WASHINGTON — With congressional negotiations stalled over a new round of pandemic aid, President Trump has floated the idea of once acting alone to stimulate the economy before the November election.

But Mr. Trump's initial attempts to unilaterally bolster the economy show the limitations of the president's ability to deliver financial help without Congress.

The fizzling of the payroll plan is the most prominent example of the difficulties Mr. Trump has encountered in trying to stimulate the economy while bypassing Congress. Another of his executive actions, to repurpose disaster funds to create a temporary lift in unemployment benefits, has quickly lost steam: Federal officials told states this week that the benefits would run out after six weeks for workers.

Quite a lot has been going on:

Letters: Override would mean higher property taxes | Your Valley

Last November, Dysart Unified School District's override was rejected by voters with 57% voting "no."

* * *

Our commitment to balanced, fair reporting and local coverage provides insight and perspective not found anywhere else.

The override funding currently in place from the 2015 Override election is still in place at 100% through the 2020-2021 school year. That funding will begin to phase out over the next two years — by one-third in the sixth year and two-thirds in the seventh year.

How Biden's Tax Plan Would Affect Five American Households - WSJ

The Tax Moves Day Traders Need to Make Now - WSJ

If you're one of the millions of day traders who have jumped in and out of markets this year, check your taxes now. Being a taxpayer may not be top of mind, but not paying attention could dent your bottom line next April.

Many things are taking place:

Order Gives Employees Social Security Withholding Tax Deferral, Not Forgiveness > U.S.

President Donald J. Trump signed an executive order on August 8 that allows employers to defer withholding Social Security taxes.

However, it's a payroll "deferral," not payroll "forgiveness" — meaning it's a temporary change, and service members and Defense Department civilians have to pay that money in 2021.

Internal Revenue Service officials said the Presidential Memorandum defers the employee portion of Social Security taxes. The Social Security tax is set for employees by law at 6.2 percent.

Biden vows to hike corporate taxes on 'day one' of his presidency | Fox Business

FOX Business' Edward Lawrence breaks down and adds context to presidential candidate Joe Biden's comments on coronavirus economic recovery.

Democratic presidential candidate Joe Biden pledged to raise the tax rate that corporations pay on "day one" of his presidency, regardless of the nation's unemployment rate.

* * *

"I'd make the changes on the corporate taxes on day one," he told CNN's Jake Tapper on Thursday when asked whether he would wait for joblessness to decline.

Average Cedar Park homeowner will pay $32 more in taxes in approved budget - News - Austin

The average homestead property in Cedar Park has increased in taxable value by 2% from $333,238 in fiscal year 2020 to $340,361 in fiscal year 2021.

The City Council on Thursday approved a lower tax rate of 44.69 cents per $100 valuation. The current tax rate is 44.7 cents per $100 valuation.

Under the new tax rate, the average homeowner will pay $1,521. The average homeowner paid $1,489 last year.

"The theme of the budget is ’Home is where the Heart Is,’ inspired by the circumstances created by the COVID-19 pandemic – in which stay home work safe orders caused many people to reprioritize and refocus on home, family and community," said City Manager Brenda Eivens.

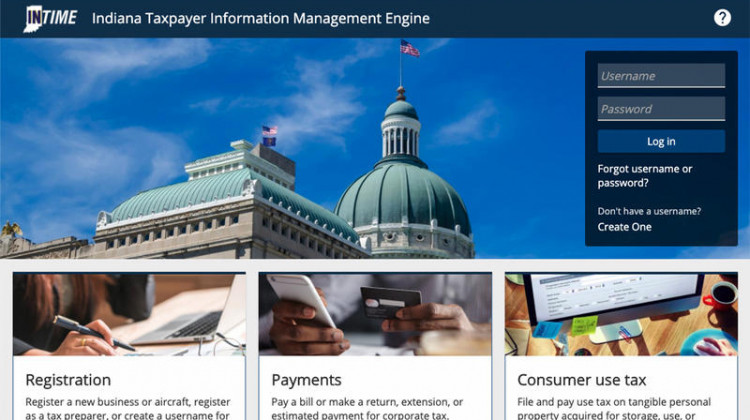

Hoosiers Businesses Able To Easily File, Pay Taxes On State Web Portal

The availability of INTIME for business customers is phase two of a four-year overhaul of the Indiana Department of Revenue’s technology.

Indiana businesses can now easily file, pay and manage their state taxes online in a web portal – INTIME – set up by the Indiana Department of Revenue.

* * *

This second phase allows sales and withholding taxes to be filed and paid online, which account for more than half of the state’s annual revenue. More than 200,000 customers can also manage any tax letters and notices in one location and easily communicate with Department of Revenue staff.

Happening on Twitter

This is Trump saying he's going to defund Social Security. With a $2 trillion deficit, there is no extra money to t… https://t.co/BtwclxAQcM aravosis (from Washington, DC) Fri Sep 11 02:24:22 +0000 2020

Add another employer that will not be implementing Trump's payroll tax deferral: The House of Representatives. "I… https://t.co/LCJxL6uYYu jimtankersley (from Washington, D.C.) Fri Sep 11 14:26:43 +0000 2020

Truth. Because Trump froze Social Security payroll tax, SS reserves will be entirely depleted by 2023. Chief Actu… https://t.co/XHGEjnAj3y DrEricDing (from Washington DC & Virginia) Fri Sep 11 02:51:29 +0000 2020

No comments:

Post a Comment