The IRS issued proposed regulations (REG-132766-18) on July 30 related to simplified tax accounting rules for small businesses and updating various tax accounting regulations to adopt the simplified rules enacted by the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, under Secs. 448, 263A, 460, and 471. The proposed regulations apply to taxpayers that have inflation-adjusted gross receipts of $26 million or less.

The simplifications provided for under the TCJA include a few main provisions, such as: (1) allowing small businesses to use the cash method of accounting instead of the accrual method, even if they have inventory (Sec. 448(c)); (2) not requiring capitalization of additional uniform capitalization (UNICAP) costs to inventory (Sec.

Check out this next:

Trump tax moves stir questions about potential legal exposure | Accounting Today

Deductions for haircuts, consulting fee write-offs, a family estate that is treated as a business property and an aggressive refund claim could open President Donald Trump to legal risks once he's out of office.

If the Internal Revenue Service ultimately prevails, Trump could be liable for millions of dollars in penalties. He potentially could be subject to criminal prosecution if the IRS mounted a case that he knowingly violated the law, though that would be very difficult to do, according to tax professionals.

Clutch Announces the Top 10 Accounting Firms in Philadelphia

The following 10 firms are recognized as market leaders in Philadelphia for accounting, payroll, and bookkeeping services.

* * *

"Proper accounting, payroll, and bookkeeping are crucial for organizations of all sizes. Our research indicates that clients prefer to work with local accounting firms, as evidenced by the popularity of the search term, 'accountants near me' in Google searches," said David Goosenberg , business development analyst at Clutch. "Each of these firms has excelled at delivering quality financial services to Philadelphia -based B2B clients in a variety of industries."

Citi taps Morgan Stanley exec as new controller, accounting chief | Banking Dive

Citi named Johnbull Okpara its new controller and chief accounting officer, the bank announced Friday in a regulatory filing . Okpara replaces Jeff Walsh, who stepped in from retirement in February to serve in the interim role after Citi's former chief accountant, Raja Akram, left the bank.

Okpara is managing director and global head of financial planning and analysis and CFO for the infrastructure groups at Morgan Stanley — the same bank to which Akram left Citi in February to become deputy CFO .

This may worth something:

CAS you like it | Accounting Today

There are generally two kinds of articles about client accounting services: The first marvels at their explosive growth as a service line over the past several years, and the second aims to explain what, exactly, CAS is.

That the fastest-growing accounting firm service in decades should also be a bit of a mystery may seem odd, it's easily explained by the fact that CAS is different for every firm that offers it. And that is one of its most attractive features.

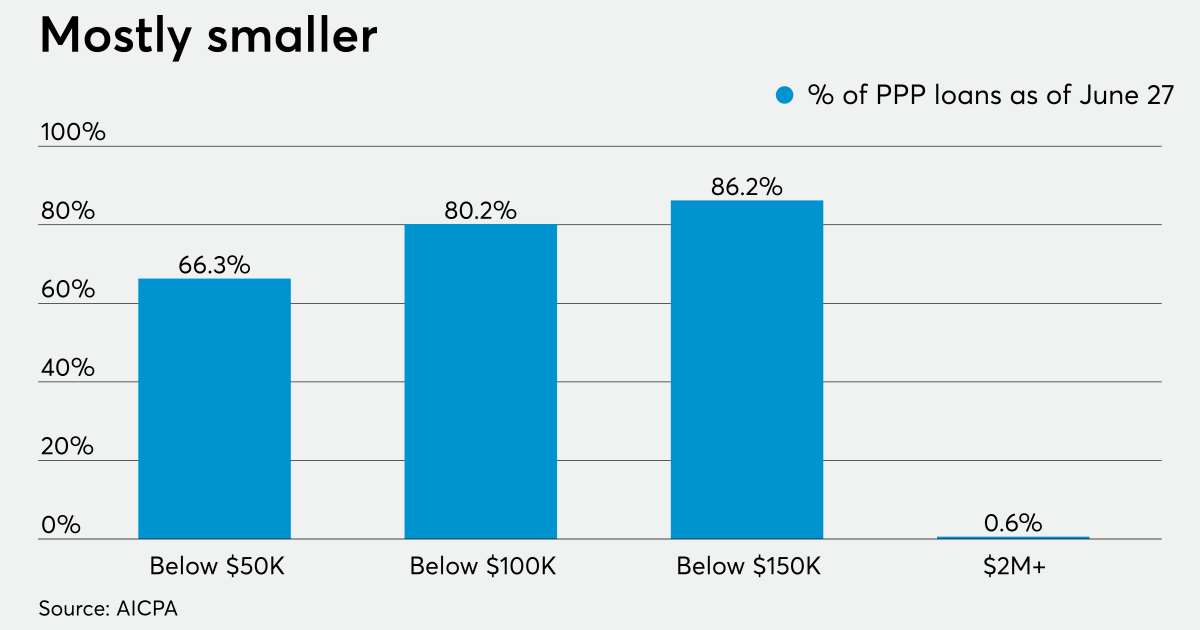

Building a PPP practice | Accounting Today

As soon as the CARES Act was passed through Congress on March 27, firms like New York City-based Top 100 Firm Prager Metis sprang into action.

"When COVID hit, when the first PPP act was signed into law, the firm proactively set up a crisis management group," explained Robert Mayer, practice leader of the CFO advisory services group. "It fell under my responsibility, within client advisory services, and [legislators] added to it as we read through the first law. Changes to the tax program needed to be done and considered. We began the process of beginning to figure out how to address it."

Paving the ramp for a smooth exit | Accounting Today

If your business clients are like the rest of America's small-business owners, they are probably getting to the point where planning their exit from the business is a good idea. Enter 2020 and the COVID-19 pandemic, and business sentiment is all over the place. Some are thriving like never before, and some whose trajectory hasn't been positive for years have been accelerated into retirement, selling or failure.

In general, we all know that it is best to plan an exit from a business for about five years before your desired date to be out. Sometimes the best laid plans do not come to fruition, so we must also talk about the contingency planning that may be needed in case your client does not reach the exit ramp. The best way to start this conversation with your best clients is with a few good questions.

Accountants favor Trump in election by large margin | Accounting Today

Accountants favor Donald Trump in the upcoming presidential election by a large margin, according to a recent survey — and regardless of who they're voting for, they expect the state of the country and the economy to improve significantly after Nov. 3.

In a survey of over 400 accountants from across the country conducted by Arizent, the publisher of Accounting Today , 55 percent of respondents said that they plan to vote for the incumbent president, against 38 percent who plan to vote for his rival, Democrat Joe Biden. ( See the data, below. )

Happening on Twitter

One thing I wish could cut through the noise: Trump regularly stiffed workers and small business owners who did wor… https://t.co/uOyXwORrvN briankoppelman (from New York) Mon Sep 28 01:50:41 +0000 2020

No comments:

Post a Comment