DENVER, Sept. 30, 2021 /PRNewswire/ -- The Reaves Utility Income Fund (NYSE MKT: UTG) (the 'Fund'), a closed-end sector fund, paid a monthly distribution on its common stock of $0.19 per share to shareholders of record at the close of business on September 17, 2021.

The following table sets forth the estimated amount of the sources of distribution for purposes of Section 19 of the Investment Company Act of 1940, as amended, and the related rules adopted thereunder.

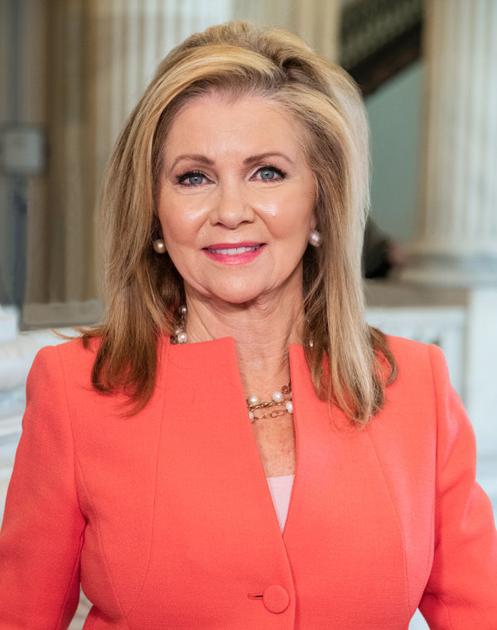

Marsha Blackburn: Biden's historic agenda would bankrupt small business | Hartsville |

Tekla Healthcare Investors Paid Distribution | Business | valdostadailytimes.com

On September 30, 2021, Tekla Healthcare Investors paid a distribution of $0.52 per share. It is currently estimated that this distribution is derived from net realized short-term capital gains and return of capital or other capital source.

The following table sets forth the estimated amounts of the current distribution, paid on September 30, 2021, and the cumulative distributions paid this fiscal year-to-date from the following sources: net investment income, net realized short-term capital gains, net realized long-term capital

Biden builds back broke | Opinion | mainstreet-nashville.com

President Joe Biden hasn't hesitated in boasting about the supposedly "historic middle-class tax cut" making its way through the halls of Congress. But, his speeches delivered behind teleprompters hide the inconvenient reality of the "historic" agenda.

Made up of 40 separate tax increases worth $2 trillion, the Democrats' plan would be the largest package of tax increases since 1968. President Biden promises these hikes will fall on "big corporations and the very wealthy," but we know we can't take him at his word.

4 Ways to Increase the Tax Benefits of Your Charitable Giving

In my experience as a financial advisor, physicians — most likely including you — give generously to charities. As long as you're donating, why not receive a tax benefit? It's gotten a bit more complicated but it's certainly doable.

Let's start with some background. The 2017 Tax Cuts and Jobs Act (TCJA) nearly doubled the standard tax deduction. For 2021 it is $12,550 for single filers and $25,100 for married couples.

The 13 types of homeowner who won't have to pay property tax this year - Irish Mirror Online

Earlier this week it was confirmed that more than 100,000 new and previously exempt properties - most of which were built after May 2013 - will become liable for Local Property Tax from November 1.

Irish homeowners now have until this date to revalue their homes as Revenue sends out over 1.4 million notices over the next three weeks alerting homeowners of the need to file an LPT return.

Relevance of the Special Valuation Branch to Importers in India

The Special Valuation Branch investigates whether the valuation of transactions between 'related persons', such as intercompany transactions, that facilitate imports into India are valued appropriately and not to reduce Customs Duty liability.

The Government has taken many initiatives in recent years, including relaxing FDI norms across multiple sectors, such as defense, PSU oil refineries, telecom, power exchanges, and stock exchanges, among others.

Faith • Family • Farming | Opinion | ccenterdispatch.com

In the nearly 30 years I've been covering agricultural issues, some topics seem to cycle back around depending on which political party is in power. One of those is estate tax regulations specifically stepped up basis or known as the inheritance tax.

Back on September 10, our Big First District Congressman Tracey Mann (R-KS) introduced legislation in the House Agriculture Committee Budget Reconciliation Mark-up which would protect Kansas farmers and ranchers by preserving the stepped-up basis.

Form 497K Investment Managers Seri

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Statutory Prospectus and Statement of Additional Information and other information about the Fund online at

The investment objective of the WCM International Long-Term Growth Fund (the “Fund”) is long-term capital appreciation.

No comments:

Post a Comment