DALLAS (CBSDFW.COM) – Dallas police have recovered the vehicle driven by missing accounting executive Alan White, but his whereabouts remain a mystery.

* * *

“When I first got that call, I just went and sat in a chair and cried like a 5-year-old,” says his brother Tim White. White immediately traveled to Dallas from West Virginia to aid in the search. “I don’t feel like he’s taken off this earth. I’ve lost enough, I don’t want that to happen.”

Not to change the topic here:

PSC approves water utility's accounting plan

The Missouri Public Service Commission has approved an agreement in a case filed by Missouri American Water seeking an order to govern costs and financial impacts the company has faced associated with the COVID-19 pandemic.

The PSC approved an Accounting Authority Order authorizing the company to deviate from accounting rules it must otherwise follow. The AAO will permit Missouri American Water to defer these costs and carry them as a regulatory asset rather than expensing them in the period in which they were incurred.

Global Accounting Software Market: Starling Bank Partnered with Free Agent to Digitize and

Please visit: https://www.fortunebusinessinsights.com/industry-reports/accounting-software-market-100107

* * *

In 2018, the market in North America was worth US$ 3,759.4 Mn. The region is expected to lead in the global accounting software market through the forecast period. The U.S. government is increasingly spending on installing accounting software systems in private and public organizations. This, coupled with the strong presence of players in the U.S., is expected to create growth opportunities for the market in the forthcoming years.

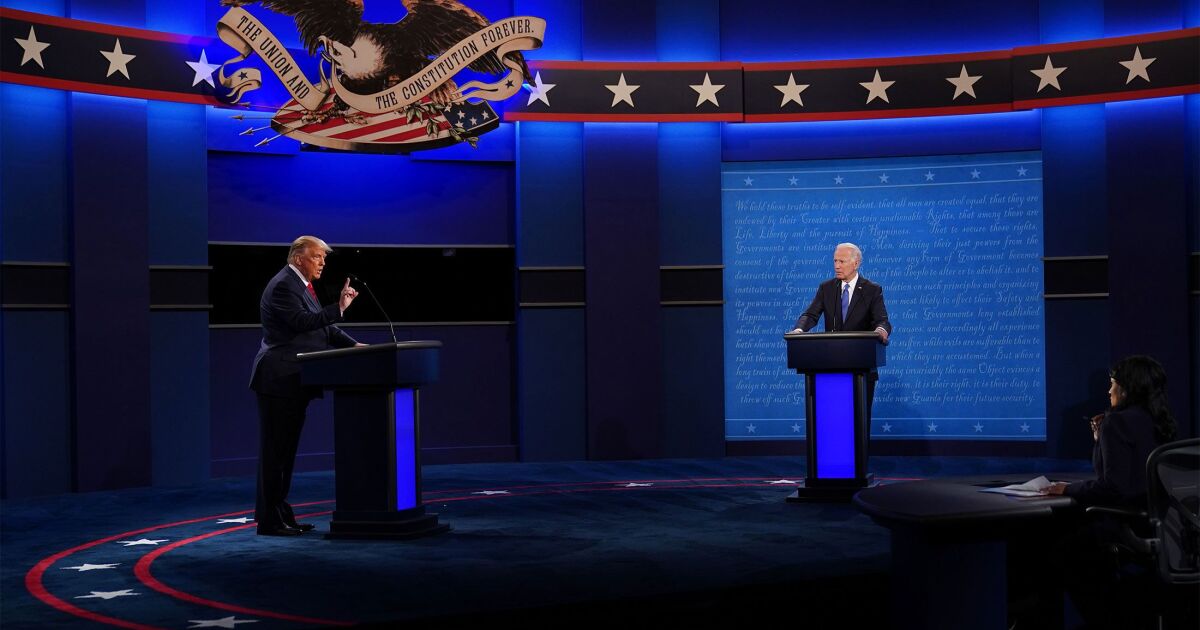

Tax reform may be coming after election | Accounting Today

The outcome of Tuesday's election could be profound tax changes, but that's only if one party wins control of both houses of Congress and the White House.

"After the November election the Democrats and the Republicans are going to know how many seats they hold in the House and the Senate," said Tim Speiss, co-leader of EisnerAmper's Personal Wealth Group. "One of the parties will be the majority. Let's say it's the Republicans. The Republicans would rather act in early 2021 on tax reform because they know who their members are. They know where they stand in terms of having a majority or not.

While you're here, how about this:

Cleveland accounting firm starts initiative to help Black-owned businesses - cleveland.com

A Cleveland accounting firm said it's starting a new program aimed to help Black-owned businesses in Northeastern Ohio.

Apple Growth Partners (AGP) said the program is called "Increase Minority Professionals' Awareness and Create Traction," or IMPACT.

It was created and will be directed by tax manager A'Shira Nelson and audit and assurance manager Sunny Adams.

* * *

Get the best in local business news sent straight to your inbox with the Cleveland Business Journal. Free to sign up.

FASB proposes clarifying forwards and options accounting - Journal of Accountancy

FASB proposed an accounting standard Monday that would clarify an issuer's accounting for certain modifications or exchanges of freestanding equity-classified forwards and options.

The proposal would affect forwards and options (such as warrants) that remain equity classified after modification.

Based on a consensus of FASB's Emerging Issues Task Force, the proposal would provide guidance on how an issuer would measure and recognize the effect of these transactions. The proposal would provide a principles-based framework to determine whether an issuer would recognize the modification or exchange as an adjustment to equity or as an expense.

FASB proposes to clarify scope of reference rate reform guidance | Accounting Today

Since the release of that ASU, stakeholders raised questions about whether Topic 848 can be applied to derivative instruments that do not reference a rate that is expected to be discontinued but that use an interest rate for margining, discounting or contract price alignment that is modified as a result of reference rate reform.

This latest proposed ASU would clarify that certain optional expedients and exceptions in Topic 848 for contract modifications and hedge accounting apply to contracts that are affected by the discounting transition. The amendments to the expedients and exceptions in Topic 848 are included to capture the incremental consequences of the proposed scope refinement and to tailor the existing guidance to derivative instruments affected by the discounting transition.

3 approaches to boosting your online presence | Accounting Today

We'll weigh the pros and cons of three different approaches to creating an impressive online presence. Depending on your time, budget and resources, you can figure out the best fit for your firm.

* * *

I've learned through trial and (lots of) error there are three basic approaches to building a website and newsletter for your firm:

There are some great "build your own website" tutorials and tools on the web. The benefit of DIY is obvious: You'll save money on hiring an agency. But you'll face a big opportunity cost: the value of your time. If you choose to go the DIY route, make sure you budget enough time to learn how to use the technology (and to use it well). Also, budget time for client emergencies and normal disruptions to your daily workflow. Suppose a frantic client calls you with an emergency?

Happening on Twitter

#UPDATE: Porsche Driven By Missing Accounting Executive Alan White Recovered In South Dallas https://t.co/AUK1CrOycG CBSDFW (from Dallas / Fort Worth) Sat Oct 31 03:03:56 +0000 2020

No comments:

Post a Comment