PASADENA, Calif., April 5, 2021 (SEND2PRESS NEWSWIRE) — KROST CPAs and Consultants , Los Angeles-based firm, receives two new accolades from Accounting Today, Top 100 Firms and Fastest-Growing Firms in the U.S.

New to the list, KROST, ranked No. 78, with an 80.08% change in revenue from last year. Additionally, the firm ranked No. 11 on the Regional Leaders on the West Coast which includes firms in California, Nevada, Oregon, and Washington. The average firm growth was 7.59%, which KROST surpassed with the highest percent change.

Quite a lot has been happening:

AI is creating a single source of truth | Accounting Today

Accounting firms need to increase their focus on technology; that's not new. But how technology and software companies are using artificial intelligence and machine learning within the accounting industry is new — and it's impacting accounting, tax and audit!

The audit space is a bit outside of my comfort zone, but I know that AI and ML are having a huge impact on the audit world. AI-powered technology can do a lot of the grunt work accountants do today to improve workflows at a much faster pace.

How Per Diem Payments Can Simplify Your Accounting and Taxes

Due to the current pandemic, business travel has decreased dramatically. No more large conferences, trade shows, or company retreats. But although travel has declined, it hasn’t stopped, and some industries like transportation and shipping have even seen a surge in demand from the massive uptick in online shopping.

Not only a record-keeping nightmare, business travel expense reports also don’t incentivize employees to be frugal with company money. As well, expense reporting can distract employees from their job by instead having to focus on documenting each expense. And, if employees don’t provide expense reports, they are responsible to pay tax on the money.

Art of Accounting: Don't be the holdup during tax season | Accounting Today

You are busy, as is your firm, and everyone you work with. Success is much easier when everyone works together and does their part. That means no one holds up anyone else. Here are some suggestions on how not to be the holdup.

During tax season (and also the rest of the year), everyone is part of the team. One person lagging or falling behind or not meeting their due date commitment holds back everyone else. Tax preparation needs smooth coordination between the admin staff, schedulers, preparers, reviewers and partners. Each person should be tasked with following up on missing information and making sure everything is moving as it should.

In case you are keeping track:

SEC accounting chief cautions on SPAC rush | CFO Dive

The newly popular IPO alternative is often completed in months, a short time frame that can make public compliance rules hard to met, a top federal official says.

Companies acquired by a special purpose acquisition company (SPAC) can expect to face an accelerated timeframe for going public, requiring them to ramp up reporting capabilities and internal controls quickly or risk compliance problems, the Securities and Exchange Commission's chief accountant said last week in a rare public statement.

Moving the audit into the future | Accounting Today

Using a task-based approach to audit is one way to position your firm so you're ready to move audit into the future. This approach will give your best and brightest team members the time and bandwidth to delve deeply into the services that machines can't perform. Let's take a look at how this model works.

The traditional model for audit has been the engagement team approach. But are you really leveraging the experience of your team? As an example, let's consider the tasks that are often part of an audit of cash:

Clues to Uncover Client Assets: Accounting Partners and the Form 1040 - Dividend.com

Putting clients' best interests first is no longer relegated to certain designations of financial professionals. With the passage of the Regulation Best Interest ('Reg B.I.'), nearly every FINRA -licensed professional has the mandate to operate in clients' best interests and helping them make tax-efficient decisions is one way to do just that.

Certified public accountants and enrolled agents are some of the most trusted and valuable partners for our own business – and they are for our clients, too. Strong relationships with accountants not only provide an important referral source for financial advisors but also enable us to serve clients better.

Illinois CPA Society honors 2020 Excel Awards recipients | Accounting Today

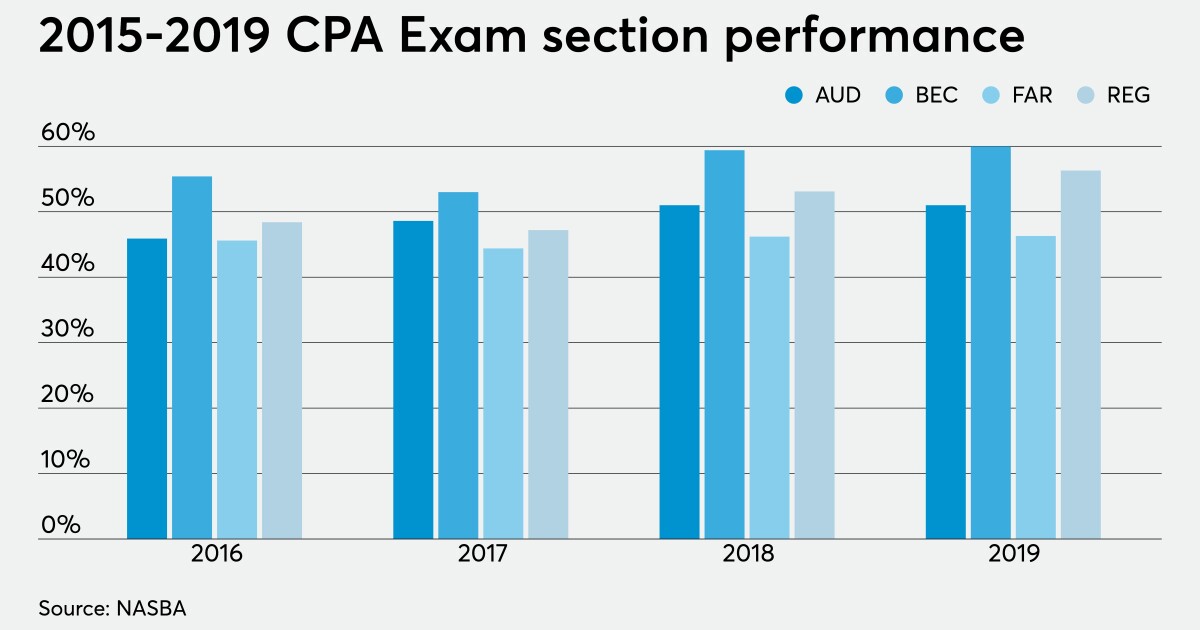

The Illinois CPA Society has announced the recipients of its 2020 Excel Awards, recognizing Uniform CPA Exam test-takers with the highest scores in the state.

Award winners must have a combined average score of 90 percent or higher on all exam sections within two consecutive testing windows, in addition to placing in the top 5 percent of all Illinois scores. The Gold, Silver and Bronze Medals, listed below, represent the top three scores in the state.

Happening on Twitter

Hundreds of food-based street vendors receive COVID-19 vaccine in South Los Angeles https://t.co/MsfPoiYvwp ABC7 Tue Mar 30 20:08:35 +0000 2021

@DenreleSonariwo expanded her Lagos-based art gallery Rele to Los Angeles by opening a new gallery there during the… https://t.co/hHGbqnEich CNNAfrica (from Africa) Sat Apr 03 16:08:27 +0000 2021

Right now, a lot of us can't even fly out of our own countries, but if Florida-based planemakers Aerion are to be b… https://t.co/lTPaVEBRoY cnni (from Everywhere) Tue Mar 30 17:00:24 +0000 2021

No comments:

Post a Comment