A proposal to raise taxes on California millionaires would result in a top tax rate of nearly 54% for federal and state taxes.

The plan follows proposals in New York state to raise taxes on the wealthy to pay for a widening budget deficit. And it adds to a growing debate over expanding inequality during the pandemic and who should pay the soaring costs to government.

And here's another article:

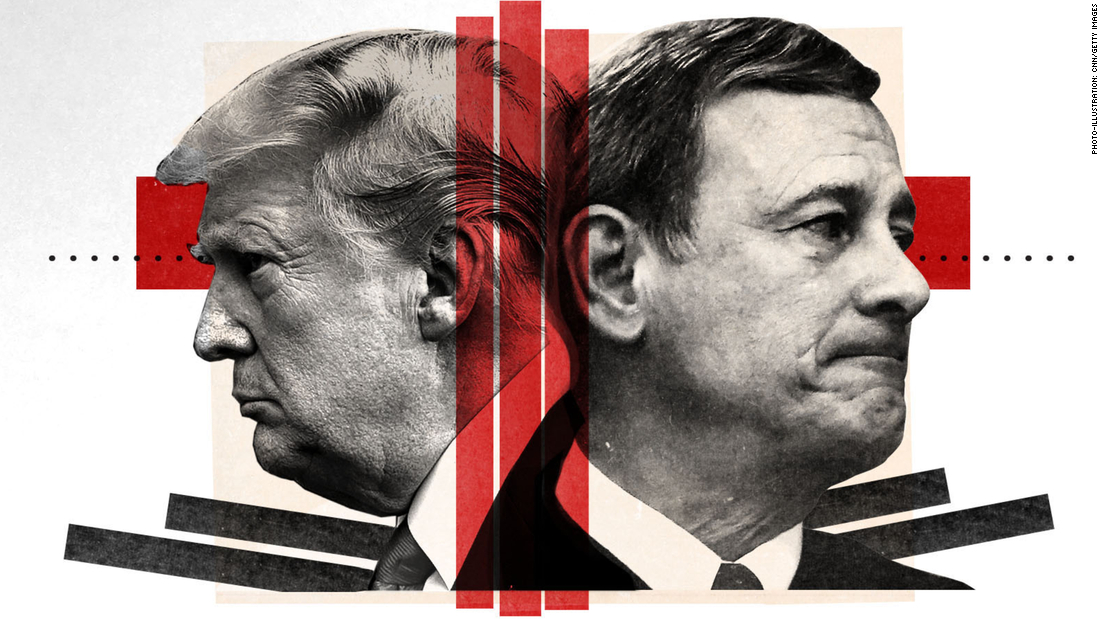

Inside the Supreme Court's internal deliberations over Trump's taxes - CNNPolitics

Maxing Out Your 401(k) Could Lead to More Taxes on Social Security.

A 401(k) plan is a great tool to save for retirement if your employer offers one. After all, investing in one is easy since the money is taken out of your paycheck directly. And you get to save with pre-tax dollars, which makes it much more affordable to put money into your account. Your employer may even match some of the contributions you make, which is a huge benefit since you're literally getting free money.

But just because a 401(k) is a good option for a retirement investment account doesn't mean there aren't downsides. And one of the big disadvantages is that putting all your retirement savings into a 401(k) could lead to more taxes on your Social Security benefits. Here's why.

Lancaster Event Center wants $2.25 million in property taxes to help pay for rodeo improvements |

The grandstand at the Lancaster Event Center sits empty on Saturday, which would have been the final day of competition of the National High School Finals Rodeo in Lincoln. The event moved to Guthrie, Oklahoma, over concerns about COVID-19.

The Lancaster Event Center wants $2.25 million from a property tax increase to cover expenses it incurred and revenue it lost because of the coronavirus pandemic.

The Lancaster County Board of Commissioners, which will have to decide whether to increase the tax levy by three-quarters of a cent, wants to hear from the public about the request, as well as the importance the community places on the event center.

Quite a lot has been going on:

IRS gears up to target people, companies with taxes due on offshore earnings | Fox Business

The IRS stopped processing paper returns at the end of March to comply with coronavirus-related social distancing and stay-at-home guidelines; Rich Edson reports.

The IRS is launching a campaign this fall to audit U.S. companies that have overseas earnings and have not paid the taxes owed on that money.

* * *

A new compliance initiative announced by the IRS’s Large Business and International Division earlier this month pertains to section 965 of the Revenue Code – added by the 2017 tax reform law – which requires U.S. shareholders to pay a “transition tax” on untaxed foreign earnings of certain specified foreign corporations as if those earnings had been repatriated to the United States.

Breed budget prioritizes cuts to frontline workers over taxes on the rich | 48 hills

The mayor is, in effect, asking for pay cuts – the 3 percent raises that city workers are due were part of an existing contract. The contract states that in a fiscal crisis, those pay hikes can be deferred to December, which is already happening. If the workers won’t take the cut, she’s threatening layoffs.

But let's take a step back for a second: The only reason SF isn't in far worse shape in this crisis is because frontline city workers have helped contain the virus.

How You Can Write off a Home Office on Your Taxes – NBC 7 San Diego

NBC 7 Responds’ Consumer Bob looked at the requirements to get a tax break while working from home

Millions of people around the country are working from home because of the coronavirus pandemic. Many have converted dining, family, and spare rooms into workspaces, but can you get a tax break for having a home office?

"You either have to be an employee or you have to have your own company," said Enrolled Agent Rod Couts. "So long as you have a place that you use regularly and exclusively for business, you shouldn't have a problem."

Brazil Consumption Tax? Brazil Could Foster Tax Progressivity Too

On July 21 the Brazilian government sent to its Congress the first stage of its proposed tax reform. The proposal includes unifying two levies on consumption, the so-called PIS and COFIN taxes, into a 12% value-added tax (VAT).

Brazil has one of the world's most complex tax systems. According to the World Bank while a typical business spends 234 hours to fulfill its tax obligations, a Brazilian company faces 1,500 hours. Brazil's fiscal system is characterized by opaque regulations and constantly shifting rules across federal, state, and municipal levels. Overhauling the tax system would create efficiencies for companies and help promote private investment.

Happening on Twitter

Tax hike on California millionaires would create 54% tax rate https://t.co/dyw6ucncYp CNBC (from Englewood Cliffs, NJ) Thu Jul 30 18:33:49 +0000 2020

"California's top marginal tax rate is 13.3%. New proposal would add three new surcharges on seven-figure earners.… https://t.co/igE0AZmFZw cate_long (from New York) Thu Jul 30 19:36:34 +0000 2020

A proposal to raise taxes on California millionaires would result in a top tax rate of nearly 54% for federal and s… https://t.co/PcJxOgMX4B CNBC (from Englewood Cliffs, NJ) Fri Jul 31 11:34:23 +0000 2020

No comments:

Post a Comment