Two dozen economists earned doctorates from Yale University in 1971. Janet Yellen was the only woman.

In 1997, Yellen was appointed Chair of the Council of Economic Advisers (CEA) by President Clinton. She was confirmed and was the first woman to hold the position.

In 2014, Janet Yellen was sworn in as chair of the Federal Reserve. She was the first female Federal Reserve chair.

Yesterday, Joe Biden announced he will nominate Yellen to serve as Secretary of the Treasury. If confirmed, Yellen would become the first woman to hold that position.

Other things to check out:

Subscribe to read | Financial Times

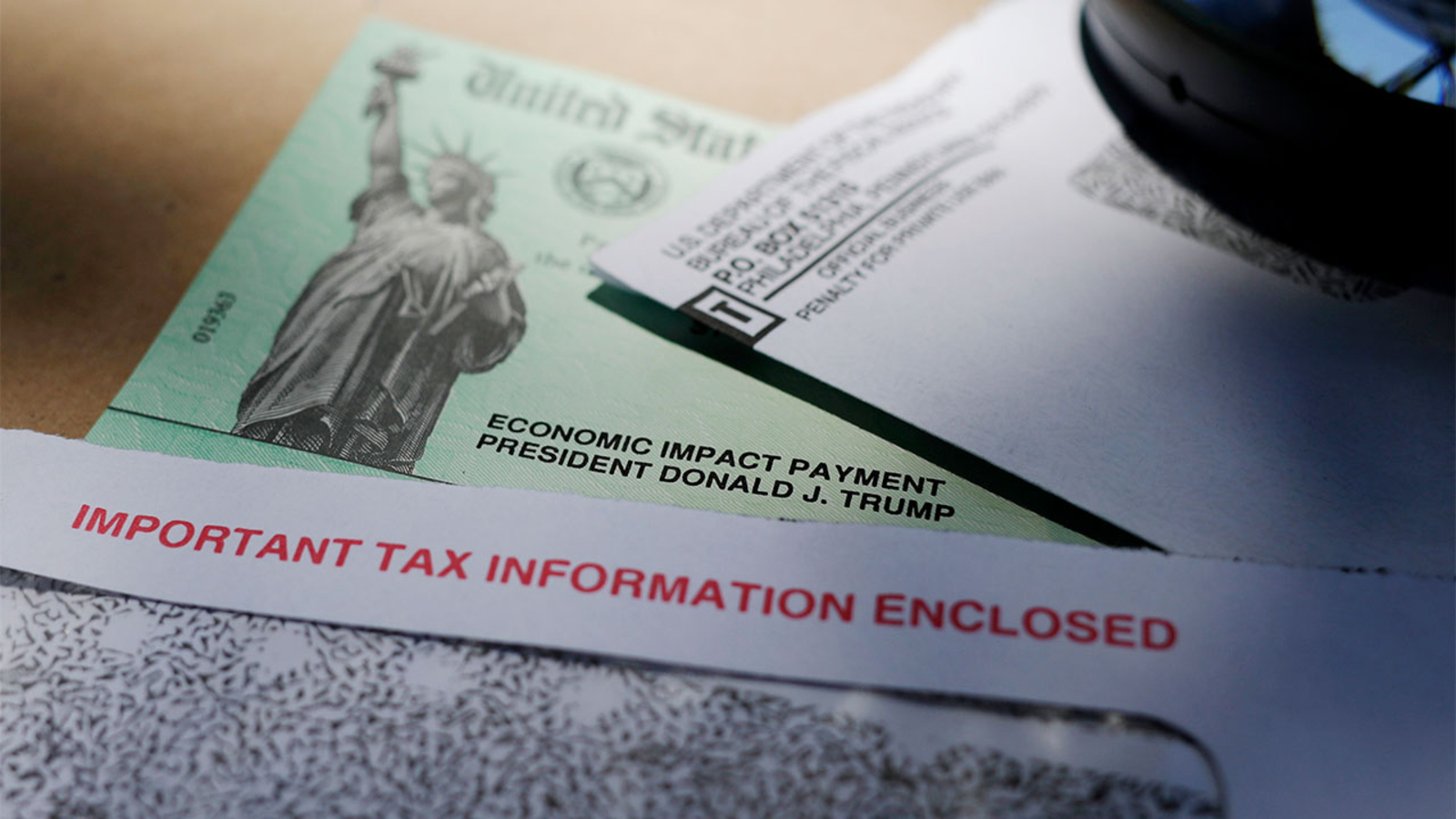

2nd stimulus: Top US economists urge lawmakers to issue another $1,200 COVID-19 relief payment -

NKU Economics Professor Earns National Recognition | The River City News

Dr. Abdullah Al-Bahraini received the Kenneth G. Elzinga Distinguished Teaching Award from the Southern Economic Association, a national recognition for contributions to economics education.

Al-Bahraini is the director of the Center for Economic Education (CEE) and an associate professor of economics at the Northern Kentucky University Haile/US Bank College of Business.

And here's another article:

Coffee And Economics: Making Sense Of Remarkable Times - Finance and Banking - Canada

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Free, unlimited access to more than half a million articles (one-article limit removed) from the diverse perspectives of 5,000 leading law, accountancy and advisory firms

* * *

You'll only need to do it once, and readership information is just for authors and is never sold to third parties.

Hyperinflation and Rent Controls - 2020's Telltale Signs of Economic Distress Haunts Many

If history serves us well, 2020 is likely a precursor to a long and dreadful economic depression throughout a myriad of countries worldwide. During the last year, economists and analysts have been discussing how specifically the United States economy and the U.S. dollar are losing global dominance quite rapidly. While a few analysts believe the old adage “it could never happen here,” many economists expect the increase of rent controls and hyperinflation to ravage the U.S.

The coronavirus outbreak was a great excuse for the world’s banking cartel to mint more promissory notes than any other time in history. In the U.S., Americans have seen $9 trillion in stimulus injections, but the Federal Reserve’s 2020 pump has barely stirred the masses. Estimates say, in 2020 alone, the U.S. has created 22% of all the USD issued since the birth of the nation.

Premarket stocks: Vaccine progress is trumping bad economic news - CNN

2021 housing market: It's about politics, not economics - HousingWire

Last April, we released the first of our series of monthly housing market forecasts. Our forecasts generally followed a "Flying W" shape, with an initial sharp drop this spring, a noticeable rebound in the summer followed by another dip in the fall, and finally, a stable road to recovery sometime in 2021. These forecasts have been based on assumptions that – because of a split congress – protective economic policies would be hard to come by.

Unfortunately, a third wave is upon us at a time of peak political division in the country. The protections for U.S. households and support for financial markets are set to expire at the end of the year, congress is split, and the outgoing administration is sending signals they are going to let next year's congress and administration sort out a new relief package. Our forecasts below reflect the political uncertainties concerning a renewed relief legislation.

No comments:

Post a Comment