Were you following this:

Georgia Senator David Perdue Privately Pushed for a Tax Break for Rich Sports Team Owners –

Sen. David Perdue, R-Ga. , privately pushed Treasury Secretary Steve Mnuchin to give wealthy sports owners a lucrative tax break last year, according to a previously unreported letter obtained by ProPublica.

After the 2017 tax bill championed by President Donald Trump passed, Mnuchin and the Treasury had to write rules on how the legislation would work in practice.

Of the hundreds of pages of new regulations the agency developed, Perdue wrote about his concern with one extremely narrow rule: The owners of professional sports teams were being excluded from a valuable tax break being granted to many other businesses that are structured so that the companies don't pay taxes but the owners do.

IRS Issues Final Regulations On Income Tax Withholding On Certain Periodic Retirement And Annuity

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

* * *

Position Please select Position CEO, Owner, Chairman, President, Mng Director Director, Vice President, Senior Company Executive Inhouse Counsel, Lawyer in Company/Government CFO/FD, Inhouse Accountant, Treasurer Corporate/Company Secretary, Compliance Officer Lawyer in Law Firm, Private Practice, Barrister Consultant, Accountant in Accountancy Firm, Practicing Accountant Banker, Stockbroker, Analyst, Economist Marketing, Business Development Editor, Journalist,

Aberdeen Standard Global Infrastructure Income Fund Announces Record Date and Payment Date for

Under U.S. tax rules applicable to the Fund, the amount and character of distributable income for each fiscal year can be finally determined only as of the end of the Fund's fiscal year. However, under Section 19 of the Investment Company Act of 1940, as amended (the "1940 Act") and related Rules, the Fund may be required to indicate to shareholders the source of certain distributions to shareholders.

The following table sets forth the estimated amounts of the sources of the distribution for purposes of Section 19 of the 1940 Act and the Rules adopted thereunder. The table has been computed based on generally accepted accounting principles.

Were you following this:

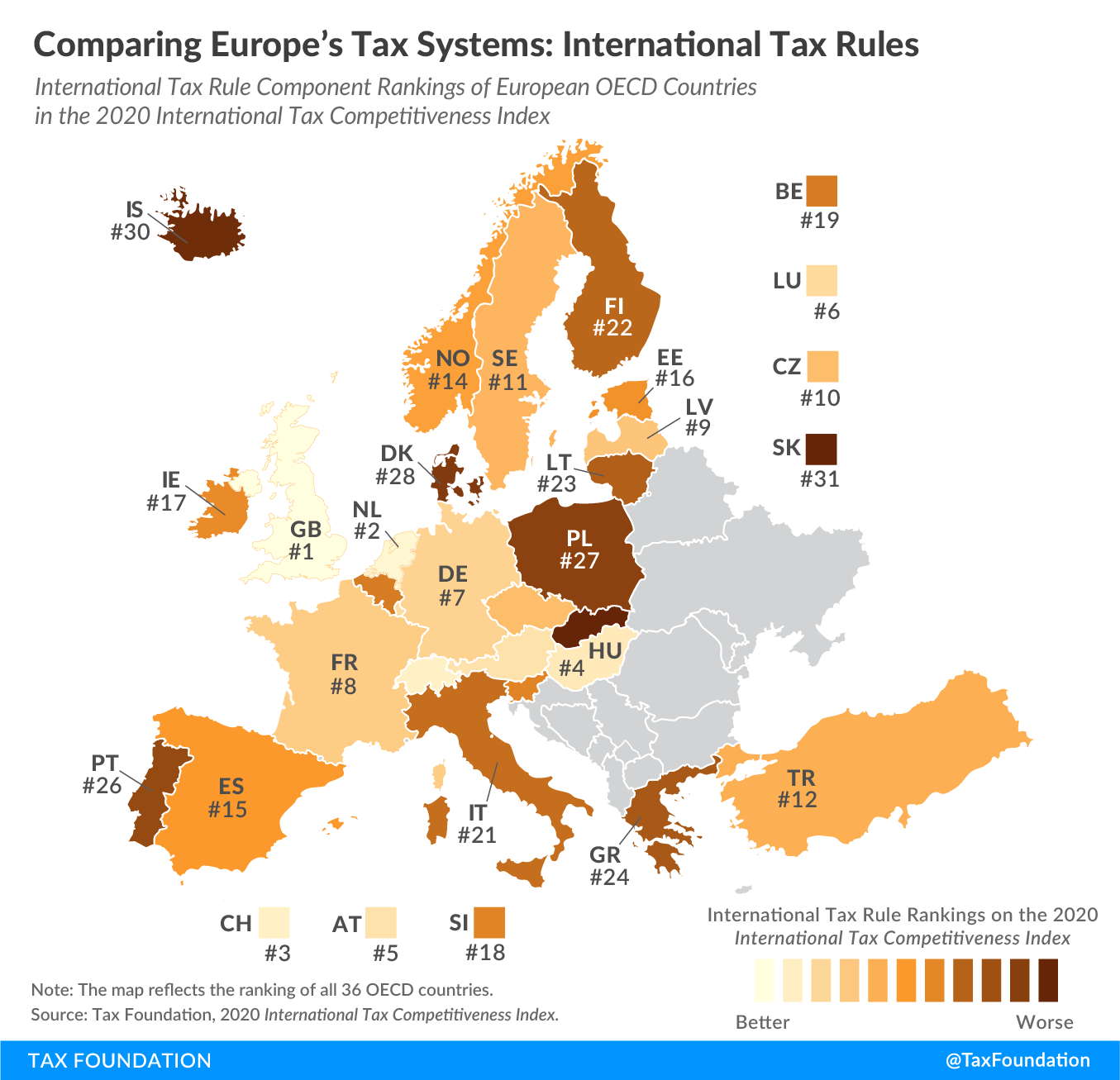

Comparing Europe's Tax Systems: International Tax Rules

Today's map looks at how European OECD countries rank on international tax rules and is the last in our series examining each of the five components of our 2020 International Tax Competitiveness Index ( ITCI ) . International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country's tax code.

The ITCI 's international tax rules component compares various aspects of OECD countries' international tax systems, namely territoriality, withholding taxes, tax treaties, and international tax regulations such as controlled foreign corporations (CFC) rules and thin-capitalization rules.

Final regs. govern computation of UBTI for separate businesses - Journal of Accountancy

The IRS posted an advance copy of final regulations that provide guidance on how an exempt organization subject to the unrelated business income tax (UBIT) determines if it has more than one unrelated trade or business ( T.D. 9933 ). The regulations also discuss how an exempt organization calculates unrelated business taxable income (UBTI) if it has more than one unrelated trade or business.

* * *

Under Sec. 512(a)(6), enacted by the law known as the Tax Cuts and Jobs Act, P.L. 115-97, tax-exempt organizations subject to tax on UBTI must calculate UBTI separately for each business — or "silo" revenue and expenses for each separate business.

Three Years of Opportunity Zones and Outlook for 2021

New Regulations Impact Excise Tax on Certain Private College and University Investment Income |

Internal Revenue Code section 4968, enacted as part of the 2017 Tax Cuts and Jobs Act, imposes a 1.4 percent excise tax on the net investment income of certain private colleges and universities. The U.S. Treasury Department issued final regulations effective Oct. 14, 2020, that addressed multiple comments received on the previously issued proposed regulations. The final regulations also made multiple modifications to key definitions that impact the implementation of this new excise tax.

Happening on Twitter

NEW at SCOTUS: Court denies request to restore safety procedures at Texas prison housing elderly inmates that has b… https://t.co/XDAWhhtqyj stevenmazie (from Brooklyn, NY) Mon Nov 16 20:20:48 +0000 2020

No comments:

Post a Comment