There are three tax brackets for long-term capital gains based on your total adjusted gross income. For 2020, the tax brackets look like this:

* * *

A couple making six figures in wages doesn't really have any room to take capital gains at 0% while they're working. But if they wait until retirement, when their work income drops to $0, they could theoretically realize capital gains up to $104,800 per year and pay absolutely no federal taxes on them. That number accounts for the $80,000 in the 0% long-term capital gains tax bracket and $24,800 for the standard deduction in 2020.

Other things to check out:

Greene County property tax: A software problem is why bills are late

Greene County property tax notices are being mailed out later than normal this year, despite state laws that set up a fixed timeline for getting the job done.

For example, the county clerk is supposed to have completed his portion of the process — calculating the taxes — no later than Oct. 31 . At that time, he hands the tax book (in digital form, these days) over to the county collector, and they send out the bills to property owners.

New Taxes Your Business Should Be Aware Of

New Jersey, home to facilities that process trades for stock exchanges like Nasdaq, is considering a cousin to the gross receipts tax, that is, a levy on securities transactions. The exchanges are now looking to leave the state. Texas and other states beckon.

It's Easier to Get a Tax Deduction for Donations This Year - The New York Times

Thinking of making a donation to a charitable cause before the end of the year? This is a good time to do it, as the pandemic rages again. Plus, you can take a deduction for contributions in 2020, even if you don't itemize on your income tax return.

Under the CARES Act, part of the federal government's pandemic relief program that passed in March, individual taxpayers can take a deduction of up to $300 for cash donations made in 2020 when they file their tax return in the spring.

Check out this next:

NY probes Trump consulting payments that reduced his taxes

NEW YORK (AP) — New York's attorney general has sent a subpoena to the Trump Organization for records related to consulting fees paid to Ivanka Trump as part of a broad civil investigation into the president's business dealings, a law enforcement official said Thursday.

The New York Times, citing anonymous sources, reported that a similar subpoena was sent to President Donald Trump's company by the Manhattan district attorney, which is conducting a parallel criminal probe.

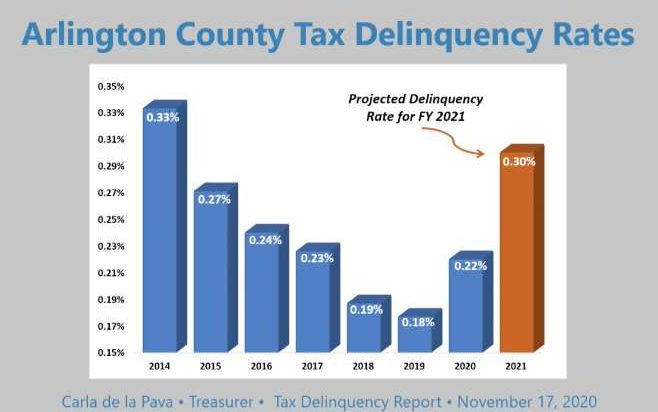

County Missing $10 Million in Delinquent Taxes Amid Pandemic | ARLnow.com

“As the pandemic unfolded, we got further and further from our goal, which was to be expected,” Treasurer Carla de la Pava told the County Board during its recessed meeting on Tuesday.

Delinquency rates had decreased by almost half since 2014, but COVID-19 erased two years of record-setting lows. The County is currently out nearly $10 million in uncollected tax revenue, de la Pava said.

For every 10,000 tax-paying residents and business, de la Pava had aimed to have only 17 fall behind, but when the collection year ended on Aug. 14, that proportion increased to 22. She told the County Board that next year, she predicts it will be “difficult, but achievable” to keep the rate under 30 delinquent residents and businesses per 10,000.

North Huntingdon taps fund balance to hold line on taxes for 2021 | TribLIVE.com

Property owners in North Huntingdon will not have to pay more real estate taxes in 2021 under a tentative budget that takes $1.14 million from the fund balance to cover a projected deficit.

The commissioners voted Wednesday to adopt a proposed $14.17 million general fund budget that maintains real estate taxes at 11.55 mills. Commissioner Jason Atwood, who cast the only opposing vote, said he believed more effort should be made to balance the budget without tapping into the fund balance.

The United States Needs a Value-Added Tax

No comments:

Post a Comment