Phil Knight, co-founder and chairman of Nike, attends the annual Allen & Company Sun Valley ... [+] Conference, July 8, 2016 in Sun Valley, Idaho. (Photo by Drew Angerer/Getty Images)

In the excellent book Shoe Dog , Phil Knight details how he built Nike into a world power. Interestingly enough, one of his keys to success — during the early years — was that he worked full-time as a CPA to pay the bills!

But of course, the knowledge he gained from understanding the language of business — that is, accounting — proved invaluable. Let's face it, running a fast-growing company requires tremendous discipline.

In case you are keeping track:

Ernst & Young Says It Isn't Responsible for Luckin Coffee's Accounting Misconduct - WSJ

HONG KONG—Ernst & Young Hua Ming LLP, the auditor to Luckin Coffee Inc., on Thursday said it bears no responsibility for the Chinese coffee chain's 2019 financial statements and what it called the company's fraudulent misconduct.

EY said in a post on its WeChat account that its Luckin audit records were inspected in May this year by Chinese authorities, as part of an investigation into Luckin's April 2 disclosure of fabricated sales.

AICPA updates guidance on auditing blockchain assets | Accounting Today

"This non-authoritative guidance goes a long way in helping auditors consider the potential risks unique to the digital assets ecosystem and the skillsets needed to conclude whether to accept or continue an engagement," said Susan S. Coffey, CPA, CGMA, executive vice president of the Association of International Certified Professional Accountants, the international arm of the AICPA, in a statement.

The Practice Aid provides auditors with information to consider when accepting or continuing audit engagements that involve digital assets. As CPA firms seek to provide audits to entities involved with digital assets, they'll need to perform evaluations to ensure that only client relationships and engagements, for which the audits can be performed in accordance with professional standards and applicable legal and regulatory requirements to enable an appropriate auditor's report, are

Williams-Keepers acquires Mexico-based accounting firm - News - The Mexico Ledger - Mexico, MO -

Columbia public accounting firm Williams-Keepers LLC has announced the acquisition of the Mexico, Missouri based Mid-Missouri Accounting Services.

Williams-Keepers wrote in a news release most members of the Mexico firm’s six-person staff are expected to transition to full-time roles in the merged company, including co-owner Stephen Thoenen.

Mid-Missouri Accounting was established in 1989 by Thoenen and specializes in accounting, tax, payroll and bookkeeping for independent grocers in Missouri and other small businesses and individual clients, according to the release. It will continue operating at its Mexico location until Aug. 28 and on Aug. 31 will relocate to Williams-Keepers Columbia office.

Not to change the topic here:

CFOs can help organizations with sustainability reporting, diversity and data | Accounting Today

The first report, "CFO as Value Creator: Finance Function Partnering for the Integration of Sustainability in Business" is accompanied by a white paper, "CFO as Value Creator: Finance Function Leadership in the Integrated Enterprise."

"This paper came about last year," said Shari Littan, manager of corporate reporting technical activities at the IMA, who co-authored the reports. "We started to observe and hear about an uptick in interest by external users and drivers for more information in general. Yet we also heard sort of misinformed urban legends about how the mainstream finance and accounting functions at most companies are uninterested and uninvolved in sustainable business practices.

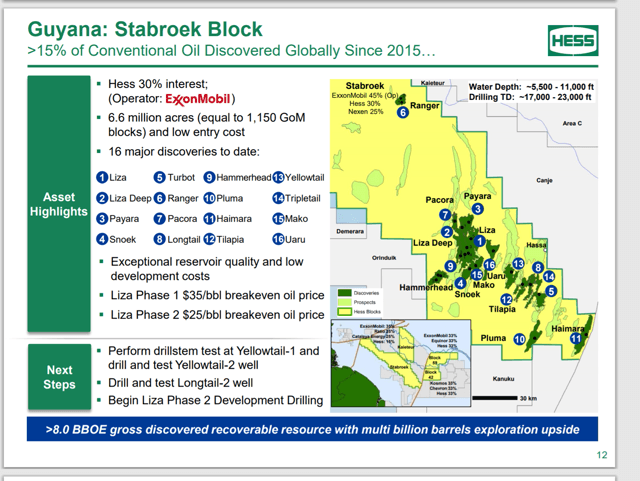

Exxon Mobil: Accounting Issues (NYSE:XOM) | Seeking Alpha

Some impaired assets will earn a decent return in the future which will cause some managements to not impair the assets.

Conservative depreciation can overcome an excess purchase price as can conservative reserve assumptions and other variables.

Integration may be the source of usually large profitability not seen by smaller pure upstream competitors.

* * *

Several authors and analysts have determined that Exxon Mobil ( XOM ) needs a write-off or impairment of unconventional assets. In order to get to that conclusion one has to first be aware of the assumptions made by the accounting system for those assets.

Former FASB chair Russ Golden joins outside advisory committee for PwC | Accounting Today

Russell Golden, who just completed his term chairing the Financial Accounting Standards Board at the end of June, will be chairing a newly formed independent Assurance Quality Advisory Committee at PricewaterhouseCoopers.

The other members named Friday to the committee are Joanne Wakim, who previously served as the chief accountant of the Federal Reserve Board's Division of Banking Supervision and Regulation, and Alan Beller, vice chairman of the International Financial Standards Board Foundation, which oversees the International Accounting Standards Board. Beller is also a director of the Sustainability Accounting Standards Board and a senior counsel at Cleary Gottlieb Steen & Hamilton LLP.

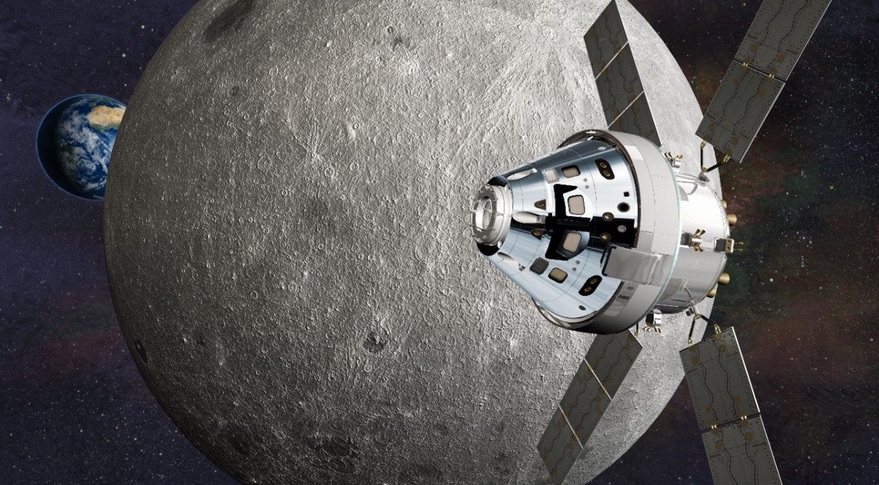

NASA's inspector general criticizes Orion cost accounting - SpaceNews

WASHINGTON — NASA's inspector general criticized the agency for its accounting of Orion program costs in a new report, arguing it has "hindered the overall transparency" of the program amid growing costs and schedule slips.

Through January of 2020, the latest financial data was available, NASA spent $16.7 billion on Orion, dating back to the Constellation program. NASA estimates spending $12.8 billion on Orion through 2030, primarily on production of future spacecraft.

Happening on Twitter

On the occasion of #CSCDiwas, my greetings to all village level entrepreneurs of Common Services Centres across Ind… https://t.co/keGpyHCUFo rsprasad (from India) Thu Jul 16 07:57:59 +0000 2020

"The shutdown lobby isn't simply arguing for more protective measures against the spread of COVID-19. They are argu… https://t.co/CBpSBwseK2 RepAndyBiggsAZ (from Arizona, USA) Thu Jul 16 00:55:24 +0000 2020

If you could spend $5 a month to help BLACK entrepreneurs, BLACK creators, and single BLACK mother's, would you do it? ThatDudeMCFLY (from Toronto) Thu Jul 16 17:45:02 +0000 2020

No comments:

Post a Comment