President Donald Trump asked the Supreme Court on Tuesday to block lower court rulings that would give the Manhattan District Attorney's office access to years of his income tax returns.

Trump's lawyers filed an emergency application with the Supreme Court asking the court to issue a stay, or suspension, of a grand jury subpoena demanding those tax returns and other financial records from his accountants.

The request is pending the president's plan to formally ask the high court hear his appeal of the lower court rulings that have allowed that subpoena.

In case you are keeping track:

Global Talks on Taxing Tech Firms Will Slip Into 2021 - The New York Times

WASHINGTON — International negotiators said on Monday that they would not reach agreement this year on how and where to tax technology giants like Google and Facebook, as talks remain hindered by the pandemic and an ongoing dispute between the United States and other wealthy nations.

Pressure is mounting on negotiators, as an increasing number of countries look to patch budget holes by imposing new taxes on American tech corporations, inviting retaliatory threats from the Trump administration.

Federal workers should have option to pay Social Security taxes now, senators say - The

"During this time of heightened uncertainty, our public serva nts deserve the ability to choose what makes most sense for them and for their pocketbooks. That's why the President's payroll tax deferral must be made optional," lead sponsor Sen. Chris Van Hollen (D-Md.) said in a statement.

Some employees with basic biweekly pay above $4,000 are subject to the suspension because Social Security-taxable income is reduced by pretax health insurance premiums and flexible spending account set-asides. Meanwhile, extra earnings such as overtime could push an employee over the threshold for a pay period.

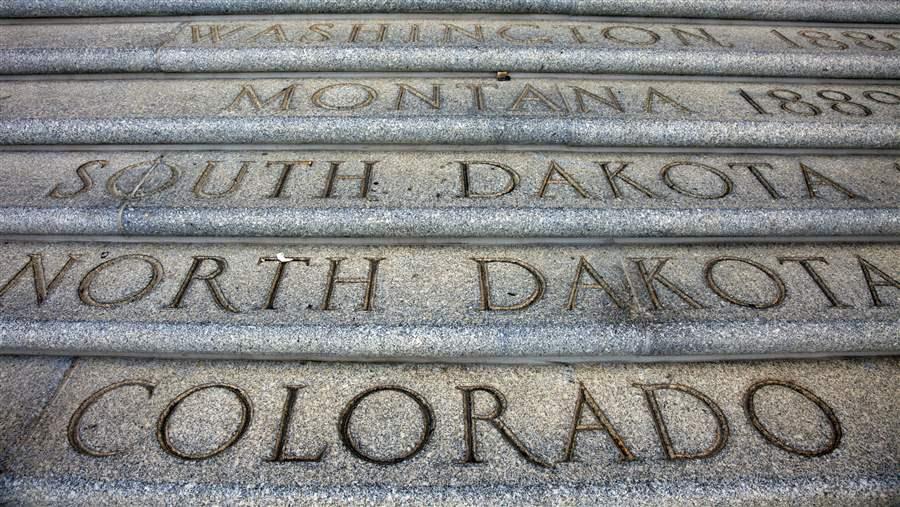

Tax Revenue Swings Complicate State Budgeting | The Pew Charitable Trusts

The coronavirus pandemic is causing sharp, unpredictable swings in tax collections, confounding state lawmakers’ efforts to balance budgets. Sudden fluctuations present challenges even under less extreme economic conditions—with some states experiencing far higher levels of tax revenue volatility than others, depending on their tax mix.

In 2020, for example, no major tax revenue sources were left unscathed as the pandemic brought an abrupt end to the longest economic expansion in U.S. history. Even sources that are relatively less volatile, such as broad-based personal income taxes on wages and investment earnings, have been battered by unemployment rates that spiked early this year and remain high along with historic stock market volatility.

In case you are keeping track:

Proposition EE will raise taxes on tobacco products in Colorado — with one very big

When Coloradans fill out their ballots over the next three weeks and vote on Proposition EE, they will decide whether to significantly raise taxes on cigarettes and other tobacco and nicotine products.

* * *

The ballot question, if passed, would actually reduce the taxes — at least for the next six years — on one special subset of items, called modified-risk tobacco products.

Despite pandemic, McCoy budget plan cuts spending, taxes

ALBANY — The county’s 2021 budget will include a slight tax decrease and 2 percent raises for all county employees.

County Executive Dan McCoy said the $720 million budget is also not dependent on any potential future federal aid to assist local governments that saw sharp reductions in tax revenue due to the coronavirus pandemic. McCoy's spending proposal is roughly $13 million less than the current budget the county operates on.

“This is based on our expenses going forward,” he said. “I have to work within our means.”

District 3 Supervisor candidate Terra Lawson-Remer details support for raising taxes on

SAN DIEGO (KUSI) – The 2020 election is about three weeks away, and the San Diego County Board of Supervisors District 3 race will decide which party will have majority control.

Incumbent County Supervisor representing District 3, Kristin Gaspar, is being challenged by Democrat candidate Terra Lawson-Remer.

Lawson-Remer was recently endorsed by Supervisor Nathan Fletcher , who has been the sole vote against any expedited safe reopening amid the coronavirus pandemic. Both Lawson-Remer and Fletcher are attacking Gaspar for her support of President Trump. In response, Gaspar says Lawson-Remer is supported and funded by the radical Bill Ayers, leader of the Weather Underground.

Alamo: Measure W aims to increase local parks funding without raising taxes | News |

Amid a slew of state propositions and the county sales tax measure, voters in the unincorporated community of Alamo have their own ballot question with Measure W, which seeks to increase the financial appropriations limit for Alamo Parks and Recreation with no tax increase implications.

* * *

"A 'Yes' vote on Measure W allows tax money already collected by the County on your property tax bill to be spent in your Alamo community," proponent Anne Struthers wrote in the ballot argument in favor of Measure W -- written on behalf of the Alamo Municipal Advisory Council.

Happening on Twitter

Anyone who pays taxes is helping the Trump family's struggling business stay afloat. And not just a little: the Sec… https://t.co/u4ocQmrD21 CREWcrew (from Washington, D.C.) Mon Oct 12 23:30:03 +0000 2020

Voters do not want higher taxes, street anarchy, packed courts, or power-grabbing #socialist schemes. This "silent… https://t.co/8PLx6Vix62 michaeljohns (from New Jersey, USA 🇺🇸) Mon Oct 12 11:25:36 +0000 2020

I fear that we moved past this shocking story too quickly -- $750. https://t.co/5Pe2VA5B7L CongressmanRaja (from Schaumburg, IL) Tue Oct 13 12:55:03 +0000 2020

I'm the Dem running against Kevin McCarthy. In light of Trump paying only $750 in income taxes, we'd like to raise… https://t.co/LZFtwiAzBR KimMangone (from CA-23) Tue Oct 13 00:21:12 +0000 2020

No comments:

Post a Comment