The IRS has made clear it's not extending the tax filing deadline past July 15. But if you still need more time to get your return in, filing for an extension is quick and straightforward.

As in previous years, filing for an extension gives taxpayers until October 15 to get their tax return in.

You can file an extension via commercial tax software, IRS Free File or even by physically mailing in Form 4868. The IRS strongly encourages people to file electronically, and offers a number of ways to do so via its website. If you typically use a tax preparer to file your returns, your preparer can also file an extension on your behalf.

Were you following this:

Stimulus check: Do you have to pay tax on the money? - CBS News

The majority of people who qualify for a stimulus check have already received their direct deposits, paper checks or prepaid debit cards. But the payments — $1,200 for most single earners and $2,400 for most married couples — have raised plenty of questions about how they'll impact taxes.

Chief among those is whether the payments, which are designed to help families weather the economic hit from the coronavirus pandemic , are subject to income taxes. In other words, should people set aside a chunk of the payment to pay the IRS when they file their 2020 tax returns?

Unemployment taxes could nearly triple by 2022 in Washington due to COVID | The Seattle Times

Employers in Washington could see sharp increases in unemployment taxes starting next year as the state confronts the unexpected costs of hundreds of thousands of layoffs during the pandemic.

By 2022, taxes that employers pay to cover state jobless benefits could rise to an average of $936 per worker. That’s almost three times the expected 2020 figure of $317, according to preliminary figures released Thursday by the state Employment Security Department (ESD).

Retirees, Beware These Tax Traps on Social Security and Medicare - Barron's

Medicare has a series of income limits that trigger increasingly higher payments for retirees. And it's not just the rich who are affected. Brickman's 2018 modified adjusted gross income of $163,414—derived from a combination of required minimum distributions, Social Security, and her husband's pensions—was just enough to put her in the second-highest Medicare bracket (which begins at $163,000) and drive up her premium this year.

Retirees face multiple income traps like the one Brickman fell into. Lower- and middle-income retirees get hit by the so-called tax torpedo, as rising income causes their Social Security benefits to be taxed. The result is marginal tax rates as high as 40.7%. There is also a Medicare surtax of 0.9% on couples with taxable income topping $250,000, and capital-gains taxes increase as incomes rise, among others.

In case you are keeping track:

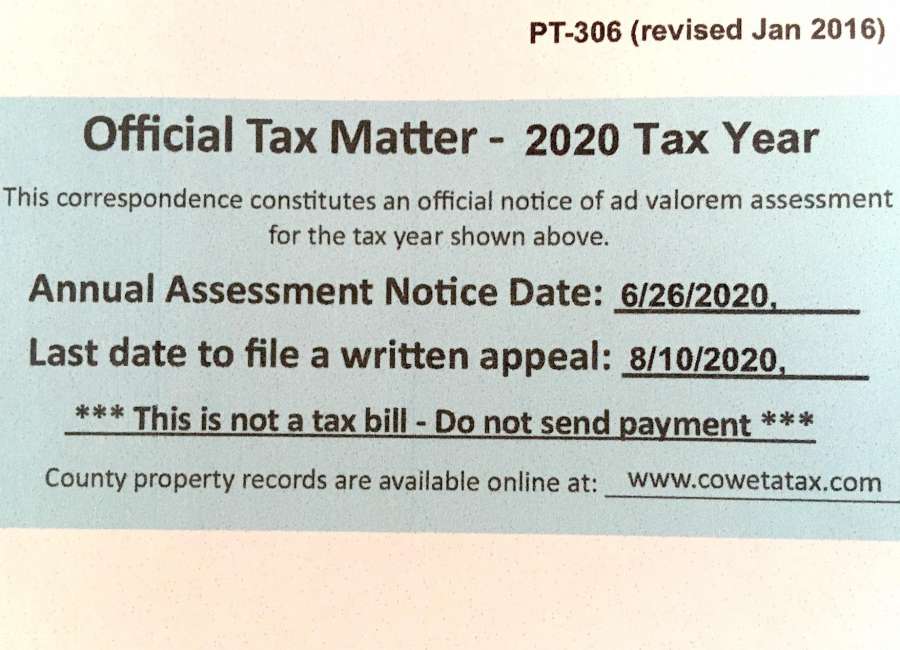

Property values skyrocket – but taxes haven't been set - The Newnan Times-Herald

Some Cowetans got an unwelcome surprise in their mailbox this week – assessment notices showing significant increases in their property's tax valuation – sometimes tens of thousands of dollars or more. The assessment notices don't go into detail of what makes up the value – the value of the structure, of the land and of accessories.

Be in the know the moment news happens

Every state with a progressive tax also taxes retirement income

Illinois could be the next state to tax retirement income if voters approve the progressive income tax in November.

States with progressive income taxes are not friendly places for retirees: Each of them also taxes retirement income.

All 32 states with a progressive income tax impose some sort of tax on retirement income from 401(k)s, IRAs, Social Security and pension benefits. Mississippi limits its retirement taxes to the income of those who retire before age 59.5.

Home deliveries don't get food-tax exemption during pandemic | Govt-and-politics |

New Mexico Gov. Michelle Lujan Grisham speaks about the uptick in confirmed COVID-19 cases in the state and her decision to hold off on opening more of the economy during a news conference at the state Capitol on Thursday, June 25, 2020.

A panel of government income experts including Taxation Secretary Stephanie Schardin Clarke noted the problem as they delved into the financial consequences of COVID-19 and New Mexico's stay-at-home order to avoid infections. The pandemic is wreaking havoc on public finances in state and local government.

Will mom have to pay taxes after a Roth IRA conversion? - nj.com

She had a choice to put the funds into her own IRA or she could have established an inherited IRA.

* * *

If she rolled her husband's IRA into her own IRA, then she's good to convert, said Jeanne Kane, a financial planner with JFL Total Wealth Management in Boonton.

But if she put the funds directly into an inherited IRA, she can't do the conversion from that account.

To convert, your mom would pay ordinary income taxes today and then never has to pay taxes on her withdrawals again, assuming that she meets the five-year rule, Kane said.

Happening on Twitter

How to file for an extension on your taxes https://t.co/ix3TzOlvbR CBSNews (from New York, NY) Thu Jul 02 23:59:42 +0000 2020

#IRS: File and pay your taxes by 7/15. You can request an automatic extension of time to file until 10/15 if you ca… https://t.co/Vx1mOxyYWK IRSnews (from Washington, D.C.) Wed Jul 01 12:45:05 +0000 2020

No comments:

Post a Comment