The Manhattan district attorney can enforce a subpoena seeking President Trump's personal and corporate tax returns, a federal appeals panel ruled on Wednesday, dealing yet another blow to the president's yearlong battle to keep his financial records out of the hands of state prosecutors.

The unanimous ruling by a three-judge panel in New York rejected the president's arguments that the subpoena should be blocked because it was too broad and amounted to political harassment from the Manhattan district attorney, Cyrus R. Vance Jr., a Democrat.

Not to change the topic here:

Paying for the pandemic: Are increased taxes the answer? | Accounting Today

The pandemic has seen governments around the world take action to support businesses of all sizes and protect their economies. This is one of the core roles of any government, supporting citizens in times of critical need, and the pandemic required a quick and far reaching response. However, this support needs to be paid for, and while no one is questioning the necessity of government action, conversations have already started about how the increased expenditure will be funded.

* * *

The overall direction of the tax debate seems to be for an increase in corporation tax as a percentage of total tax revenues. This makes sense but bucks the historical trends that we have seen over recent decades. For the period 2000-2020, a total of 88 countries lowered their corporate tax rate, 15 remained the same, and only 6 raised their base rate.

These 4 states are voting to legalize and tax marijuana sales

Things may go green in four states this fall, as voters will decide on legalizing and taxing marijuana.

Arizona, Montana, New Jersey and South Dakota all have measures up for a vote to legalize and levy recreational marijuana.

Thus far, 11 states have legalized recreational pot: Alaska, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Nevada, Oregon, Vermont and Washington state.

* * *

"You can have a good tax system, but if your regulatory system isn't effective, you won't see the revenue," he said.

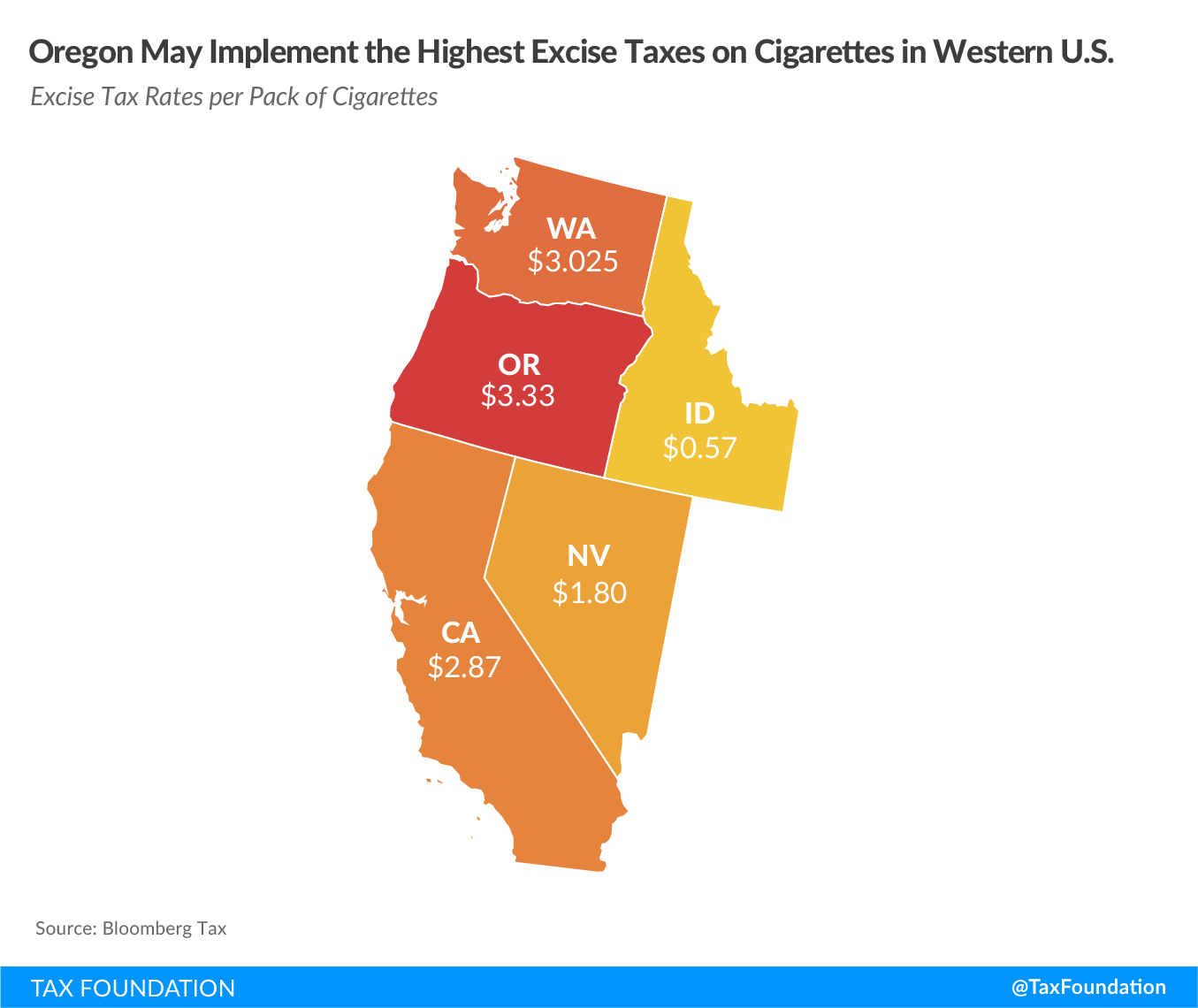

Oregon Measure 108: Tobacoo and E-Cigarette Tax Increase

In addition to the increased tax on cigarettes, the measure includes a new tax on vapor products. Vapor products would be taxed at 65 percent (levied on both devices and liquid) of wholesale value, and would raise $6.0 million in 2019-21, $25.1 million in 2021-23, and $26.6. million in 2023-25. Finally, the measure includes an increase to the tax cap on cigars (from 50 cents to $1 per cigar).

Excise tax es on tobacco products are legitimate because these products cause negative externalities. For instance, some health-care costs of smoking are covered by government, and secondhand smoke affects nonsmokers. Levying an excise tax allows a state to recover the costs related to these externalities—thereby internalizing them. However, while these taxes can be legitimate, they should be carefully designed. Unfortunately, Measure 108 contains numerous design flaws.

Were you following this:

Illinois to Vote on a Graduated State Income Tax - WSJ

CHICAGO—Illinois voters will decide next month whether to replace the state's flat income tax with a graduated rate to help solve a fiscal crisis that has been exacerbated by the coronavirus pandemic.

Even before the pandemic prompted Gov. J.B. Pritzker in March to order a shutdown that curtailed most businesses and caused unemployment to rocket, the state was beset by unfunded pension liabilities currently tallied at about $137 billion and a backlog of unpaid bills totaling several billion dollars.

Audit likely gave congressional staff glimpse of Trump taxes - ABC News

That's where Congress comes in. The audit of Trump's taxes, the Times reported, has been held up for more than four years by staffers for the Joint Committee on Taxation, which has 30 days to review individual refunds and tax credits over $2 million. When JCT staffers disagree with the IRS on a decision, the review is typically kept open until the matter is resolved.

The upshot is that information on Trump's taxes, which Democrats are now suing to see, has almost certainly passed through the JCT's hands, putting it tantalizingly close to lawmakers.

The Reality of Incomes, Taxes and Redistribution in America | Cato @ Liberty

As my Cato colleague Chris Edwards mentioned last week, the Congressional Budget Office on Friday released its annual report on trends in U.S. household income, means‐tested transfers, and federal taxes between 1979 and 2017 (the most recent year for which tax data were available).

First, and echoing Chris' post from last week, the CBO shows that total annual federal taxes — income, payroll, corporate, and excise — paid by the richest Americans (households making around $300,000/year or more) have basically doubled since 1979. Over the same period, the middle classes have paid almost the same amount of federal taxes, and the poorest Americans' federal tax burden has all but disappeared.

READ: 2nd US Circuit Court of Appeals ruling on Trump's tax returns - CNNPolitics

(CNN) The Manhattan district attorney can obtain President Donald Trump's tax returns, the 2nd US Circuit Court of Appeals ruled on Wednesday, dealing the President another setback in his effort to shield his tax returns from investigators but the case is likely to head to the Supreme Court.

Happening on Twitter

BREAKING: Manhattan D.A. Can Obtain Trump's Tax Returns, Judges Rule https://t.co/JVwhmLJv6v BenWeiserNYT (from New York, NY) Wed Oct 07 13:57:35 +0000 2020

Manhattan D.A. Can Obtain Trump's Tax Returns, Judges Rule. https://t.co/Vtr25poJGN brianrayguitar (from Yacht Rock Star) Wed Oct 07 17:17:25 +0000 2020

Judge: NY DA can obtain Trump tax returns https://t.co/oTWMil5c8c MSNNews Wed Oct 07 15:35:21 +0000 2020

We're seeing two very different visions for America, and I know which I'd prefer. I also know that so much of our a… https://t.co/YiC5tsaAGy elizaorlins (from New York, NY) Wed Sep 30 01:46:51 +0000 2020

No comments:

Post a Comment