Check out this next:

Apple, Amazon are changing Culver City. Should taxes be higher? - Los Angeles Times

Inside the 8-year-old light rail station, Culver City Mayor Meghan Sahli-Wells gazed at the bustling skyline of this once sleepy Westside suburb known for movie studios, auto repair shops and affordable single-story homes for aerospace workers.

Everything has changed for this city of 39,000 people sandwiched between Los Angeles and Santa Monica. The mayor pointed to the north, where a five-story building with red trim is now being constructed — a future home for HBO's West Coast headquarters.

WV MetroNews Senate Republicans prepare to roll out tax plan - WV MetroNews

Senate Republicans will soon roll out the most sweeping legislation of the session and it includes proposed major changes in the state's tax structure, impacting everything from property taxes to the state's sales tax and tobacco tax.

* * *

—A six-year phase out of the property tax on machinery, equipment and inventory (including retail inventory) and the property tax on cars, trucks, trailers and other "rolling stock."

Proposal to include tampons in Tennessee's tax-free weekend faces pushback | TheHill

Republican lawmakers in Tennessee reportedly pushed back on a proposal to add feminine hygiene products to a list of goods that can be purchased tax free during the state's annual " Sales Tax Holiday ."

Republicans reportedly pushed back on adding the hygiene products to the list during a Tuesday hearing, arguing that people who use the products could purchase too many if not given a limit.

"I would think since it's a sales tax holiday, there's really no limit on the number of items anybody can purchase," state Sen. Joey Hensley, a Republican from Hohenwald, said Tuesday, according to AP. "I don't know how you would limit the number of items someone could purchase."

And here's another article:

Federal Taxes and Spending Set Records Through January | CNSNews

(CNSNews.com) - The federal government set records for both the amount of taxes it collected and the amount of money it spent in the first four months of fiscal 2020 (October through January), according to data released today in the Monthly Treasury Statemen t.

* * *

The previous high for total federal taxes collected in the first four months of the fiscal year came in fiscal 2018, when the Treasury collected $1,172,088,080,000 in constant December 2019 dollars.

Pennsylvania lawmakers revive bill to eliminate school property taxes | ABC27

HARRISBURG, Pa. (WHTM) – A bill in the Pennsylvania Senate would make school property taxes a thing of the past.

”Property taxes are an unfair and archaic relic from the 1830s that were set in place during a time when children were taught in one-room schoolhouses and teachers like my grandfather Argall, back in the 1920s, were actually paid partially in vegetables,” said Sen. David Argall, the bill’s primary sponsor. “We don’t do that anymore, but we’re still stuck with this same tax that, if you do not pay it, can make you homeless.”

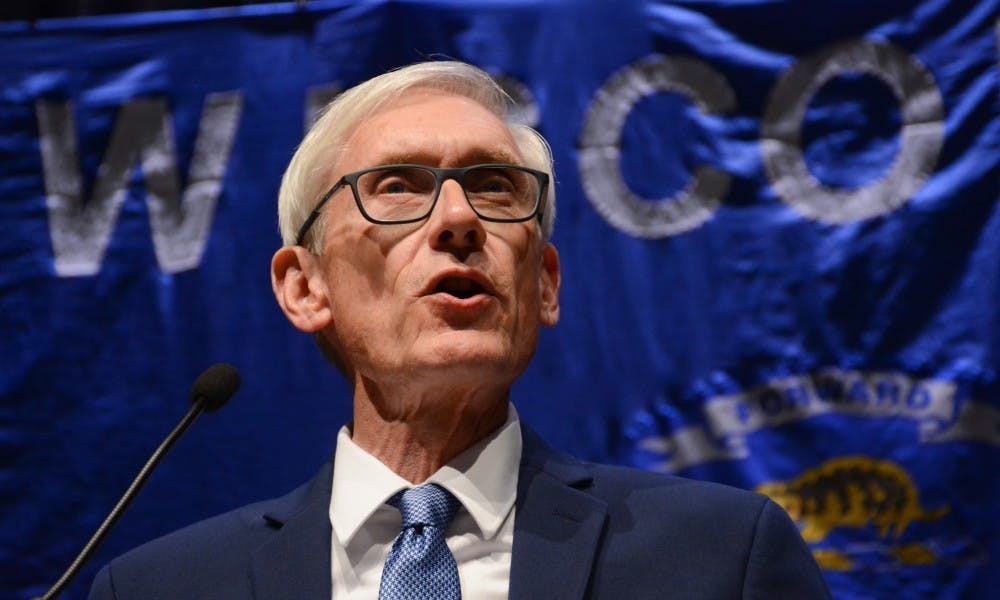

Wisconsin small businesses urge lawmakers to close tax loophole that helps 'big box' businesses |

Gov. Evers previously vowed to close the "dark store" loophole which lets big businesses get tax breaks for closed stores in the area.

The National Federation of Independent Business — the leading small business organization in Wisconsin — is urging lawmakers to pass legislation in the next few weeks to sign two bills to eliminate personal property taxes, as well as close the dark store loophole.

9 things new parents need to know before filing their taxes in 2020

Having a new baby can not only change your sleep patterns, it can also change how you file your taxes.

Last year, almost three out of four Americans, 72%, received a tax refund, with the average amount being close to $3,000, according to a recent survey from TurboTax .

This year, tax filing season started on January 27, 2020 and runs through Wednesday, April 15, 2020 for most taxpayers. The IRS is expecting to receive over 150 million individual tax returns for the 2019 tax year, with the vast majority coming in before the April 15 deadline.

No comments:

Post a Comment