In the realm of economic and workforce development, Gov. Ned Lamont's proposed budget adjustments include expanding the Office of Workforce Competitiveness and offering tax credits to businesses that create at least 25 good-paying jobs.

Lamont on Wednesday recommended a $22.29 billion budget for the fiscal year starting July 1, a 0.6% increase from what was appropriated in 2019 for the upcoming fiscal year.

It involves the extension of more than $28 million of taxes that were set to expire. This includes the permanent extension of the corporate surcharge at the current rate of 10%, allowing the state to generate $22.5 million next fiscal year. The governor also expects to get $5.7 million from the capital base tax next year and proposes eliminating the tax from 2026 onward.

This may worth something:

Latest Louisiana news, sports, business and entertainment at 1:20 a.m. CST

BATON ROUGE, La. (AP) — Gov. John Bel Edwards is suing Louisiana's state treasurer for blocking a $25 million fund transfer the governor and lawmakers earmarked for state operating expenses. The Democratic governor is asking a judge to declare Republican state Treasurer John Schroder's actions illegal. Schroder has refused to shift the $25 million from Louisiana's unclaimed property account this budget year and he blocked a $15 million transfer last year.

* * *

BATON ROUGE, La. (AP) — Gov. John Bel Edwards' administration is proposing a $32 billion Louisiana budget for next year that pours millions of new dollars into education and keeps most other government programs on an even keel. But it uses money that isn't yet available to spend under the law. The Friday release of the Democratic governor's spending recommendations kicks off months of budget negotiations with lawmakers.

[Budget 2020] DDT Abolished but dividend taxable for investors

In a relief to companies, budget 2020 on Saturday announced to remove the infamous Dividend Distribution Tax (DDT).

A dividend is the amount that a company or a mutual fund (MF) house pays its investors from its profits, and DDT is levied on that dividend. Domestic companies have to pay 15 per cent DDT on the aggregate dividend declared or paid. Additionally, 12 per cent surcharge and 3 per cent education cess is also levied, amounting to effective DDT of 20.35 per cent.

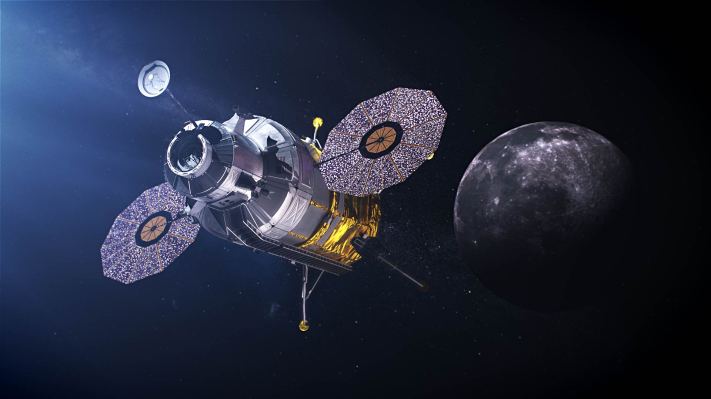

Trump said to propose roughly $3 billion NASA budget boost for 2021 – TechCrunch

This represents one of the single largest proposed budget increases for NASA in a couple of decades, but reflects Trump’s renewed commitment to the agency’s efforts as expressed during the State of the Union address he presented on February 4, during which he included a request to Congress to “fully fund the Artemis program to ensure that the next man and first woman on the Moon will be American astronauts.”

NASA Administrator Jim Bridenstine has frequently repeated the agency’s goal of sending the first American woman and the next American man to the surface of the Moon by 2024, a timeline the current mission cadence of the Artemis program is designed against. Bridenstine has previously discussed esimated total costs for getting back to the Moon by 2024 between $20 billion and $30 billion , and the Administrator was pressed by a House Appropriations Subcommittee late last year about a

In case you are keeping track:

While cutting $58.7M from Medicaid, Raimondo budget gives $15.7M to insurance companies –

One of my biggest concerns with Rhode Island Governor Gina Raimondo ‘s proposed budget is the deep cuts to Medicaid – $58.7M in cuts that only “save” the state $20.2M because of lost federal funds. The most common excuse for these cuts is that the budget picture is bad, and we have not choice but to do this.

That choice is spelled out in this line item in the Senate Fiscal Office First Look budget analysis:

This line of budget jargon could mean a lot of things. Initially, I was concerned that this might be an effort to force providers into a horrific payments model known as “full risk capitation,” something the Raimondo administration has been trying (and mostly failing) to push our healthcare system towards. Fortunately, it doesn’t seem to be quite so bad. Instead, it’s just an initiative to give more public money to insurance companies.

Budget 2020: ₹22,000-crore equity support for two infrastructure finance companies - The Hindu

A joint project educating Uttar Pradesh farmers on sustainable agriculture practices has helped improve ...

With the Budget offering little to boost consumption, companies are left to their own devices to navigate the ...

* * *

While borrowers may benefit despite the central bank's decision to keep the repo rate unchanged, it may be a ...

The tag line said 'Go IndiGo' and the Indian air traveller heartily obliged, making the low-cost airline with ...

Boston Schools propose $1.26B budget

Union Budget 2020: A balancing act for taxpayers, govt

Abolishing of the DDT regime should benefit foreign investors/companies having subsidiary in India, as they should now be eligible to claim credit for the tax paid on dividends in India The Finance Bill 2020 introduces a new scheme of tax rates for individuals and Hindu undivided families, providing an option to pay taxes at reduced tax rates from financial year 2020-21

Happening on Twitter

#아이즈 #IZ #THE_IZ 3rd Single Album 'THE:IZ' 'The Day' MV 🔗 https://t.co/HRhaLFifzL #IZ_NEW #IZ_200131 #TheDay… https://t.co/XsGAdIrl5d official__IZ Fri Jan 31 09:00:00 +0000 2020

[#아이즈] 3rd Single Album 'THE:IZ' TITLE 'The Dy' M/V 촬영 비하인드가 멜론 매거진에 오픈되었습니다. [비하인드 컷]K 록 대표 밴드를 향한 열망을 담은, 아이즈(IZ… https://t.co/rJed5HisYy official__IZ Fri Jan 31 09:06:25 +0000 2020

No comments:

Post a Comment