While you're here, how about this:

Chief Accounting Officer - Amherst | Built In Austin

Competitive compensation and bonus program. Flexible PTO. Health, vision, dental and long term disability coverage. Paid maternity/paternity leave. Attractive office space. Training certifications assistance. Daily catered lunch and stocked kitchens. Monthly birthday celebrations. Casual work environment with regular team-building outings. Breakfast Taco Thursday.

Tech news: Armanino expands blockchain assurance platform | Accounting Today

The Top 100 Firm continues as a pioneer in distributed ledger solutions; Damien Greathead moves to practice ignition; Xero launches a global ad campaign, and more stories from technology.

Harnessing lease accounting centers of excellence | Accounting Today

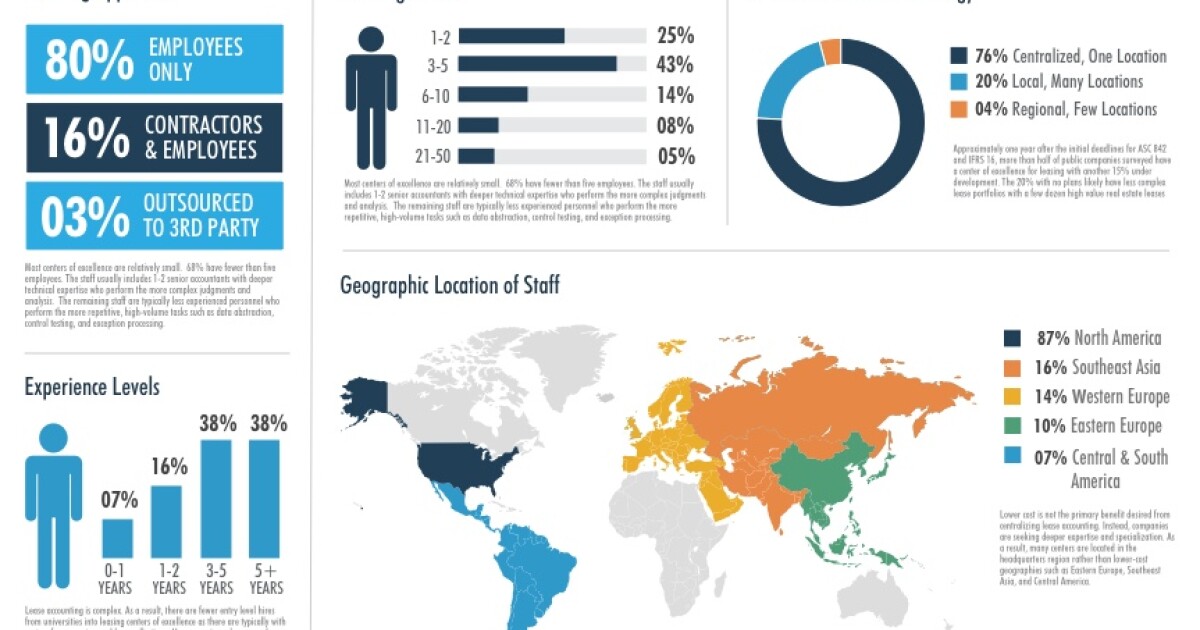

ASC 842, the new lease accounting standard, was adopted by most public companies at the start of 2019. Called by some experts "the biggest accounting change ever," the new leasing standards are moving trillions of dollars of leases onto corporate balance sheets and require significant changes to accounting systems, business processes and financial controls.

The new requirements have been no small undertaking, and a deep level of technical accounting expertise is required to apply the standards, which are documented in guides numbering over 1,000 pages in length and result in over 100 billion different possible use cases.

This may worth something:

FASB Proposes Improvements to Accounting for Contributed Nonfinancial Assets by Not-for-Profit

Examples of contributed nonfinancial assets include fixed assets such as land, buildings, and equipment; the use of fixed assets or utilities; materials and supplies, such as food, clothing, or pharmaceuticals; intangible assets; and/or recognized contributed services.

The proposed ASU would require a not-for-profit organization to present contributed nonfinancial assets as a separate line item in the statement of activities, apart from contributions of cash or other financial assets.

New State Features For Bonus Depreciation Available From Bloomberg Tax & Accounting

ARLINGTON, Va. , Feb. 10, 2020 /PRNewswire/ -- Bloomberg Tax & Accounting today announced an enhancement to its Advantage Fixed Assets software that addresses the challenges of bonus depreciation calculations for states whose rules do not conform with the Internal Revenue Code.

Since the introduction of bonus depreciation to the federal tax code in 2001, many states have disallowed this tax benefit either partially or in full. Bloomberg Tax & Accounting's new state bonus depreciation feature includes new state books and reports that manage the complexity of complying with state regulations by providing built-in state specific rules for the application of bonus, as well as calculations of federal-to-state modifications.

Art of Accounting: Content vs. issue tax return review disagreement | Accounting Today

There are two major types of tax return reviews: a content review and an issue review. The content review is where reviewers check all of the preparer's input. Basically they tick off what they see and tie in the entry with what the client provided, i.e., they tick and tie. The issues review is where the reviewer examines tax issues and tries to uncover planning opportunities.

I know a lot of accountants who will not abandon the ticking and tying because they say they do not want to make a mistake. Here is where we differ in goals. To them a mistake is where something the client gave us is entered incorrectly or not at all. To avoid this, they have their most qualified tax professionals recheck everything the low-level preparers do.

Sage Now Accepting Nominations for Second Annual Circle of Excellence Accounting Awards

TORONTO, Feb. 10, 2020 (GLOBE NEWSWIRE) -- Sage ( SGE.L ), the market leader in cloud business management solutions, is proud to announce today that following last year's successful launch, it's now welcoming nominations for the annual Sage Circle of Excellence Accounting Awards .

"We're thrilled to once again acknowledge the hard work and dedication so many of our accounting partners have shown to their profession, businesses, and communities," said Paul Struthers, EVP and Managing Director, Sage Canada. "The Circle of Excellence Awards celebrate some of the industry's greatest accomplishments and remind everyone of the tremendous difference these professionals make across Canada.

No comments:

Post a Comment