Not to change the topic here:

Greece to cut taxes for remote workers in post-covid recovery effort

LONDON — Greece has introduced new tax incentives in an effort to attract those working from home as it looks to rebuild its battered economy.

Anyone moving to Greece in 2021 will not have to pay income tax on half of their salary for the next seven years, whether salaried or self-employed. The only catch is that it won't apply to people who have been a tax resident in Greece for seven out of the past eight years.

"We are targeting companies that want to open offices in Greece due to Brexit , Greeks abroad who want to return to Greece, digital migrants or tech companies; anybody or any company that wants to open (an) office in Greece," Alex Patelis, economic advisor to the Greek prime minister, told CNBC on Thursday.

Here are some easy ways to reduce taxes in retirement

Investing and withdrawing retirement funds in a tax-efficient way is among the top ways financial advisors can boost returns for clients, according to an analysis published by researchers at Morningstar.

Doing so can boost retirement income by more than 4%, they found. In other words, a retiree could have an extra $4 for every $100 of income if certain tax strategies are implemented.

More from Advisor Insight:

Here's how to handle an unexpected windfall of money

This tax strategy can keep Medicare premiums in check

It's legal to give bad financial advice. New SEC protections may not help much

Unemployment taxes won't rise as SC pays out millions weekly

COLUMBIA, S.C. (AP) — Although the recession brought on by the coronavirus pandemic has strained South Carolina's unemployment trust fund, the state won't raise unemployment taxes on most businesses next year, Gov. Henry McMaster announced Thursday.

Instead, the state legislature has replenished the fund through $920 million of federal pandemic aid to keep tax rates at their current levels, and state leaders are urging South Carolinians who have lost their jobs in the pandemic to get back to work sooner than later.

And here's another article:

Taxes: Will you pay more under Biden? Probably not - CNNPolitics

Preliminary budget looks to keep taxes flat | News, Sports, Jobs - Leader Herald

GLOVERSVILLE — City officials continued to discuss the $18.08 million preliminary 2021 city budget this week that would keep property taxes flat while a public hearing on the budget yielded no comments from residents.

The Common Council on Tuesday held a public hearing on the preliminary 2021 city budget planning to enact the budget at a future meeting. Under city law the council has until Dec. 10 to adopt the annual budget.

Budget Holes Loom After Voters Reject Some Tax Hikes | The Pew Charitable Trusts

After voters last week rejected his signature tax proposal — which he promoted with $58 million from his own pocket — Illinois’ governor was blunt.

* * *

The proposed constitutional amendment, approved for the ballot by Illinois lawmakers, would have created a graduated income tax with higher rates for wealthier residents, bringing in an estimated $3.4 billion in one year for the state. It needed 60% voter approval to pass but got 55%.

Best & Worst State Income Tax Codes | Tax Foundation

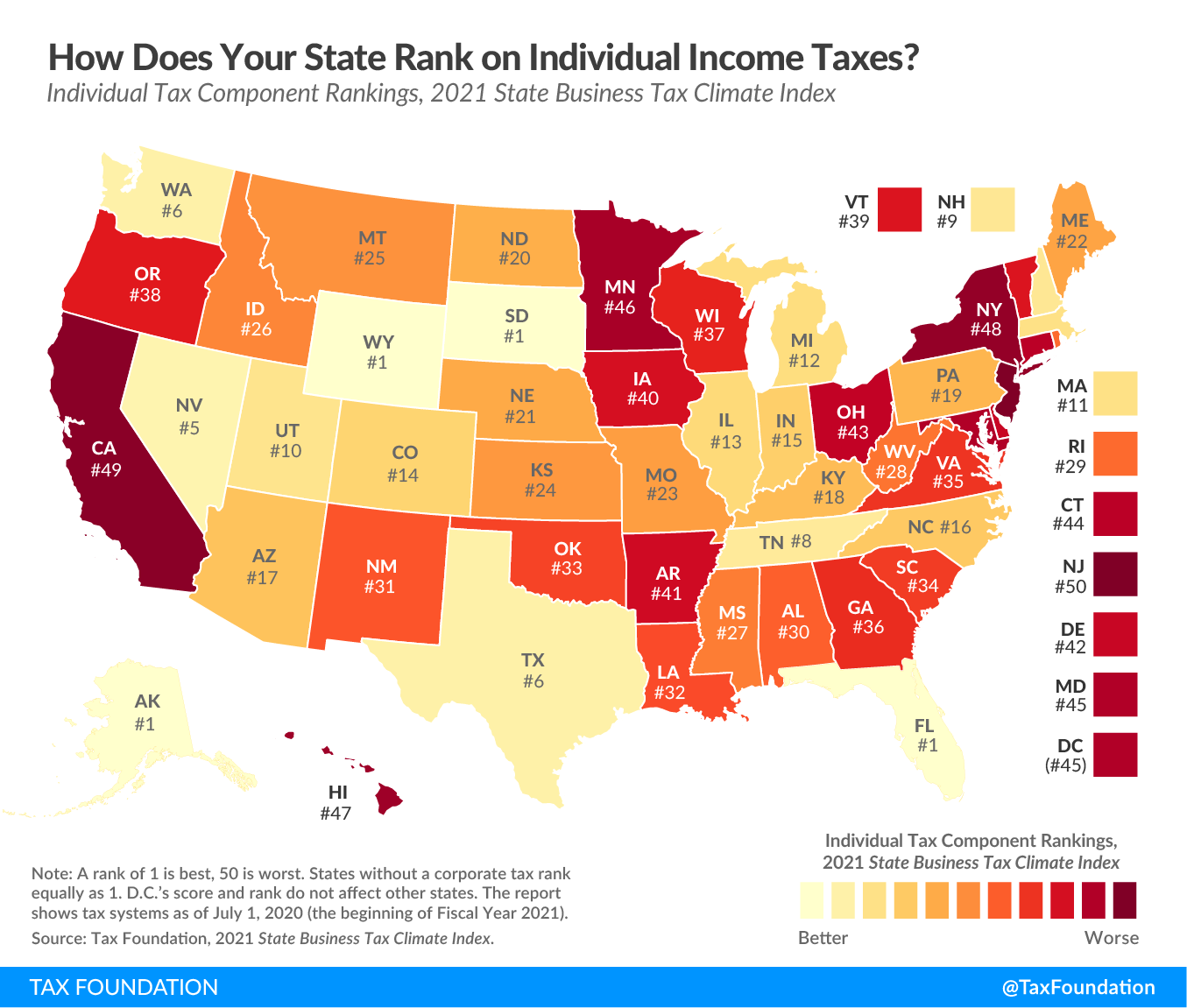

This week's map examines states' rankings on the individual income tax component of the 2021 State Business Tax Climate Index . The individual income tax is important to businesses because states tax sole proprietorships, partnerships, and in most cases limited liability companies (LLCs) and S corporations under the individual income tax code.

States that score well on the Index 's individual income tax component usually have a flat, low-rate income tax with few deductions and exemptions. They also tend to protect married taxpayers from being taxed more heavily when filing jointly than they would be when filing as two single individuals. In addition, states perform better on the Index 's individual income tax component if they index their brackets, deductions, and exemptions for inflation, which avoids unlegislated tax increases.

Happening on Twitter

Economists at Deutsche Bank have proposed making staff pay a 5% tax for each day they choose to work remotely. Sh… https://t.co/a8eYSbThVi talkRADIO (from United Kingdom) Thu Nov 12 15:48:10 +0000 2020

Should you pay higher taxes because you work from home? https://t.co/iS06p2ytyw CNNBusiness (from Global) Thu Nov 12 15:22:03 +0000 2020

No comments:

Post a Comment