.co/B0eqhJXtGm jeffstone500 (from BUF to NYC) Tue Feb 04 22:41:05 +0000 2020

Developer of blockchain-enabled applications, @acoerco, today announced that it is helping its healthcare and life… https://t.co/1k98zhEZIl hashgraph (from Dallas, TX) Mon Feb 03 19:52:05 +0000 2020

No comments:

Post a Comment