Sep 18, 2020 — A decision by New Jersey leaders to raise taxes on that state’s wealthiest residents has provided new hope to advocates who want to tax the rich in New York. But Governor Andrew Cuomo and his budget director are throwing cold water on that proposal.

New Jersey’s top tax rate for those making between 1-5 million dollars a year will rise to 10.75% . That rate already applied to people making over five million dollars a year.

And here's another article:

Tax Strategies to Embrace, or Avoid, Before the November Election - The New York Times

In unpredictable times, the desire to create a better tax strategy becomes more urgent, but that could result in some regrettable changes to perfectly good plans.

For example, many advisers counseled their wealthy clients in 2012 that the estate and gift taxes exemptions were going down and that the rates on those taxes were going up . But the opposite happened the next year, and people who had given away more than they might have otherwise were caught off guard.

Chicago suburbs warn ComEd: It's time to pay up on local utility taxes - Chicago Tribune

Already caught up in a high-profile federal bribery scheme , Commonwealth Edison is embroiled in an escalating fight with dozens of cash-squeezed Chicago suburbs that are demanding the power company deliver millions of dollars in utility taxes the communities say they are owed.

"The longer that it keeps going, the more revenue that we're out," said Chicago Heights Mayor David Gonzalez.

Generalities not enough to raise taxes on | Opinion

With due respect for their intentions, the advocates for passage of the Children's Services Council fail to make a persuasive case. No advocate has offered more than what logic professors call "glittering generalities" in support of their advocacy.

What exactly is a tax levied for the "preventive, developmental and rehabilitative services for children" specifically supposed to accomplish? And by what metric do we measure the success or failure of that accomplishment? Moreover, how do those general goals differ from those of any other agency dedicated to the welfare of children?

Many things are taking place:

King County property taxes will be due Nov. 2; no COVID-19 extension this time | The Seattle Times

King County property owners who pay their property taxes themselves, rather than through mortgage lenders, must pay their taxes for the second half of 2020 by Nov. 2, the county announced Friday.

* * *

"Many homeowners are facing extraordinary financial challenges during this public health emergency," King County Executive Dow Constantine said at the time, issuing an emergency order he said would provide “short-term relief.”

The talk about deferred payroll taxes

I've mentioned in this column before I enjoy teaching the "Real Money. Real World." program in our local high schools. It is very eye-opening for these students to see just how quickly our expenses add up each month. And another impressionable day is dissecting paycheck withholdings. The students watch their earnings shrink smaller and smaller with every line of federal, state and local taxes, FICA/ Social Security and Medicare, and health insurance costs.

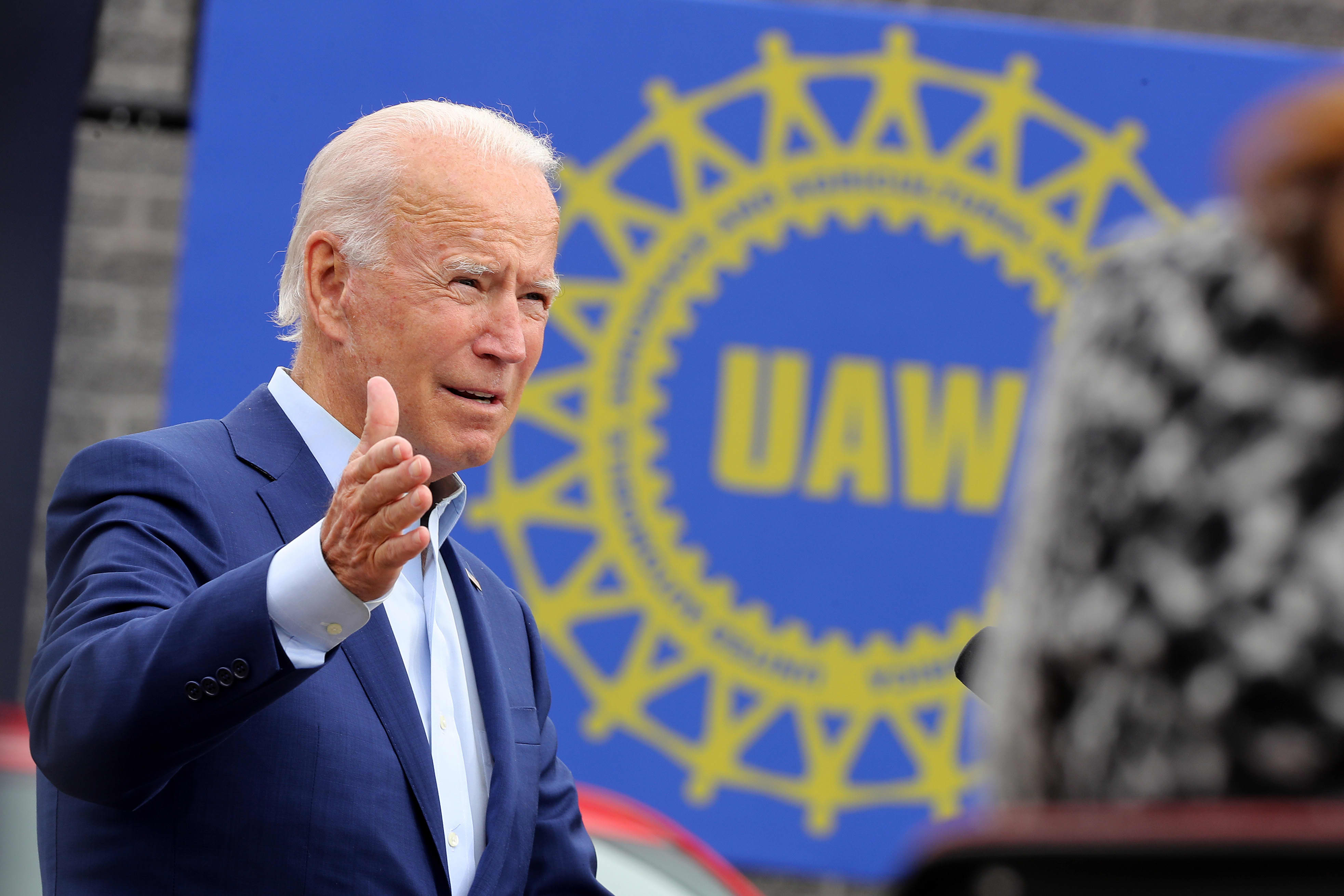

Claim linking Joe Biden to Social Security taxes is misleading

Posts widely shared on social media suggest that Joe Biden is responsible for taxes on Social Security in 1983. Those posts mislead on the details. The posts also twist Biden’s proposals on retirement contributions.

Biden was one of 88 senators who voted for a bipartisan bill in 1983 to tax up to 50% of Social Security for beneficiaries with income above a certain threshold. That vote came at a time when the Social Security trust fund for retirement benefits was running out of money. This was after a Reagan-led commission issued a report that formed the basis for amendments to the Social Security program.

Wall Street Democrat Roger Altman on Biden's capital gains tax plan

Wall Street Democrat Roger Altman said Friday that long-term investors would not be deterred by Joe Biden's plans to raise the capital gains tax rate if he defeats President Donald Trump in the November election.

Biden, the Democratic nominee, has proposed increasing the tax on long-term capital gains to 39.6% — the same top rate he has proposed for ordinary income — for those making over $1 million, according to the Tax Foundation . At present, the rate is 20% for single households who have taxable income over $441,451.

No comments:

Post a Comment