The Tax Cuts and Jobs Act (TCJA) limited the ability of taxpayers to engage in a tax-deferred exchange (1031 exchange) in property held for investment or business use. The TCJA removed the ability to engage in a 1031 exchange for any property other than real property. Gone are the days of a tax-deferred trade of equipment, vehicles, or other tangible personal property used in a trade or business. But now we need a better definition of what constitutes real estate for this purpose.

Other things to check out:

OECD Encourages Regulators To Form Uniform Crypto Tax Regulations

Mining income is taxed differently by regulators. For example, the IRS taxes crypto mining rewards at the time of the receipt as ordinary income. The Australian Taxation Office (ATO) subjects mining income to capital gains taxes if the mining operation is not considered to be a business.

* * *

While a small number of countries (Grenada, Italy, Netherlands, Portugal & Switzerland) don't consider any exchanges made by individuals to be a taxable event, the majority of the countries impose taxes on crypto to fiat trades, purchase of goods and service thru crypto and crypto to crypto trades.

Maine State Housing Authority Adopts Regulations on Low Income Housing Tax Credit

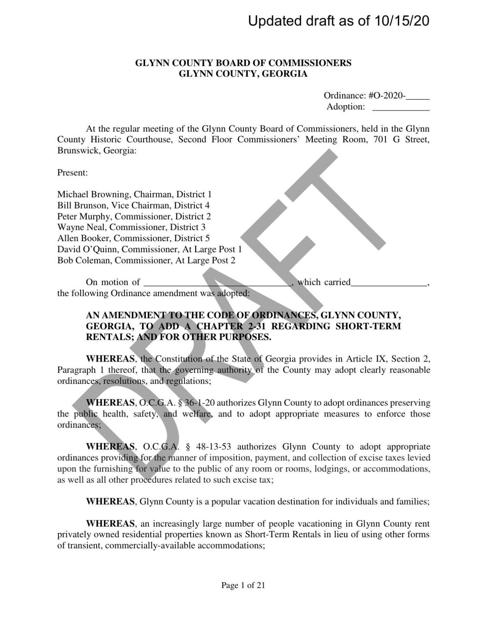

Commission approves short-term rental regulations | Local News | The Brunswick News

The Glynn County Commission unanimously voted Thursday to impose regulations on short-term rentals outside the Brunswick city limits.

Auditors checking the Brunswick-Glynn County Joint Water and Sewer Commission's books gave the commission a favorable report Thursday.

The Literary Guild of St. Simons Island forecast of its largest ever used book sale may indeed prove to be one for the books.

Camden County Sheriff Jim Proctor proposed construction of a firing range more than seven years ago for use by local military, law enforcement officials and the public.

Other things to check out:

Korean blockchain lobby calls for crypto tax plan to be put on ice

The Korea Blockchain Association has called for the government's new 20% crypto trading tax plan to be delayed for another two years.

According to an Oct. 14 report from News1 Korea, the Korea Blockchain Association, or KBA, is requesting regulators postpone the South Korean government's implementation of its long awaited new tax strategy until Jan. 1, 2023.

The KBA doesn't explicitly state it is against the 20% tax rate but said that crypto exchanges and companies in the industry need a "reasonable period" to prepare for the Income Tax Act.

At a glance: tax law enforcement in Taiwan - Lexology

How does the tax authority verify compliance with the tax laws and ensure timely payment of taxes? What is the typical procedure for the tax authority to review a tax return and how long does the review last?

Under Taiwan’s tax laws, taxpayers have an obligation to file the relevant tax returns voluntarily. Upon receipt of the tax returns filed by taxpayers, the tax authority will review the filing for accuracy. If the tax authority deems that additional information or clarification is required, the tax authority will duly notify the taxpayer, in accordance with the law.

Treasury and the IRS Finalize Regulations on Withholding on the Disposition of a Partnership

On October 7, 2020, the U.S. Department of Treasury (“Treasury”) and the Internal Revenue Service (IRS) finalized regulations ( T.D.

Section 1446(f), which was added to the Code by the Tax Cuts and Jobs Act (TCJA), requires a transferee to withhold on amounts it pays for the transfer of a partnership interest by a foreign person, in order to ensure collection of tax with respect to the portion of such foreign partner’s gain from the transfer that is treated as effectively connected with the conduct of a U.S. trade or business under section 864(c)(8) (“effectively connected gain”).

IRS Changes Non-Publicly Traded Partnership Interest Guidance

Enacted as part of the "Tax Cuts and Jobs Act," Section 1446(f) generally requires a transferee, in connection with the disposition of a partnership interest by a non-U.S. person, to withhold and remit ten percent of the "amount realized" by the transferor, if any portion of any gain realized by the transferor on the disposition would be treated under Section 864(c)(8) as effectively connected with the conduct of a trade or business in the United States ("Section 1446(f) Withholding").[5]

Happening on Twitter

DACA recipients are called Dreamers. They're literally the same. DACA is not the same as the DREAM Act, which is a… https://t.co/hQdvpCf8ij eugenegu (from eugene@coolquit.com) Fri Oct 16 01:14:40 +0000 2020

:max_bytes(150000):strip_icc()/shutterstock_82082848-5bfc2b75c9e77c00519aa183.jpg)

No comments:

Post a Comment