Facebook Inc. and the Internal Revenue Service will square off in a U.S. Tax Court case that could cost the social-media giant more than $9 billion and shape the government's ability to crack down on companies' efforts to shift profits to low-tax countries.

And here's another article:

Which taxes are the fairest? | News, Sports, Jobs - Williamsport Sun-Gazette

A recent letter argued that eliminating the earned income tax and increasing real estate tax to offset the loss would be fairer for taxpayers. My question is, “fairer” for whom?

Since there were some terms recklessly thrown about in that letter, let’s start by defining a few of those terms. A progressive tax is one that the tax rate — the percentage of the thing being taxed — increases as the value of the thing being taxed increases. A flat tax is a tax that the rate or percentage of the thing being taxed stays the same, even as the value of the thing being taxed goes up. The writer claims that Pennsylvania has several regressive taxes.

Tax debt: Call the IRS as your first step - The Washington Post

Don't call the number you see on your television screen or the one you hear in a radio ad. Make the IRS your first stop so that you don't fall prey to a scam. Because, contrary to the claims on the commercials promising quick relief, private companies are not likely to get your tax debt reduced to pennies on the dollar.

And to be clear, I'm not talking about a taxpayer who's fighting the IRS over the legitimacy of a deduction. If you've got a complicated tax situation, you may need to hire a certified public accountant or an attorney who specializes in such tax cases.

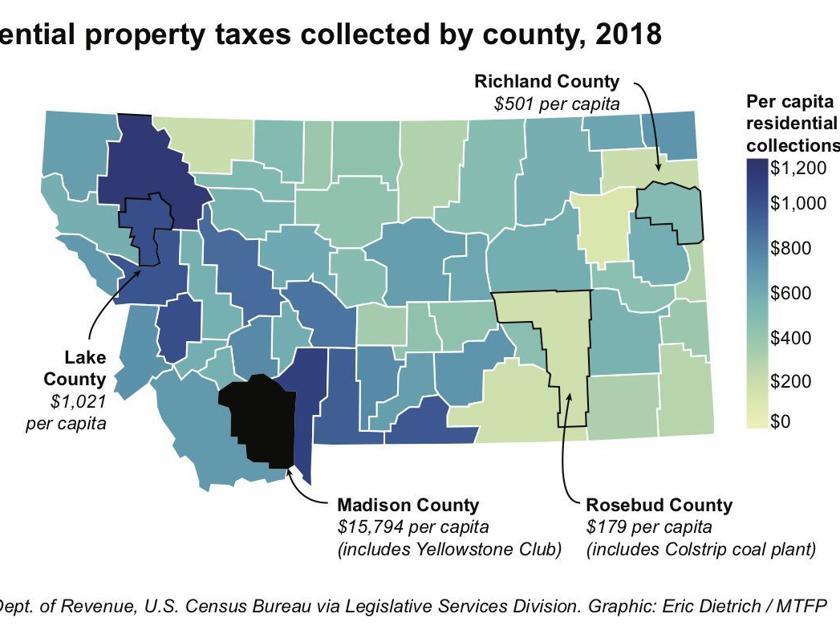

Montana property taxes keep rising. Here's where residents shoulder the heaviest loads.

HELENA — Just how hard do Montana cities, counties, and school districts lean on residential property taxes to fund government services? Figures presented to lawmakers last month indicate the answer varies widely across different parts of the state, ranging from as low as $125 annually per capita in McCone County to as high as $15,794 per capita in Madison County.

The figures include value-based property taxes paid by residential property owners to municipalities, counties and school districts. They exclude non-tax fees and assessments levied by local governments, which are difficult to tabulate across different jurisdictions.

Other things to check out:

No traffic fix without taxes - The Boston Globe

Re "Baker turns to startups to fix traffic" (Chesto Means Business, Jan. 31): Good for Governor Baker for looking at all options. But let's not kid ourselves that giving $250,000 in seed money for a high-tech incubator is going to fix things. We already know the real solution: We tax ourselves to fund a tremendous new mass transit infrastructure. It creates jobs, creates room for those who must drive, and keeps Boston growing.

Top tax-planning mistakes when saving – or not saving – for retirement

Tax season is here , and whether you're 23 or 53, it's a good time to think about tax-saving strategies , particularly when it comes to retirement.

While the biggest mistake is not having in place an overall financial plan and a risk management plan, there are smaller missteps you can easily correct that will help you when you file for taxes today and down the road.

First, just get started. Many people worry they're starting too late and then get overwhelmed by the whole process.

Real Oscar Winner: IRS, Collecting Tax On Each $225,000 'Gift' Bag

An Oscar Statue is displayed at the 92nd Annual Academy Awards Governors Ball press preview at The ... [+] Ray Dolby Ballroom at Hollywood & Highland Center, in Hollywood, California, on January 31, 2020. (Photo by VALERIE MACON / AFP) (Photo by VALERIE MACON/AFP via Getty Images)

Gift bags are taxable, but what about gift certificates or vouchers for trips or personal services? If you redeem the certificates or vouchers, you include the fair market value of the trip or service on your tax return. If you make a selection in a 'free shopping room,' the value of your selection is income too. Still, some celebs regift the bags or turn them down.

Do your own taxes like a pro with this tax certification bundle

If the W-2 and 1099 forms in your mailbox weren't enough of a hint, tax season has officially arrived. And while it's a pretty straightforward process for the typical nine-to-fivers of the world, for freelancers and entrepreneurs, the word "taxes" is like nails on a chalkboard.

You could easily hire an accountant and avoid the frustration altogether, but it'll cost you. Instead, if you're feeling ambitious, you could get a better understanding of how it all works and then do the darn thing yourself. How? Check out this Be a Tax Expert Certification Bundle .

Happening on Twitter

The IRS and Facebook are due to battle in court in a case that could shape the ability of the government to crack d… https://t.co/wrCdQZGaEa WSJ (from New York, NY) Sat Feb 08 18:30:07 +0000 2020

The social media behemoth is about to face off with the IRS in a rare trial to capture billions that the tax agency… https://t.co/DEkTNdHVyu propublica (from New York, NY) Sat Feb 08 22:30:03 +0000 2020

The potential $9 billion-plus tax hit for Facebook from this court case against the IRS is roughly equal to its tot… https://t.co/BrH4z0ezGa RichardRubinDC (from Washington, DC) Sat Feb 08 18:25:10 +0000 2020

Facebook prepares to fight IRS crackdown on its 'Irish tax shelter' https://t.co/V0vpbHhYQt DailyMail (from New York) Sun Feb 09 06:06:09 +0000 2020

No comments:

Post a Comment